General Organization for Social Insurance (GOSI)

The General Organization for Social Insurance (GOSI) in Saudi Arabia, oversees the administration of social insurance benefits and pension schemes for employees. Employers using our app must understand GOSI to ensure compliance and provide employees from Saudi Arabia with essential benefits.

GOSI manages social insurances that safeguards employees’ financial well-being, particularly during retirement and times of need. As an employer, here are key points to consider:

Mandatory Contributions

Both employers and employees are mandated to make monthly contributions to GOSI. These contributions are calculated based on the employee’s salary through our app, ensuring accuracy.

GOSI - Contribution Details

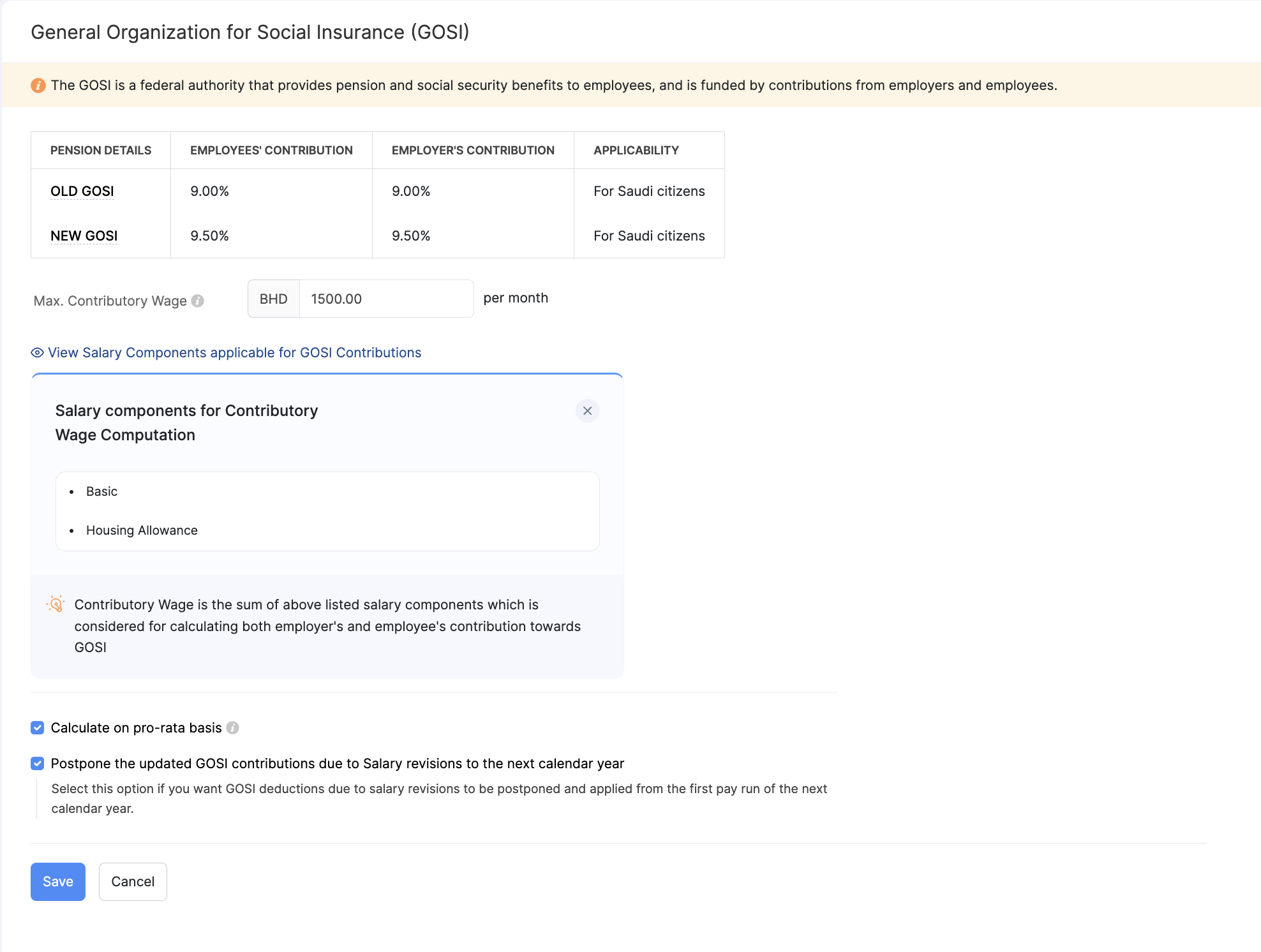

| Employee Contribution | Employer Contribution | |

|---|---|---|

| For employees who joined before July 3, 2024 | 9.00% | 9.00% |

| For employees who joined on or after July 3, 2024 | 9.50% | 9.50% |

NOTE GOSI has increased the contribution rate for employees who joined on or after July 3, 2024 to 9.50%. This revised rate is effective from July 3, 2025, and will increase by 0.5% every year until it reaches 11% on July 3, 2028.

Note Adherence to GOSI regulations is essential for employers. This involves accurate and timely reporting of contributions, maximum insurable earnings, and any changes in employment status.

Here’s how you can configure GOSI for your organisation.

Configuring GOSI

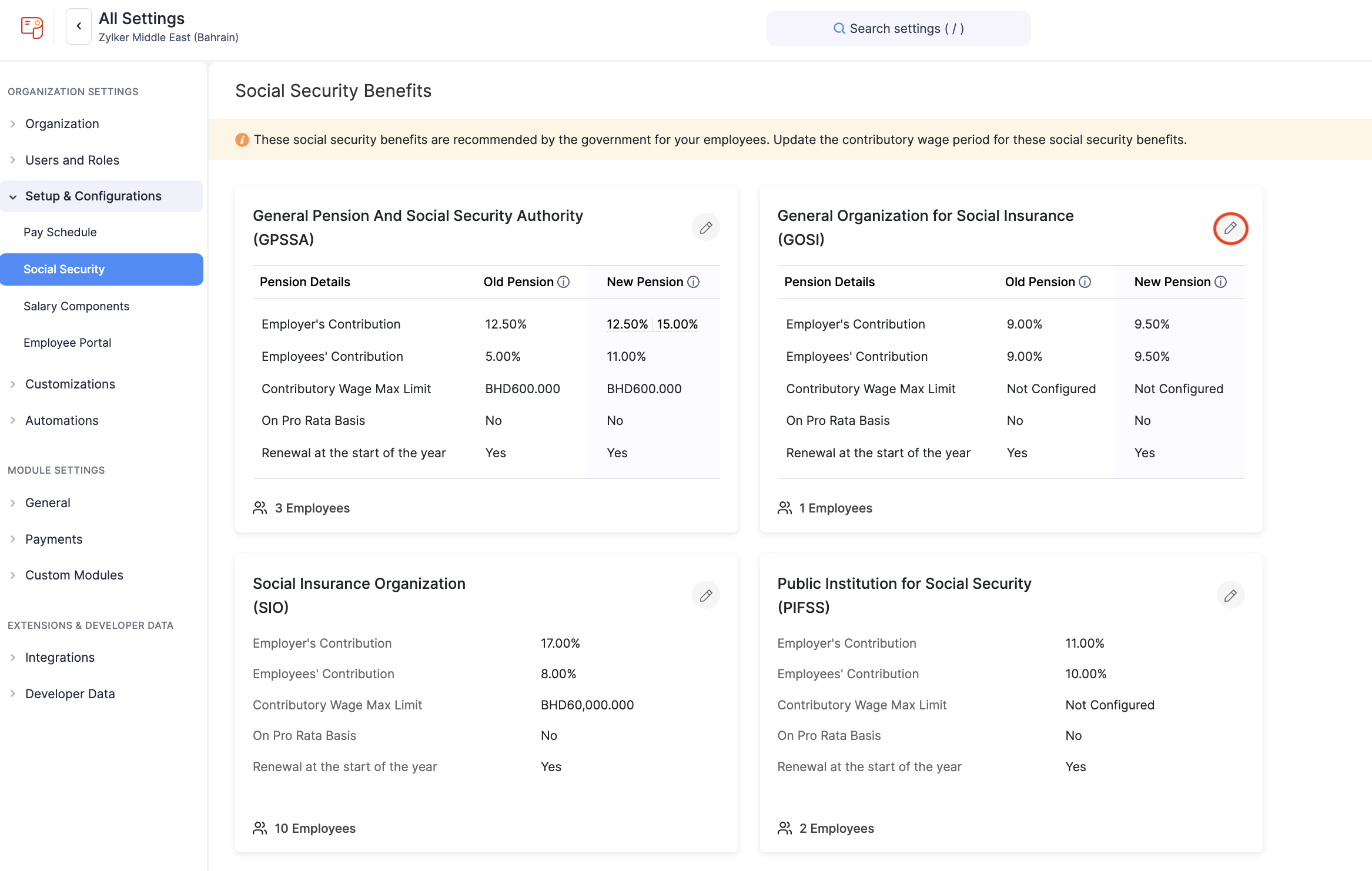

- Click Settings on the top right corner and select Social Security under Setup and Configurations.

- Click Edit in the General Organization for Social Insurance (GOSI) card.

- Enable the Calculate on Pro Rata Basis option if you want contributions to be calculated based on the actual working days of the employee. This ensures that contributions are proportional to the number of days worked in a given month.

- Choose the option to Postpone the updated GOSI contributions due to Salary revisions to the next calendar year if you wish to delay deductions resulting from salary revisions until the following calendar year.

- Click Save.

Pro Tip Understanding how the salary contributes to GOSI is vital. Click the View Salary Components Used for GOSI Contribution option to view the specific salary components is used to calculate the maximum contributory wage, providing transparency in the allocation of your salary towards GOSI contributions.