Crafted for Canada, backed by global expertise

Our platform is made to handle complex payroll compliance in countries like India, USA, GCC, and now Canada.

Businesses worldwide rely on Zoho Payroll to pay their teams accurately and on time.

Businesses in over 50 different industries have already solved their payroll challenges using Zoho Payroll.

*Data derived from editions we support across the globe.

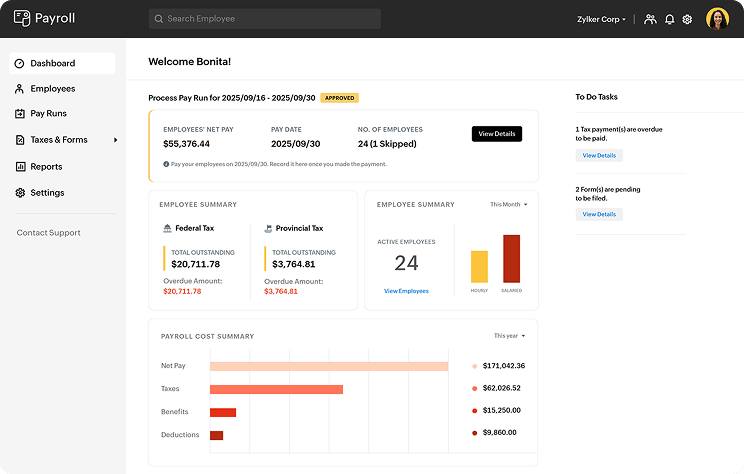

Effortless Payroll

Your complete payroll software for Canada

The automated way to process payroll

Set up your payroll once and get it right every single time. We handle each detail, from wage calculations to compliance and final payments, so you don't have to.

Modern payroll built for you

With a simple UI and guided hints throughout your payroll process, get the payroll experience you've missed, regardless of the size of your business.

Tailor Zoho Payroll to suit your business

Be it custom salary components, unique user roles, or flexible payroll options, make our platform work for you.

Send salaries online

Zoho Payroll makes it easy for you to send salaries straight to your employees' bank accounts with reliable integration with Forte.

Manage benefits and allowances

From benefits like medical expenses or parking allowance to deductions for pension contributions and insurance plans, we make it simple to handle.

Get instant insights with powerful reports

With auto-generated reports, you'll get a clear picture of your payroll costs, employee salaries, and more, so you can make smarter, data-backed decisions..

Simplified compliance

Compliance, and accuracy by design

We handle the difficult parts of Canadian compliance, so your payroll always stays aligned with federal and provincial labor laws.

Automate federal & provincial tax calculations

Zoho Payroll accurately calculates federal and provincial income taxes, including Canada Pension Plan (CPP)/Québec Pension Plan (QPP) contributions, Employment Insurance (EI) premiums, and QPIP.

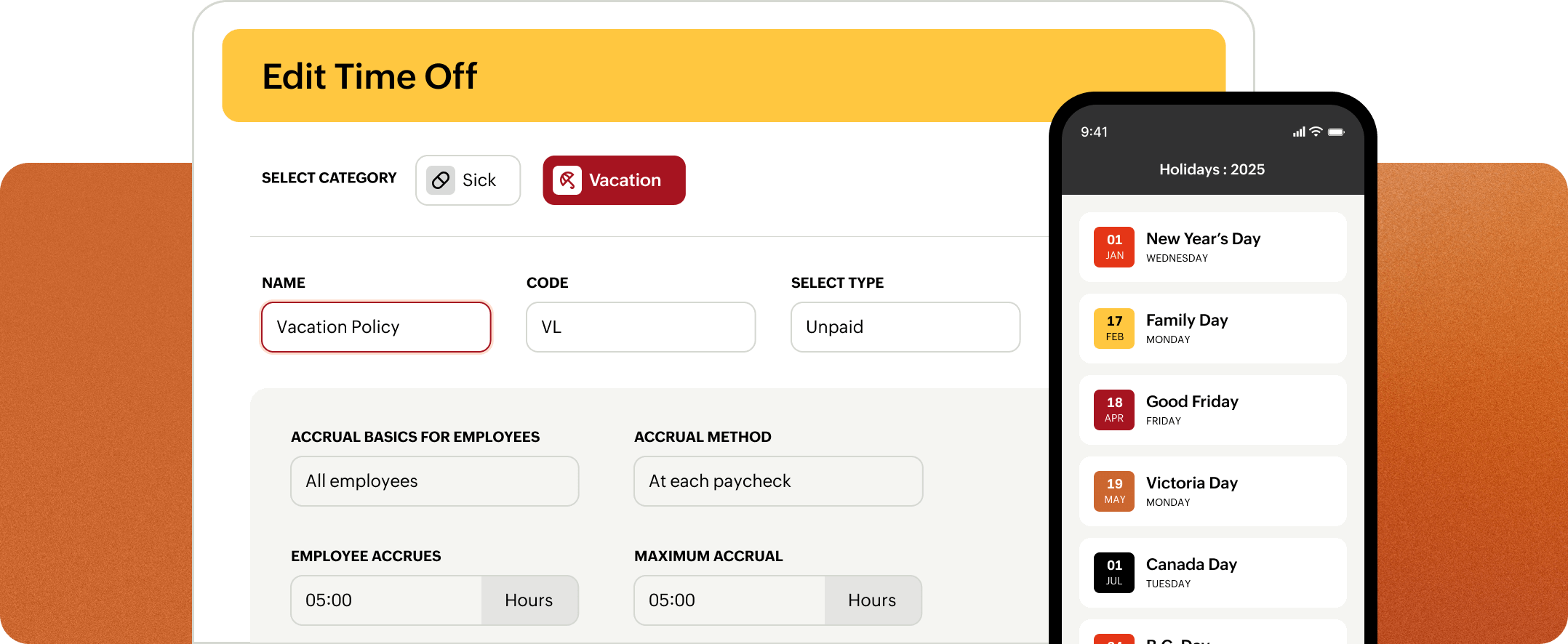

Vacation and statutory holiday pay

We'll handle all the vacation and statutory holiday pay according to Canadian statutory rules, and also give you the flexibility to design your own PTO policies that work for your team.

Record of Employment (ROE)

Say goodbye to the paperwork. We automatically generate a Record of Employment (ROE) for you when an employee leaves, making the exit process smoother.

T4 and RL1 tax forms

We automatically generate comprehensive T4 and RL1 slips, including all essential details from salaries to commissions.

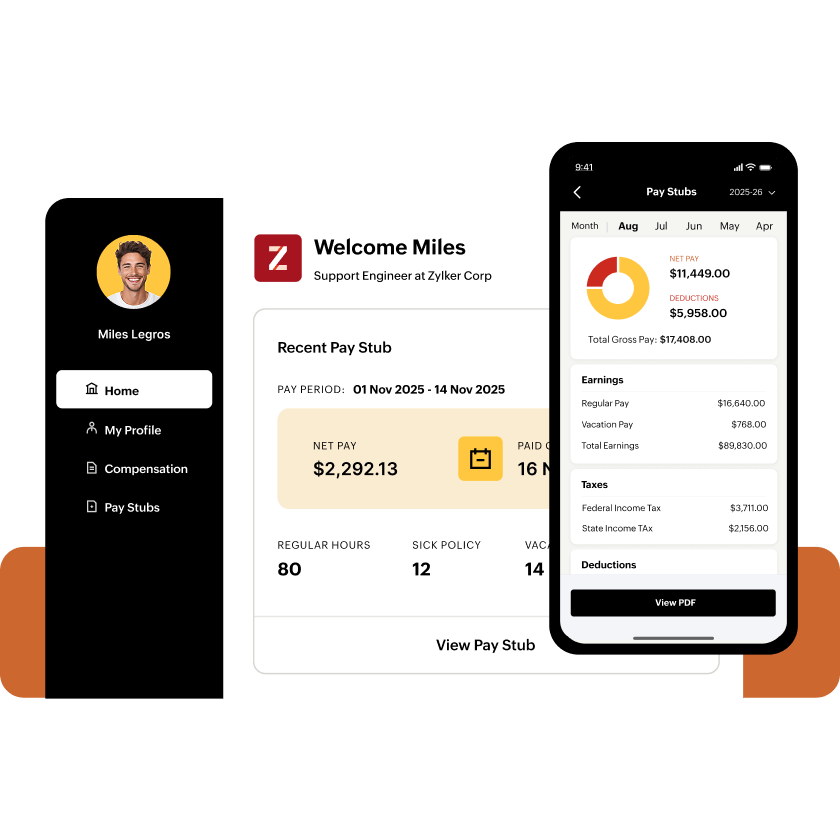

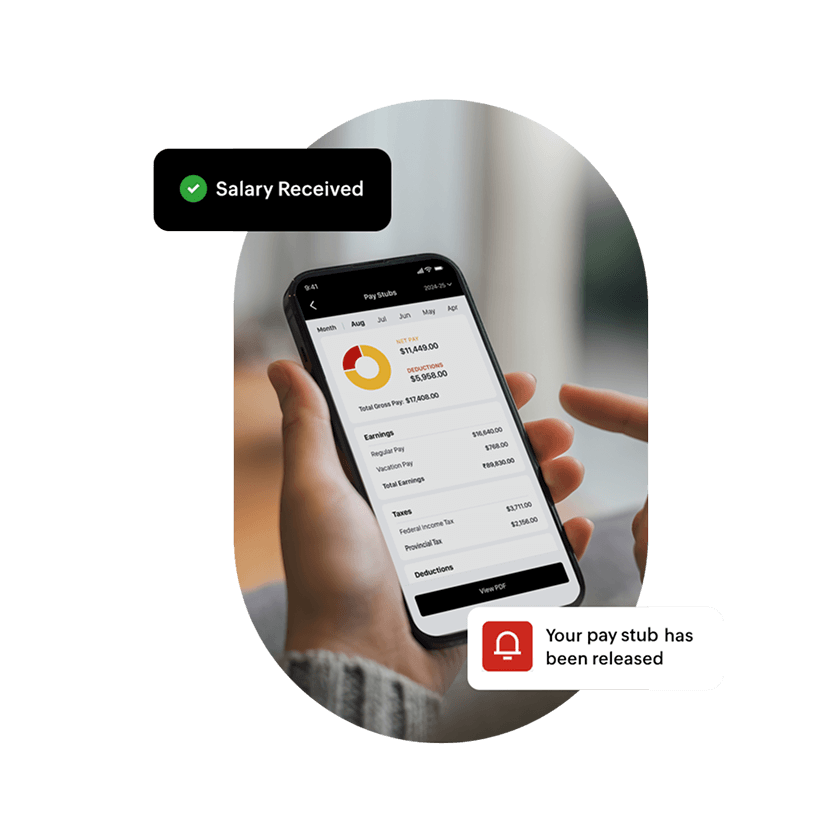

Employee self-service tool

Employee self-service experience that stands out

Integrations

Connect payroll to accounting and expense management systems

Handle every part of payroll, accounting and expense management by using the power of the Zoho ecosystem to connect your essential business operations.

Streamline payroll accounting.

Connect with Zoho Books and automatically post journal entries directly to your ledger, making your accounting process effortless.

Reimburse business expenses

Reimburse business expenses along with salaries quickly, bringing all your team's payments into a single, unified workflow.