VAT in Sales

VAT is included in both the sales and purchase transactions of your business. There are different methods in which VAT is calculated on sales, according to the region and the VAT treatment of your customers. In Zoho Books, the VAT treatment of your customer is taken into account and the VAT associated with the item is automatically populated.

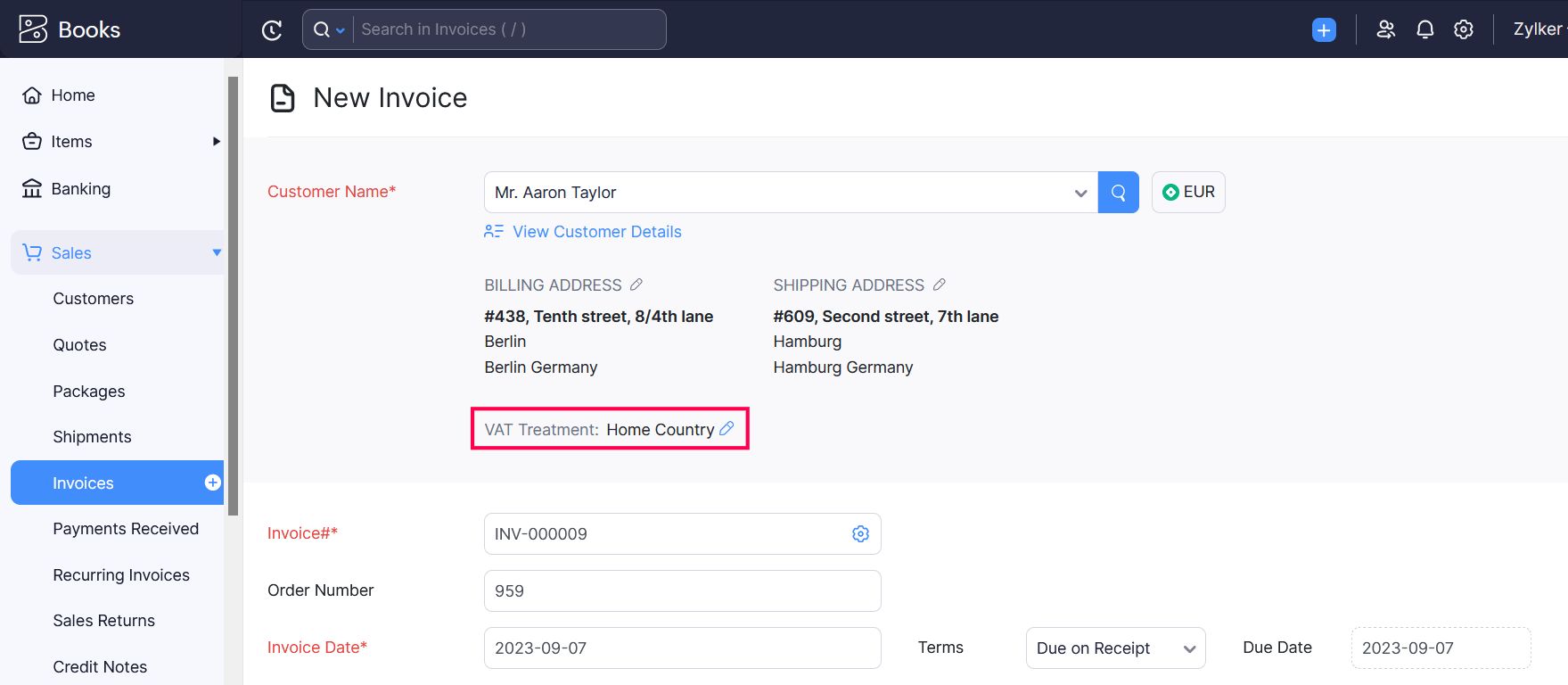

Sales Within Germany

To create a sales (Invoices, Recurring Invoices, Retainer Invoices, Quotes, Sales Orders, Credit Notes) transaction for your customer in Germany,

- Go to Sales and select one of the modules.

- Click the +New button in the top right corner of the page.

- Select the customer whose VAT treatment is Home Country.

- Associate relevant VAT rates for your items.

- After entering the required details, click Save.

Note: If you’re creating a sales transaction for a customer in Germany, you cannot associate other EU country tax rates with the items in that transaction.

Sales Outside Germany Within EU

For sales (Invoices, Recurring Invoices, Retainer Invoices, Quotes, Sales Orders, Credit Notes) that are made outside Germany but with other EU countries, the VAT rates depends on your customer’s VAT treatment.

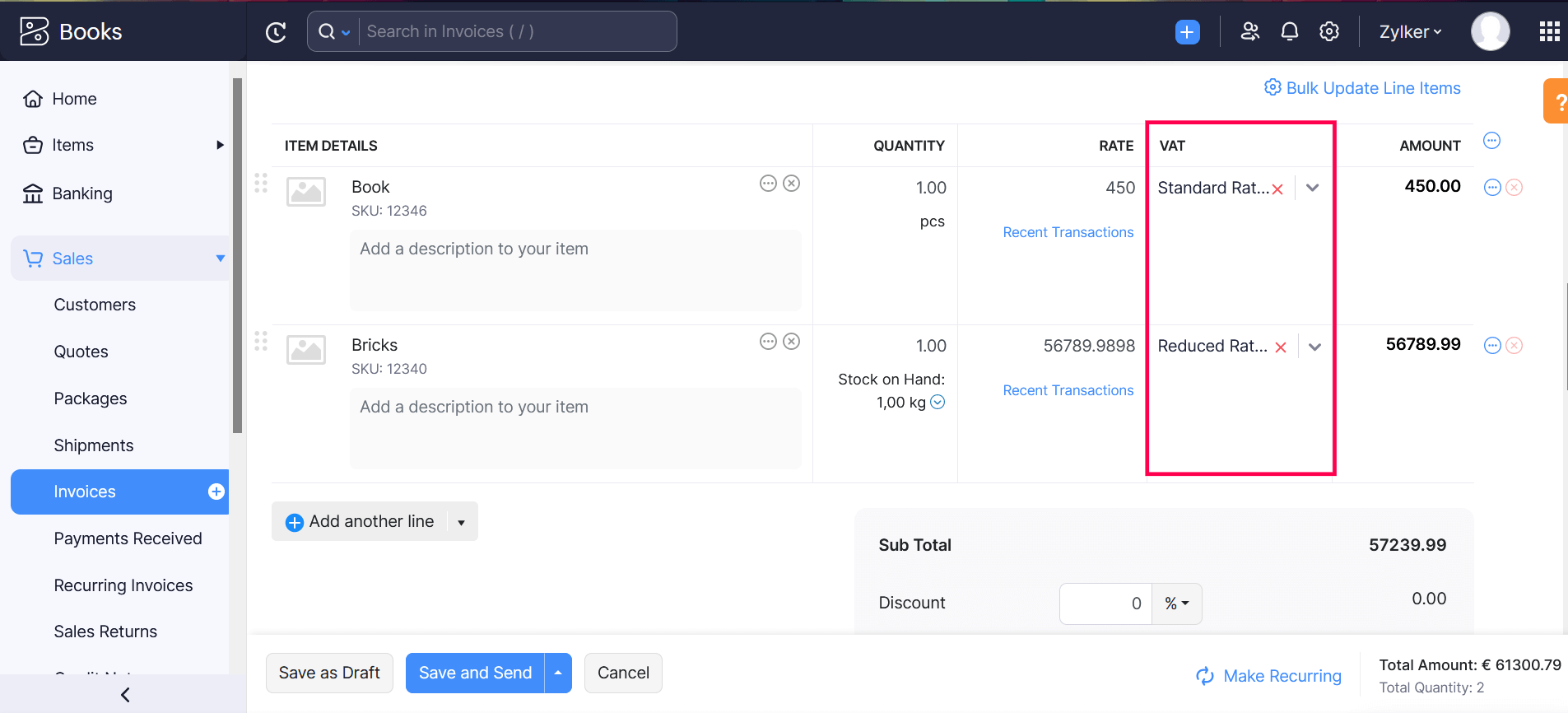

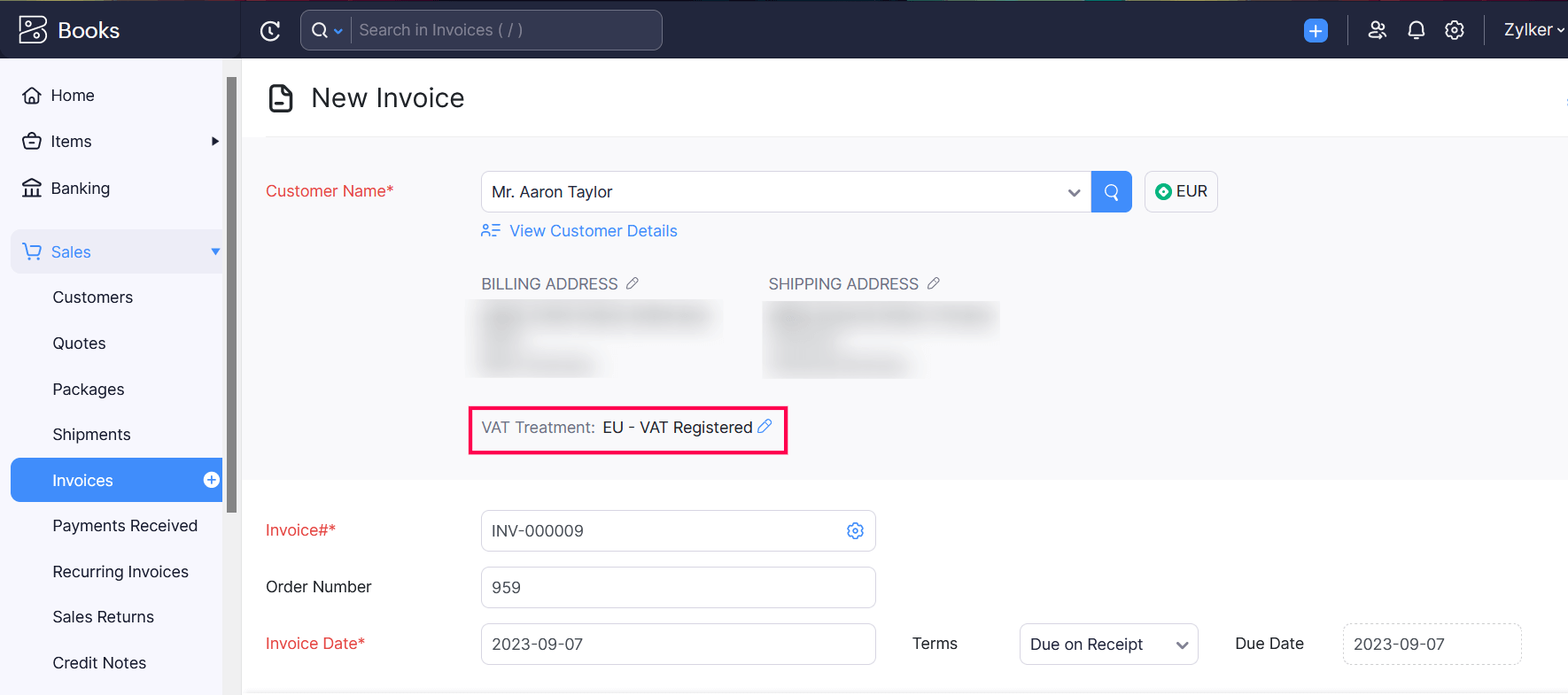

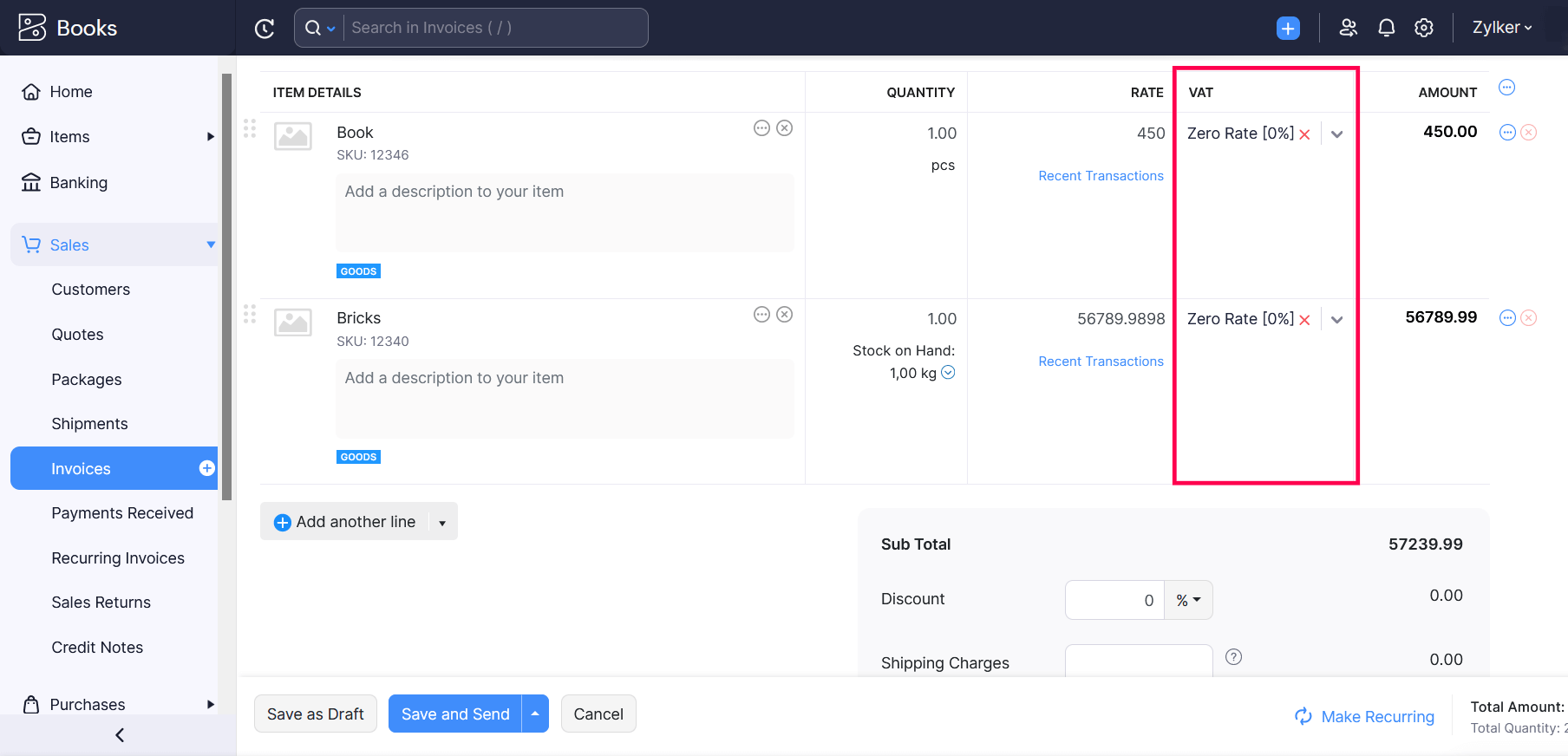

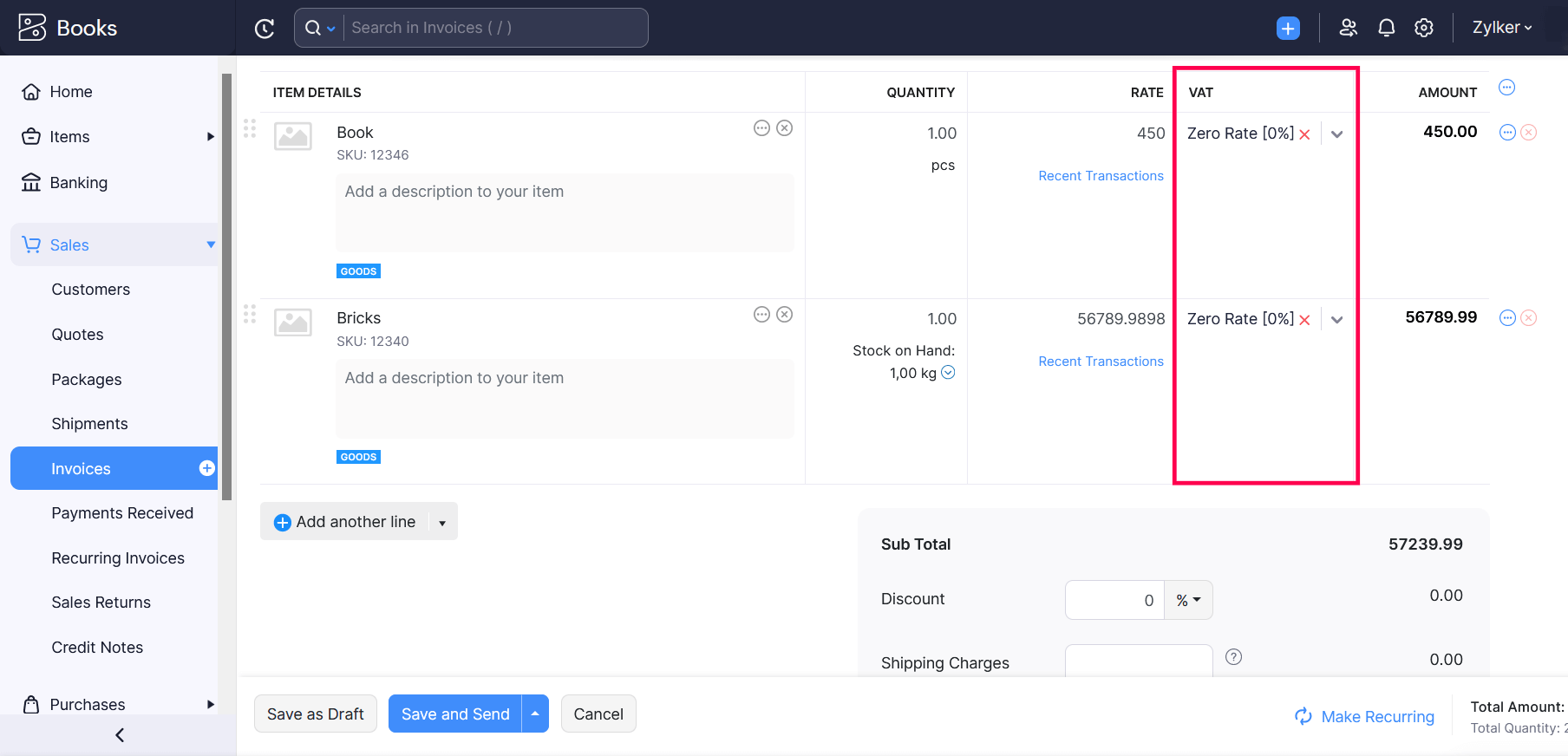

For EU VAT Registered Customers

As per Germany’s VAT regulations, if your customer lives in an EU country and has a VAT registration, all the items selected in the transaction must be associated with Zero Rate (0%) VAT.

Note: If you select only services in the transaction, they will be automatically eligible for Reverse Charge and must be associated with Zero Rate (0%) VAT.

To create a sales (Invoices, Quotes, Sales Orders, Credit Notes) transaction for your VAT registered customer in the EU,

- Go to Sales and select one of the modules.

- Click the +New button in the top right corner of the page.

- Select the customer whose VAT treatment is EU - VAT Registered.

- Associate Zero Rate [0%] in the VAT column for your items.

- After entering the required details, click Save.

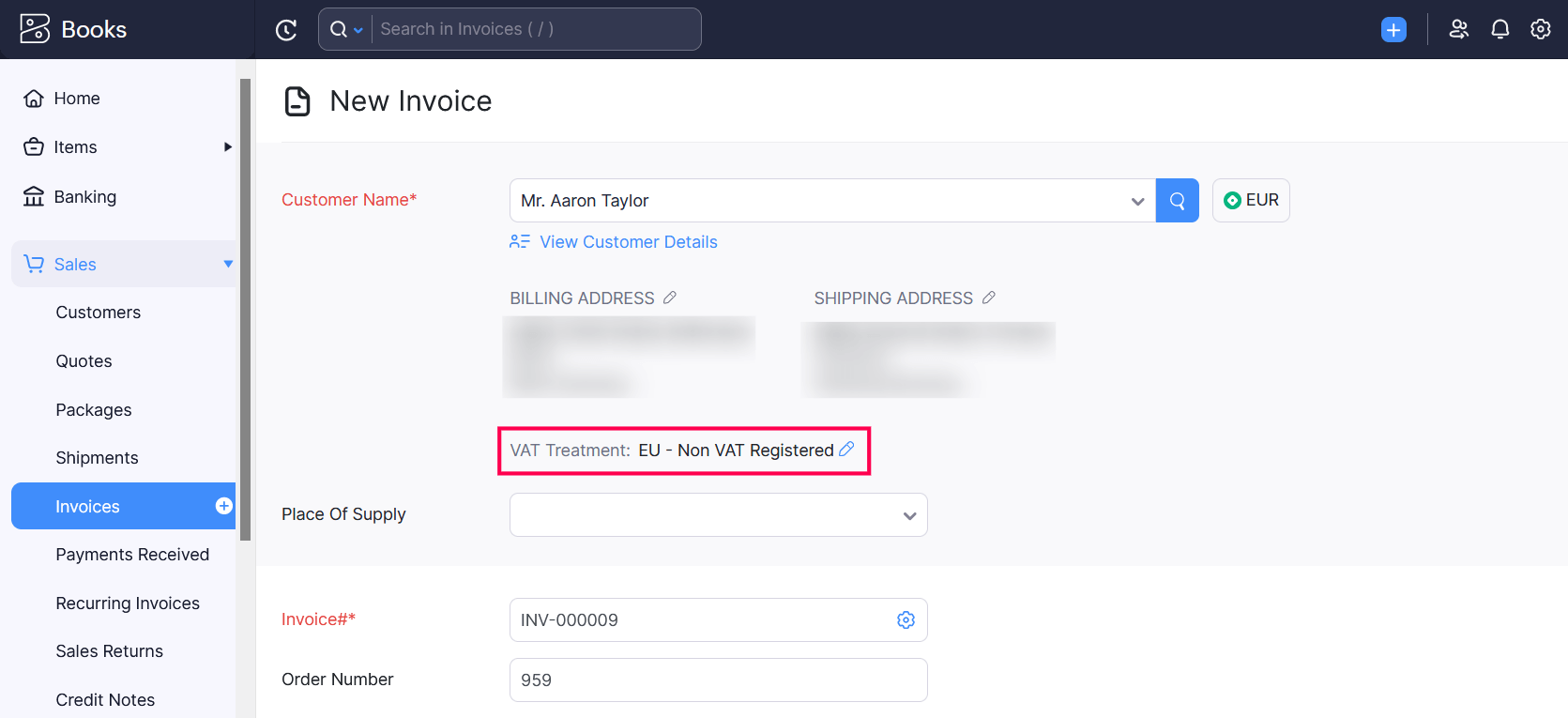

For EU Non VAT Registered Customers

According to Germany’s VAT regulations, if your customer lives in an EU country and isn’t registered for VAT, the items in their sales transactions will have either the default VAT rates or the VAT rates associated with their Place of Supply.

To create a sales (Invoices, Quotes, Sales Orders, Credit Notes) transaction for your Non-VAT registered customer in the EU,

- Go to Sales and select one of the modules.

- Click the +New button in the top right corner of the page.

- Select the customer whose VAT treatment is EU - Non VAT Registered.

- Associate relevant country’s VAT rates in the VAT column for your items.

Note: If the total transaction amount is above EUR 10,000, the items in your transaction should be associated with your customer’s country’s VAT rates.

- After entering the required details, click Save.

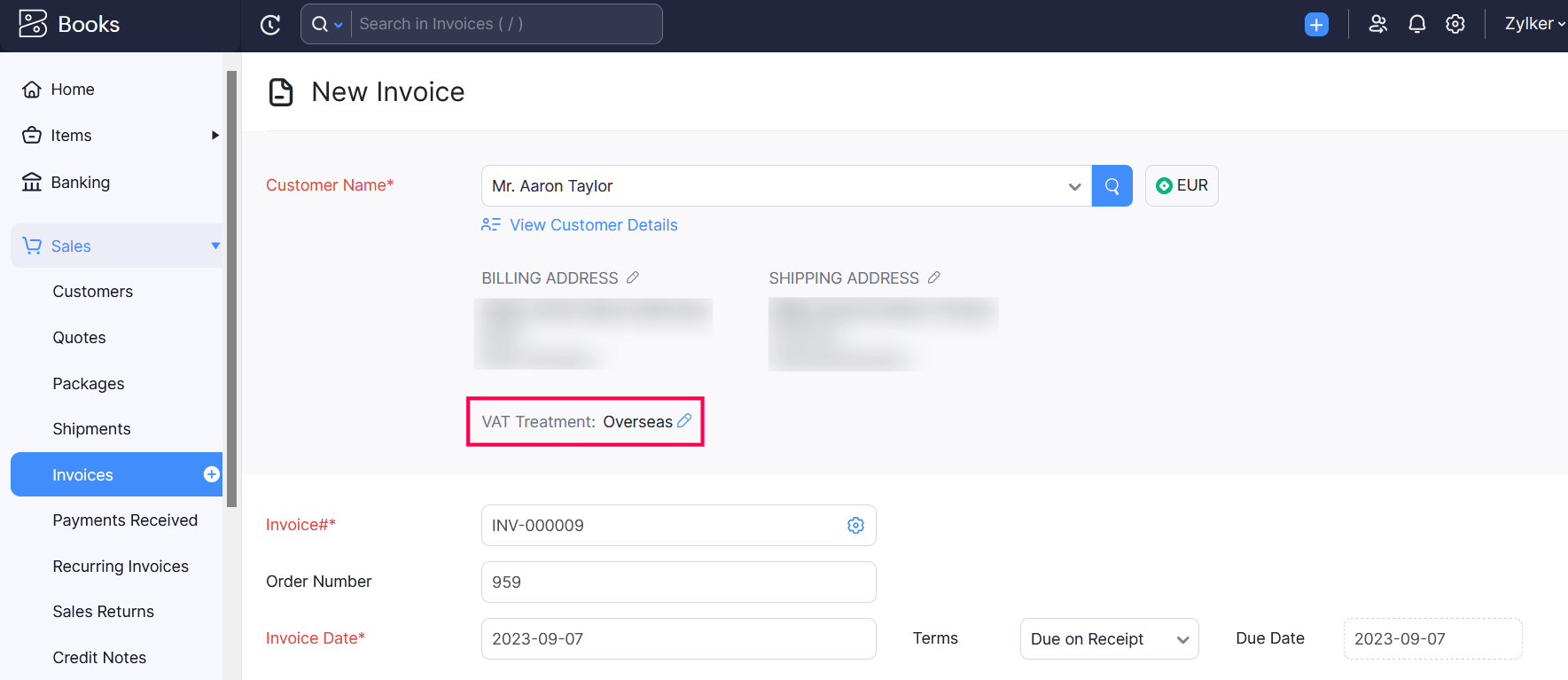

Sales Outside EU

As per Germany’s VAT regulations, if your customer lives outside the EU, all the items selected in their sales transactions must be associated with Zero Rate (0%) VAT.

To create a sales (Invoices, Recurring Invoices, Retainer Invoices, Quotes, Sales Orders, Credit Notes) transaction for your customer outside the EU,

- Go to Sales and select one of the modules.

- Click the +New button in the top right corner of the page.

- Select the customer whose VAT treatment is Overseas.

- Associate Zero Rate [0%] in the VAT column for your items.

- After entering the required details, click Save.

Yes

Yes