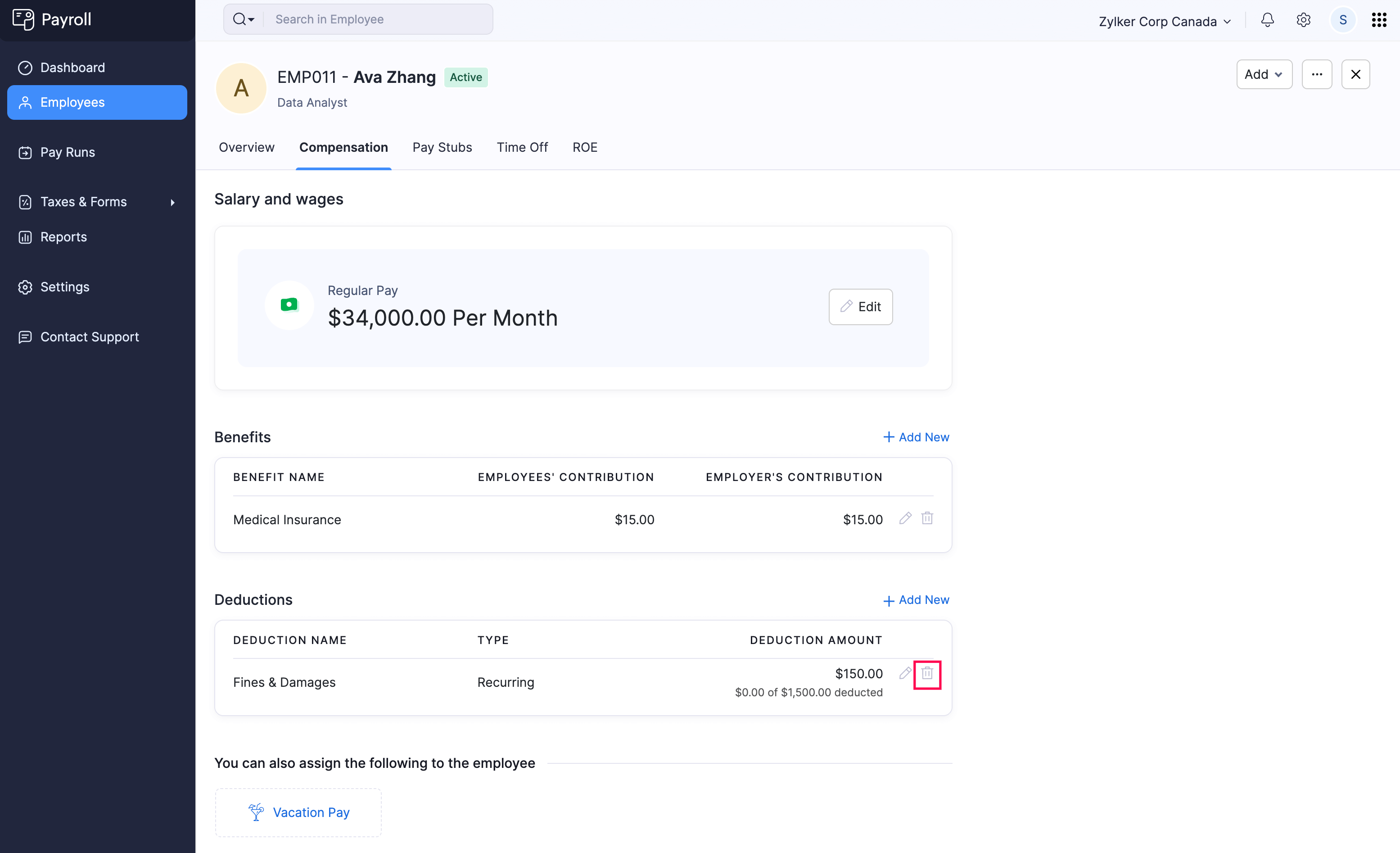

Manage Employee Compensation Details

The Compensation tab in the Employees module helps you with the compensation details of an employee. This includes:

Salary and Wages

The Salary and Wages section displays the amount an employee earns as regular pay in a pay period.

INSIGHT Regular pay refers to the fixed portion of an employee’s income, typically set as an hourly rate or annual salary, excluding overtime or additional pay.

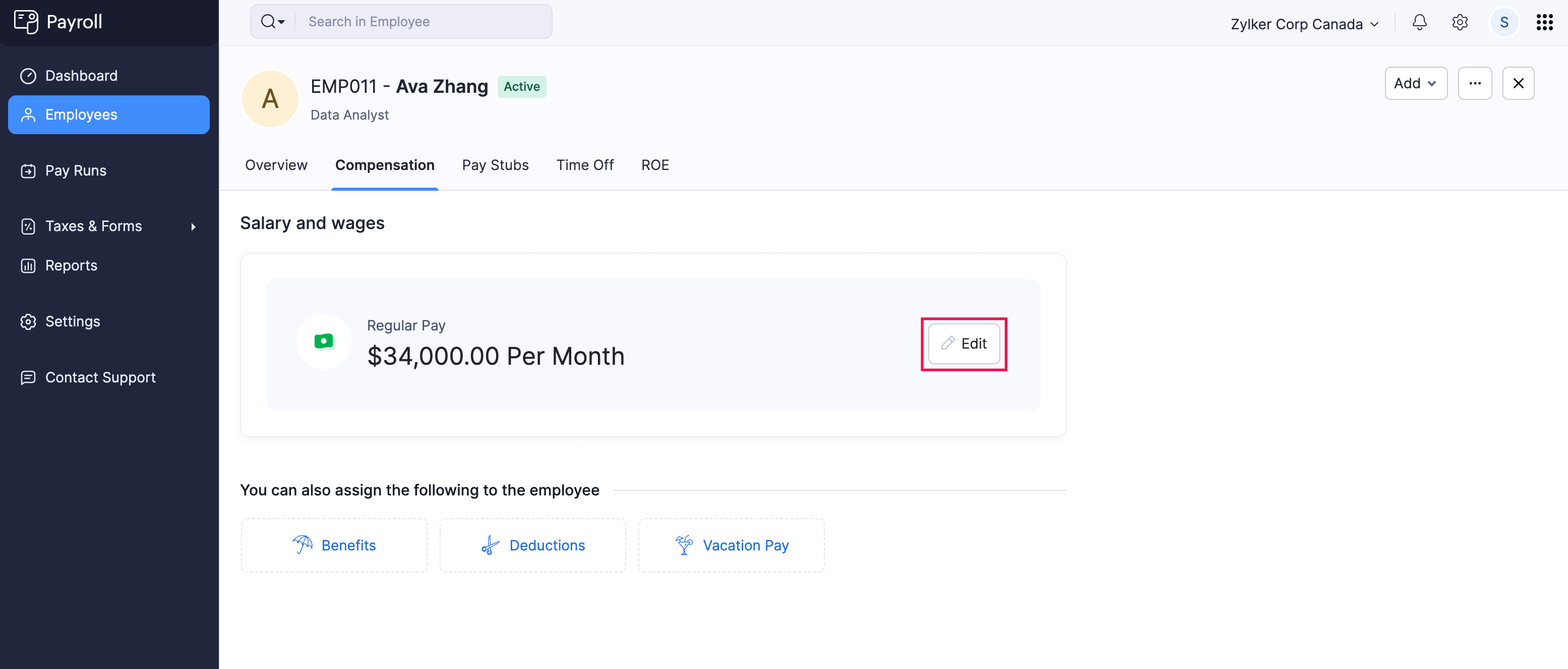

Edit an Employee’s Regular Pay

If you need to correct an error in the regular pay amount or update it due to a raise, you can easily make the changes in Zoho Payroll.

To edit the regular pay of an employee:

- Go to the Employees module.

- Click the employee’s name.

- Navigate to the Compensation tab.

- Click Edit next to Regular Pay.

- Enter the updated Amount.

- Click Save.

Once saved, the updated regular pay will reflect in the upcoming payrolls.

Benefits

Benefits are additional compensation or perks provided to employees beyond their regular wages or salary.

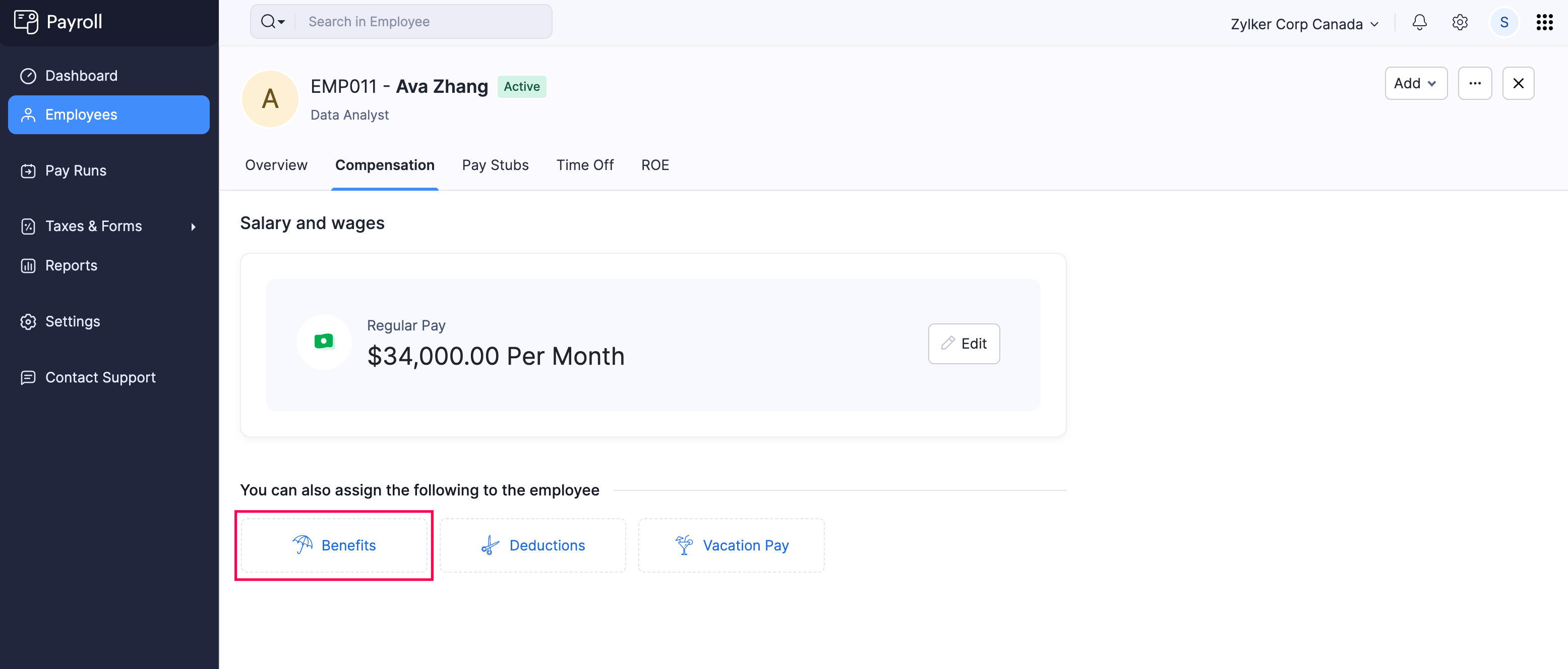

Assign Benefits to an Employee

To assign a benefit to an employee:

- Go to the Employees module.

- Click an employee.

- Navigate to the Compensation tab.

- Follow one of these steps:

- Click Add at the top right and select Benefit.

- If you have not assigned any benefits to the employee, click Benefits under You can also assign the following to the employee.

- If you’ve already assigned benefits to the employee, click Add New next to Benefits.

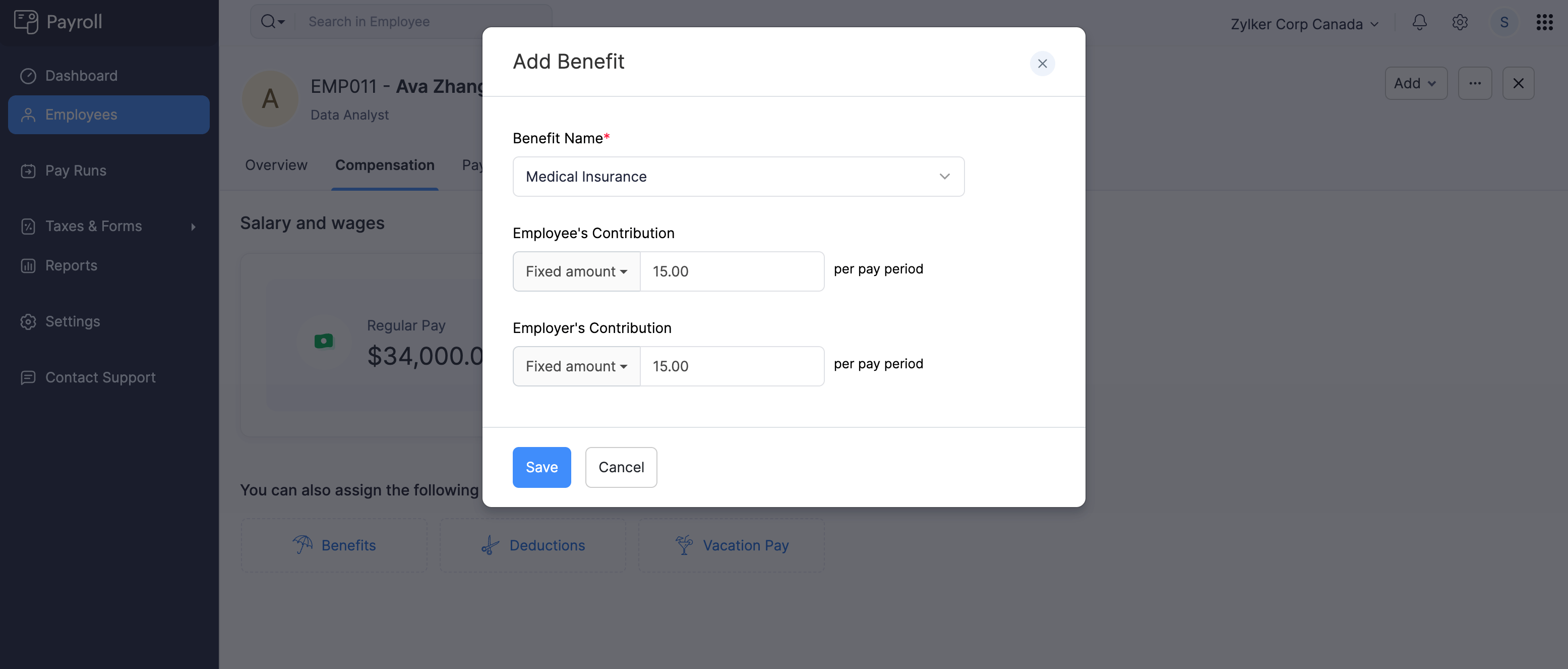

- In the popup that appears, select a benefit plan from the Benefit Name dropdown.

- Enter Employee’s Contribution and Employer’s Contribution. You can select either a fixed amount or a percentage of the employee’s gross pay.

- Click Save.

The benefit will be assigned to the employee and will be included in their upcoming payrolls.

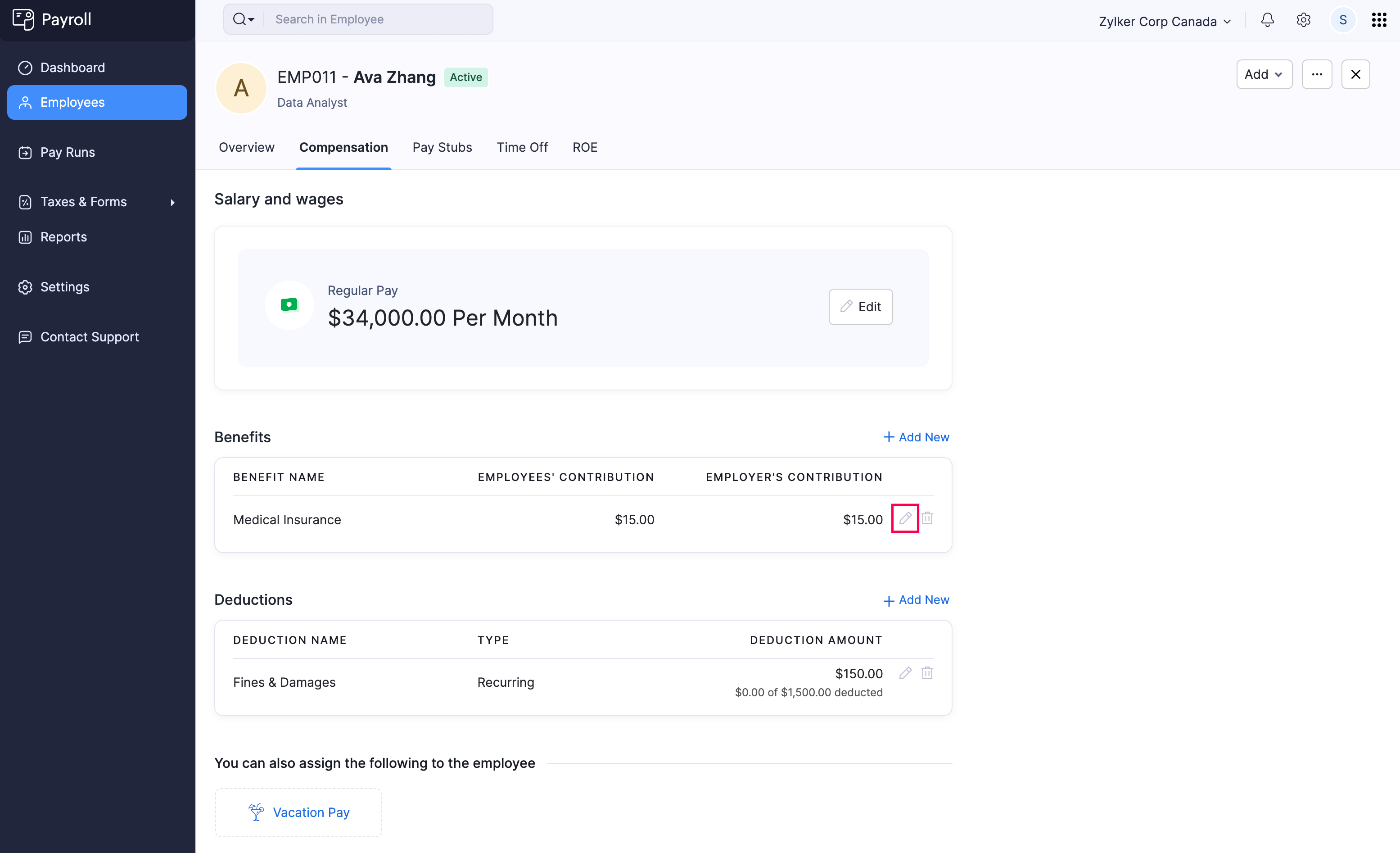

Edit Benefits Assigned to an Employee

PREREQUISITE You must have already assigned a benefit to the employee.

To edit a benefit assigned to an employee:

- Go to the Employees module.

- Click an employee.

- Navigate to the Compensation tab.

- Under Benefits, click the edit icon next to a benefit.

- In the popup that appears, update the Employee’s Contribution and Employer’s Contribution amounts. These contributions can be a fixed amount or a percentage of gross pay.

- Click Save.

The benefit assigned to the employee will be updated, and future payrolls will reflect the new contribution rates.

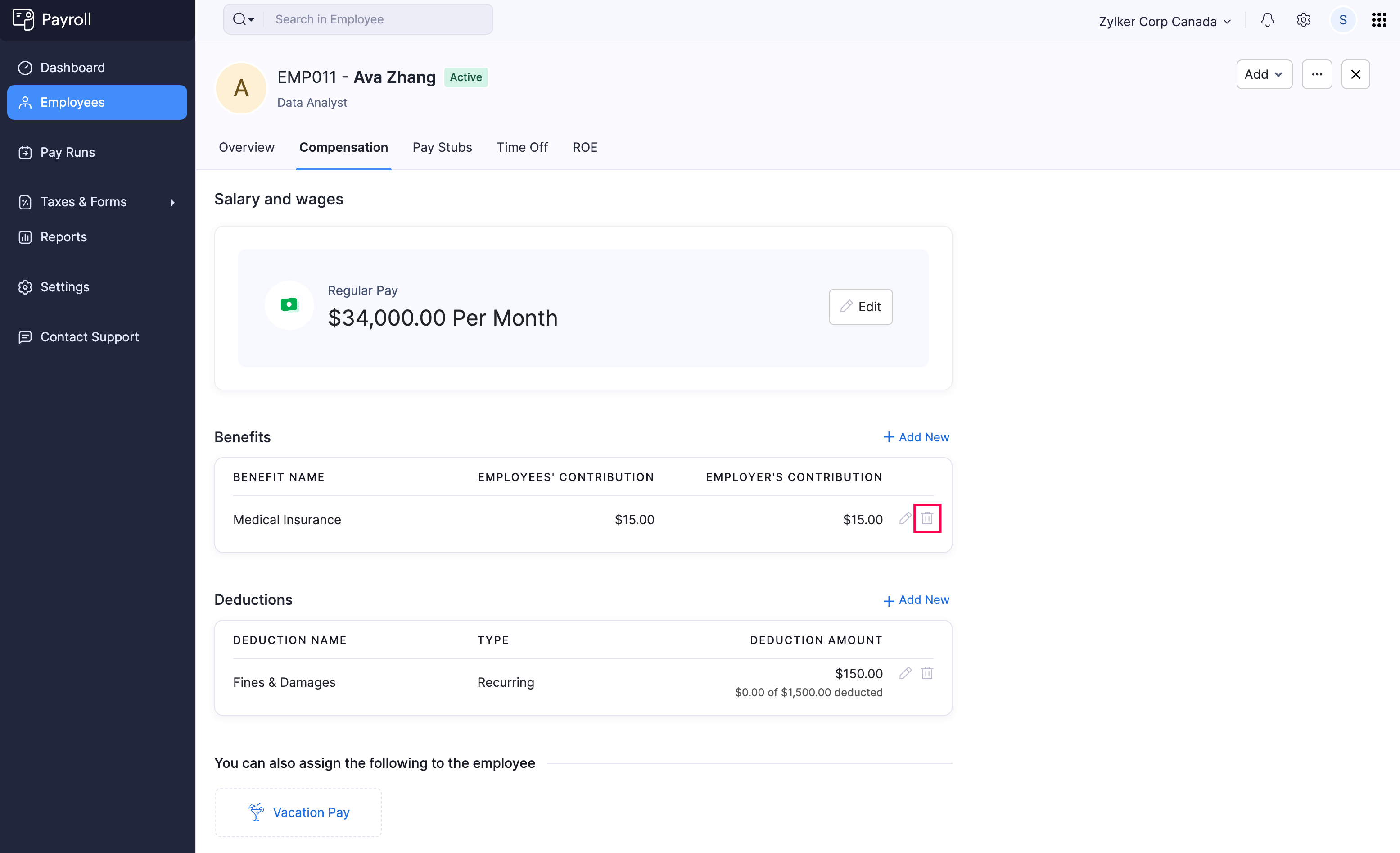

Delete Benefits Assigned to an Employee

PREREQUISITE You must have already assigned a benefit to the employee.

To delete a benefit assigned to an employee:

- Go to the Employees module.

- Click an employee.

- Navigate to the Compensation tab.

- Under Benefits, click the delete icon next to a benefit.

- In the popup that appears, click Yes.

The benefit will be removed from the employee’s profile.

Deductions

Deductions refer to amounts subtracted from an employee’s gross salary to arrive at the final take-home pay. These deductions can be for taxes, retirement contributions, garnishments, or other employee-related expenses.

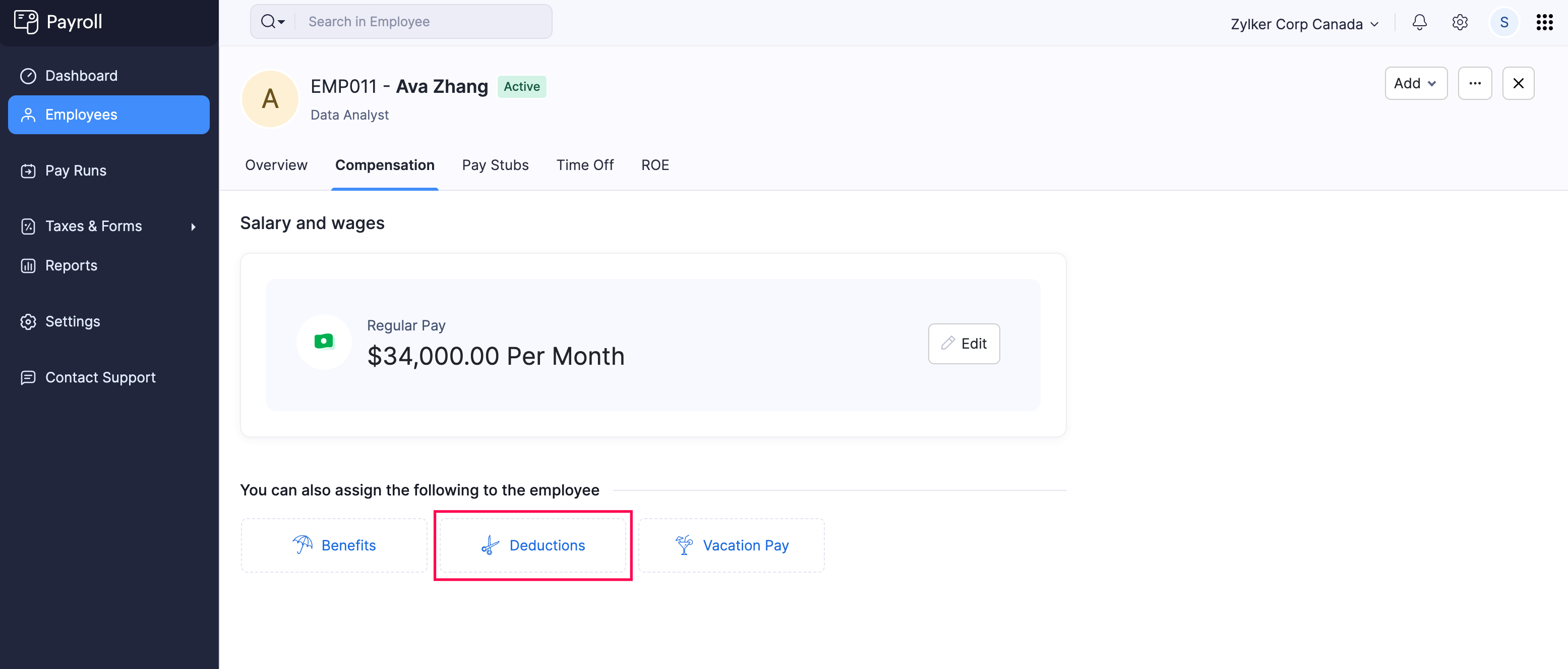

Assign Deductions to an Employee

PREREQUISITE You must have configured deductions at the organization level.

To assign a deduction to an employee:

- Go to the Employees module.

- Click an employee.

- Navigate to the Compensation tab.

- Follow one of these steps:

- Click Add at the top right and select Deduction.

- If you have not assigned any deductions to the employee, click Deductions under You can also assign the following to the employee.

- If you’ve already assigned deductions to the employee, click Add New next to Deductions.

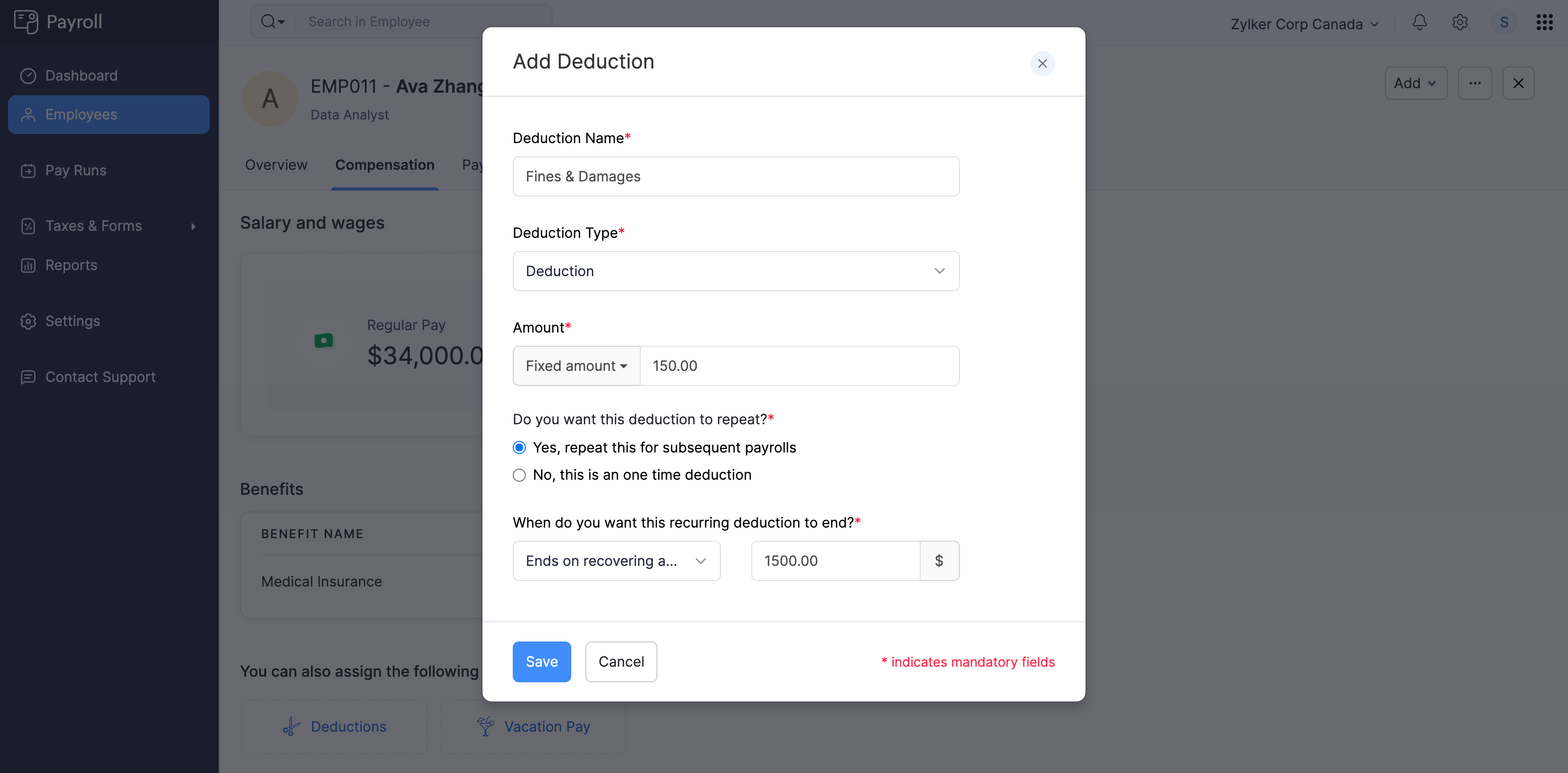

- In the popup that appears, select a deduction from the Select a Deduction dropdown.

- Enter the amount to be deducted from the employee’s salary. You can select either a fixed amount or a percentage of the employee’s gross pay.

- Click Save.

The deduction will be assigned to the employee and included in their upcoming payrolls.

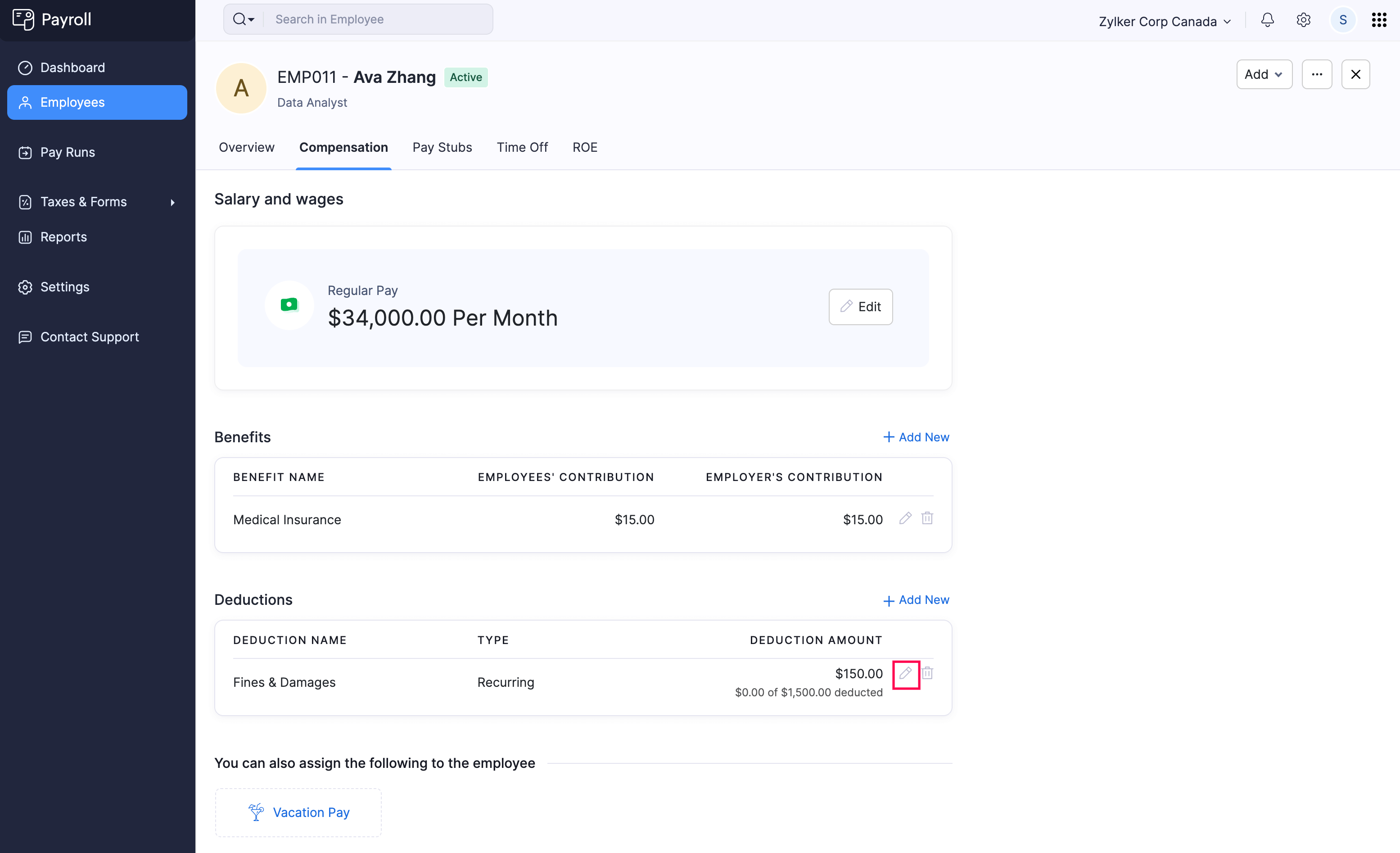

Edit Deductions Assigned to an Employee

PREREQUISITE You must have already assigned a deduction to the employee.

To edit a deduction assigned to an employee:

- Go to the Employees module.

- Click an employee.

- Navigate to the Compensation tab.

- Under Deductions, click the edit icon next to a deduction.

- In the popup that appears, update the deduction amount.

- Click Save.

The deduction assigned to the employee will be updated, and future payrolls will reflect the new deduction amount.

Delete Deductions Assigned to an Employee

PREREQUISITE You must have already assigned a deduction to the employee.

To delete a deduction assigned to an employee:

- Go to the Employees module.

- Click an employee.

- Navigate to the Compensation tab.

- Under Deductions, click the delete icon next to a deduction.

- In the popup that appears, click Yes.

The deduction will be removed from the employee’s profile.