Feature-rich payroll software built for businesses in Canada

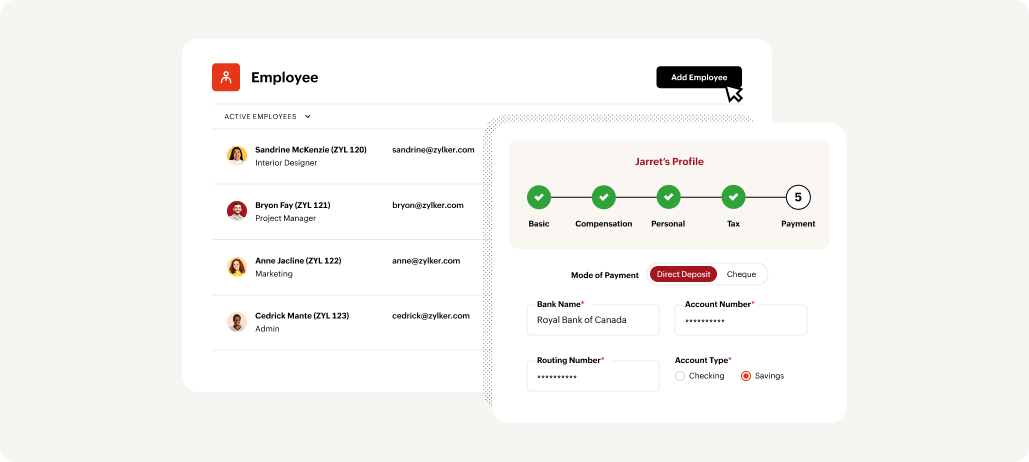

Ensure a smooth employee journey from day one

From onboarding to gratuity, manage every step of payroll with ease for your entire workforce.

Finish payroll setup in a few quick steps and focus on making the initial days engaging by building strong team connections.

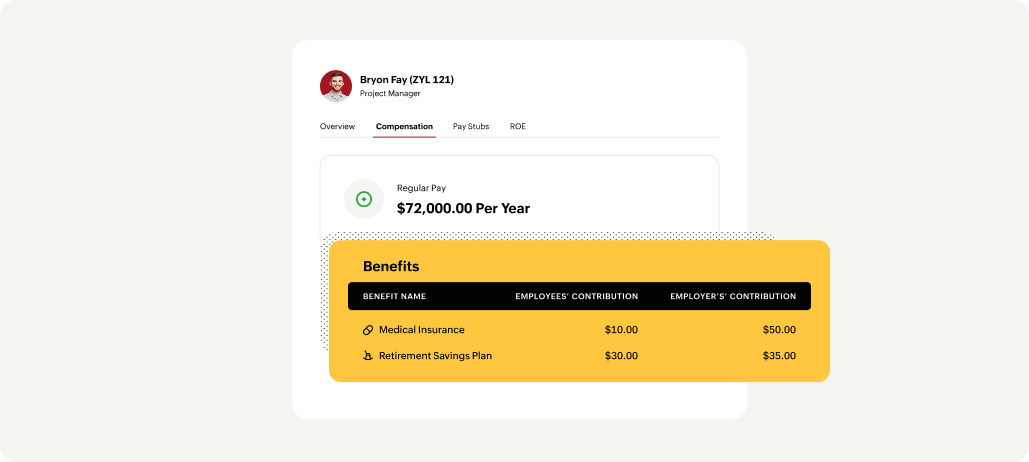

Provide employees instant access to downloadable pay stubs and other important payroll details such as salary, benefits, and more from a user-friendly portal.

Bring your historic payroll data into the existing payroll system safely, keeping all records accurate and organized without any loss of information.

Upload, organize, and securely access essential employee and organizational files in one place.

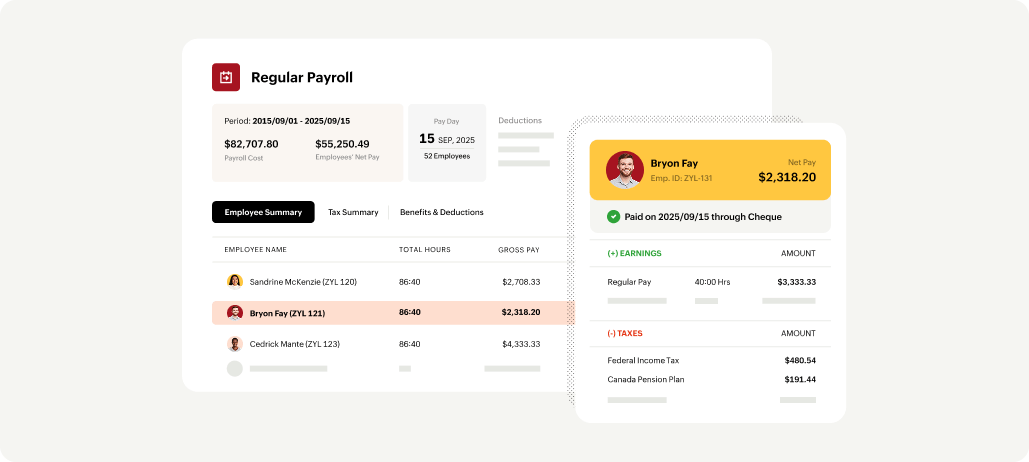

Process payroll with every essential feature

Automate payroll processes from calculation to salary disbursement, ensuring accuracy, on-time payments, and less administrative hassles.

Get payroll-ready with a dashboard that instantly displays upcoming cycles, tasks, and everything that needs your attention.

Create pay schedules that fit your business requirements, whether weekly, bi-weekly, semi-monthly or monthly.

Handle payroll for all employees, whether on a fixed salary or hourly rate, while keeping processes smooth, accurate, and on schedule.

Process every payroll cycle automatically with precise calculations of net pay, taxes, deductions, and contributions, ensuring error-free and timely salary disbursements.

Pay employees securely by transferring salaries directly to their bank accounts using Forte, ensuring accurate, and hassle-free payroll disbursements.

Process bonuses separately from regular payroll to recognize employee achievements, milestones, and contributions, and motivate continued high performance.

Handle payments for new hires, salary changes, or missed wages seamlessly without waiting for the regular pay schedule.

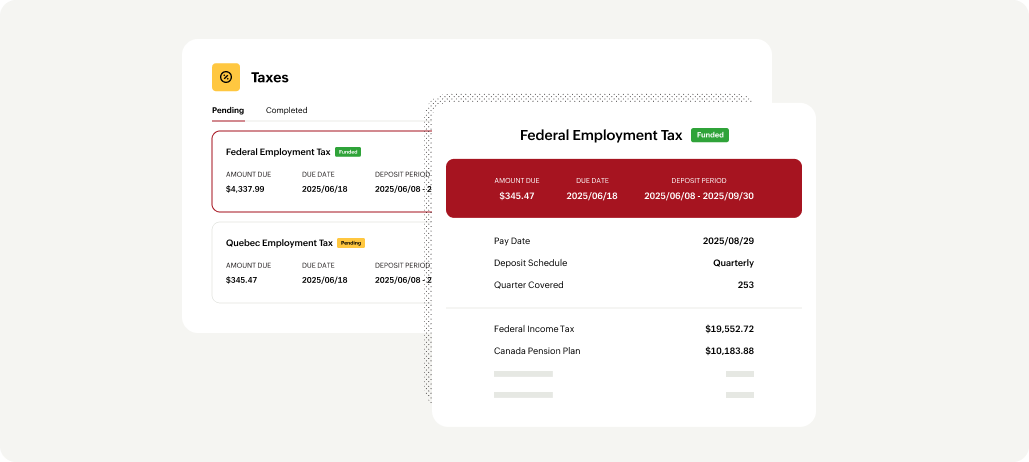

Stay compliant with every Canadian payroll laws

Effortlessly manage Canadian payroll compliance from taxes to deductions while avoiding penalties and staying up to date with every changing payroll law.

Easily calculate and withhold federal and provincial taxes along with CPP or QPP contributions while reflecting each region’s unique differences.

Quickly generate and deliver key year-end forms such as T4 and RL-1, keeping them organized for you to view details anytime.

Keep all deductions, benefits, and statutory reports organized in one place, ensuring accurate compliance and effortless audits.

Automatically issue ROEs (Record of Employment) while tracking departures, ensuring accurate exit records for employees.

Automatically calculate and deduct Employment Insurance (EI) or Quebec Parental Insurance Plan (QPIP) premiums according to federal and provincial rules, keeping your payroll compliant across Canada.

Calculate and withhold taxes on bonuses, commissions, and other one-time payments to stay compliant while ensuring employees receive accurate compensations.

Automatically calculate and provide statutory holiday and vacation pay accurately, based on eligibility to fulfill provincial requirements.

Go beyond salaries with meaningful employee benefits

Bring value to your employees beyond pay with benefits that help employees feel supported and appreciated.

Help employees build a secure future with RPP contributions and RRSP payroll deductions for long-term financial stability.

Help employees count on uninterrupted health and dental benefits as your payroll system manages contributions accurately.

Record and process union dues to ensure correct taxable wages, while maintaining employees’ coverage and compliance.

Handle one-time or recurring perks for employees including travel allowances, parking allowances, or relocation allowances without worrying about manual calculations.

Ensure employees feel valued by paying them correctly for statutory holidays, whether they work or not, including extra pay for hours worked.

Settle one-time payouts like notice pay and severance for departing employees, giving them a proper send-off and showing appreciation for their contributions.

Simple payroll that's easy to manage

Digitize and automate routine payroll tasks so you spend less time on administrative tasks and more time expanding your business with a robust payroll software.

Send timely email and in-app alerts for important payroll tasks and deadlines, keeping your team informed, aligned, and proactive.

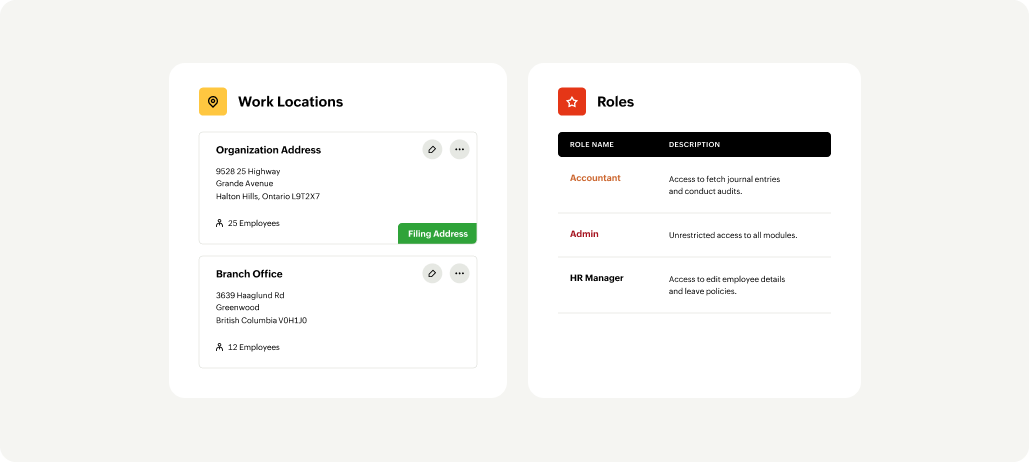

Easily manage employees in multiple offices across Canada while ensuring payroll remains accurate, compliant, and hassle-free.

Create unique roles for your team to enable seamless collaboration while granting each user access only to the sections they need.

Exclude employees who aren’t eligible for a pay period, like those on long leave, while ensuring subsequent pay runs remain accurate and uninterrupted.

All team activities and payroll changes are captured in the Activity Logs for complete transparency and accountability.

Make smart payroll decisions with strong insights

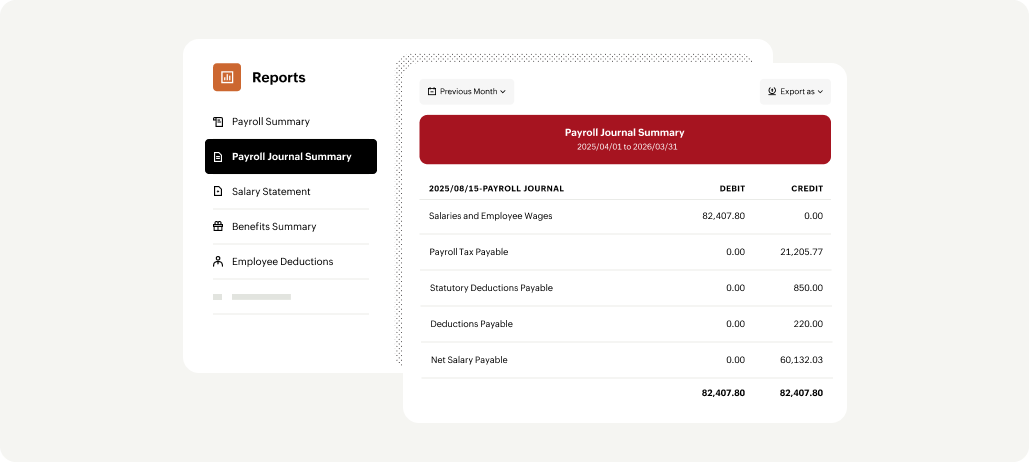

Generate essential payroll reports with an intuitive payroll software to stay compliant, track contributions, and provide employees with required documentation.

Assign labels to employees to filter data and reports easily, helping you categorize and monitor activities for precise payroll and workforce insights.

Export reports in PDF, XLS, or CSV formats for any date range, giving you full flexibility to analyze payroll.

Enable password protection on reports so sensitive payroll information stays secure, accessible only to authorized personnel.

Use detailed payroll and workforce reports to analyze trends and make informed decisions that improve employee compensation and satisfaction.

Get detailed visibility into payroll spending to identify cost-saving opportunities, optimize resource allocation, and improve overall financial efficiency.

Track and summarise federal and provincial tax withholdings, CPP/QPP, and EI contributions to simplify filings and ensure full compliance without penalties.

Generate and store ROEs instantly to guarantee precise reporting and quick EI access for departing employees.

Access accurate T4 and RL-1 forms to guide you while filling them in the CRA system, making year-end filings simple.

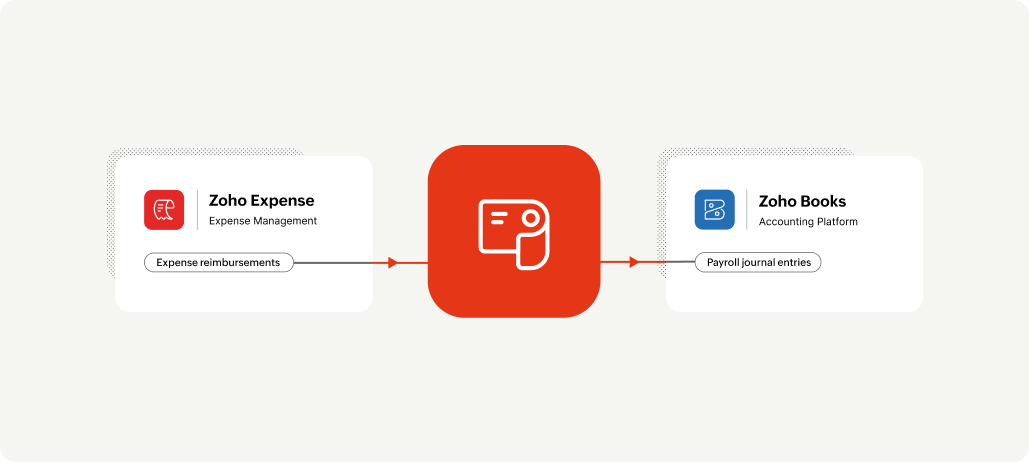

Connect payroll with other core business systems

Bring payroll, accounting and expense operations together to ensure smooth, coordinated business processes within one ecosystem.

Connect your payroll and accounting operations by integrating Zoho Payroll with Zoho Books for seamless financial management.

Handle employee payments, including salaries and expense reimbursements, in one smooth process to streamline operations and reduce administrative complexity

Build payroll around your business needs

Leverage flexible features to create a payroll workflow tailored to your business processes, ensuring efficiency and accuracy.

Design pay structures for all employees, from interns to executives, with custom earnings and deductions that ensure fair, transparent, and efficient payroll.

Capture extended employee-specific details such as emergency contacts, skill sets, certifications, and department codes by adding customizable fields to their profiles.

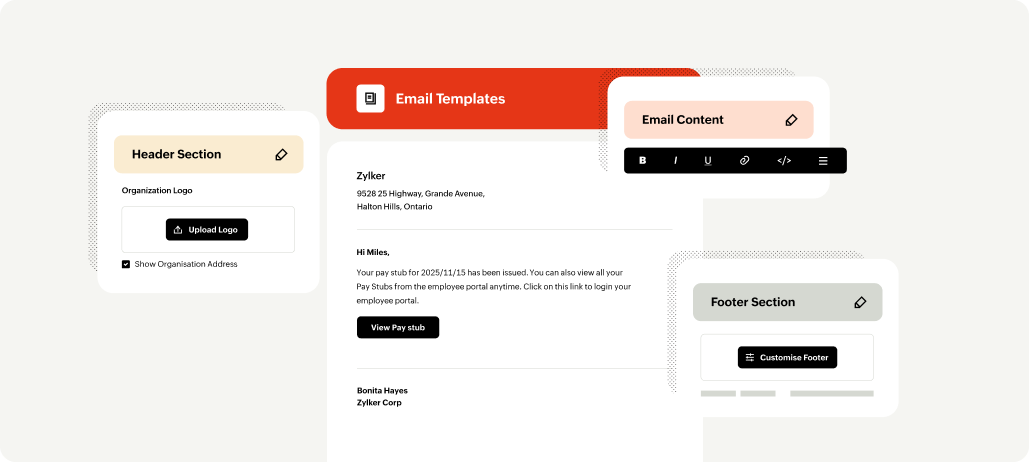

Modify email templates to personalize messages, ensuring employees receive relevant and consistent communication.

Define as many roles as you need and assign specific permissions to each, so every team member has the right access for their responsibilities.

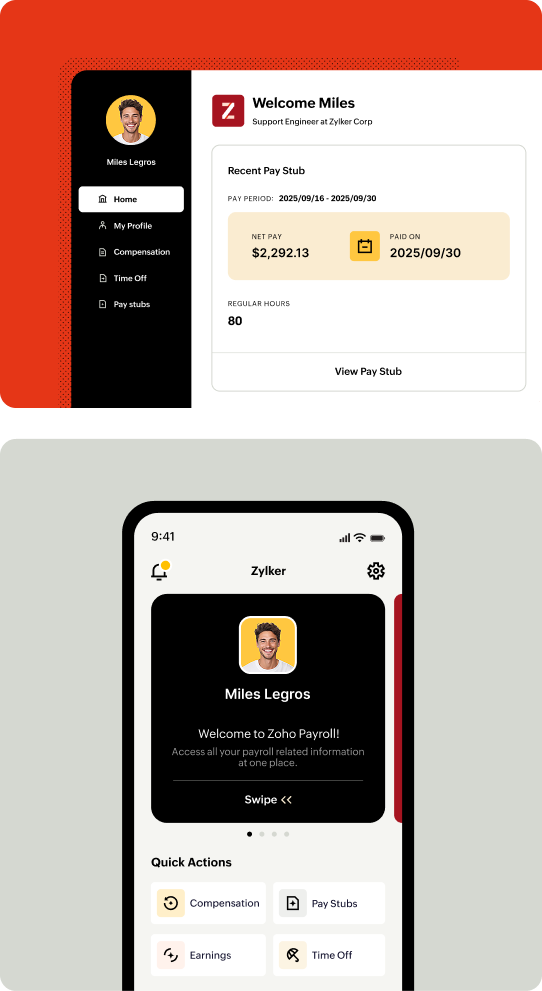

Access all personal and pay information in one convenient self-service space.

Get instant notifications when salaries are credited.

View and download your password-protected payslips with ease for secure access anytime, anywhere.

Track employee time off quickly.

Reach out directly to payroll staff whenever needed.

Get the latest company updates directly in the portal.