VAT in Purchases

VAT is included in both the sales and purchase transactions of your business. There are different methods in which VAT is calculated on purchases, according to the region and the VAT treatment of your vendors. In Zoho Books, the VAT treatment of your vendor is taken into account and the VAT associated with the item is automatically populated.

Purchases Within Germany

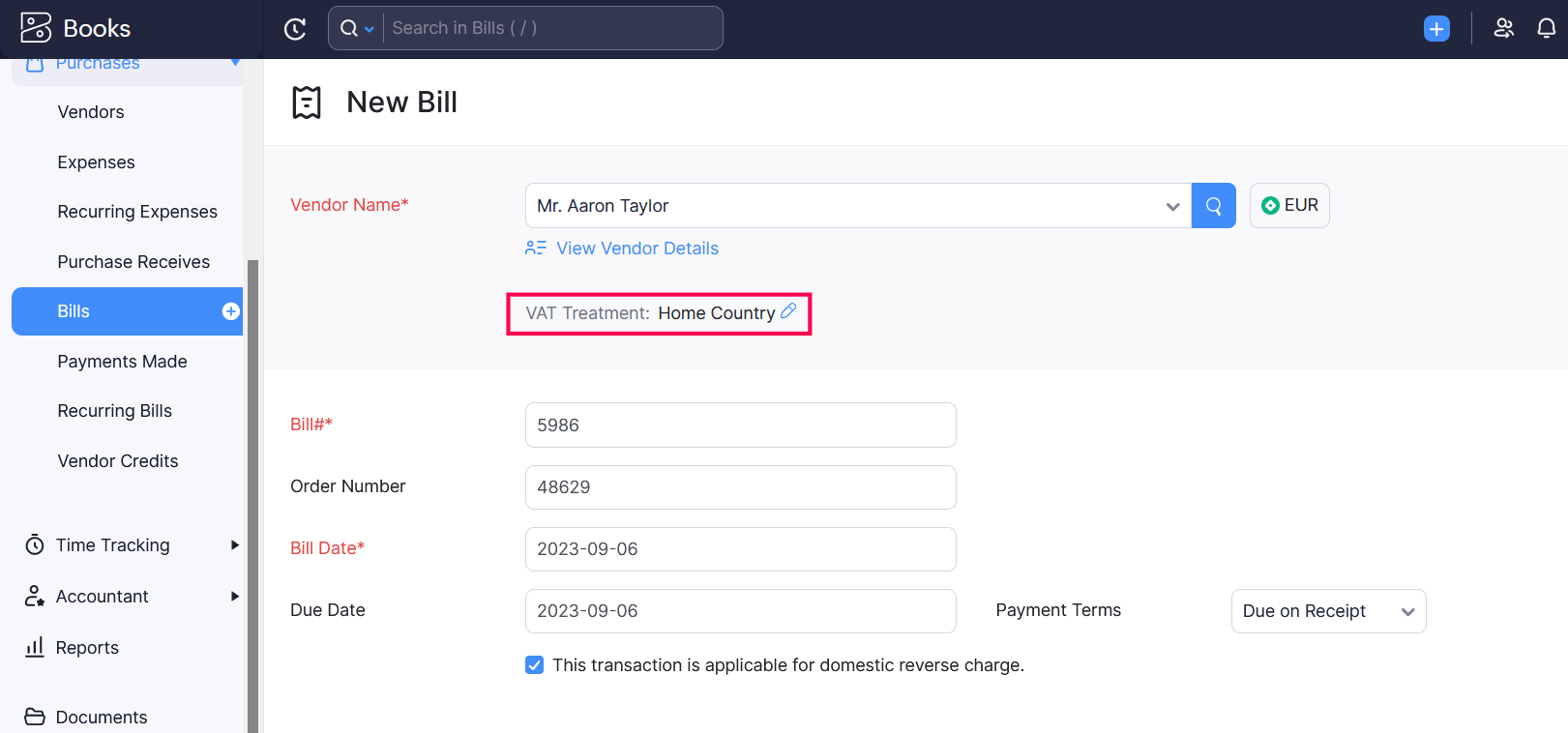

For creating a purchase (Bills, Recurring Bills, Expenses, Purchase Orders, Vendor Credits) transaction for a vendor in Germany,

- Go to Purchases and select one of the modules.

- Click the +New button in the top right corner of the page.

- Select the vendor whose VAT treatment is Home Country.

- Associate relevant VAT rates for your items.

- After entering the required details, click Save.

Note: If you’re creating a purchase transaction for a vendor in Germany, you cannot associate other EU country tax rates with the items in that transaction.

Purchases Outside Germany Within EU

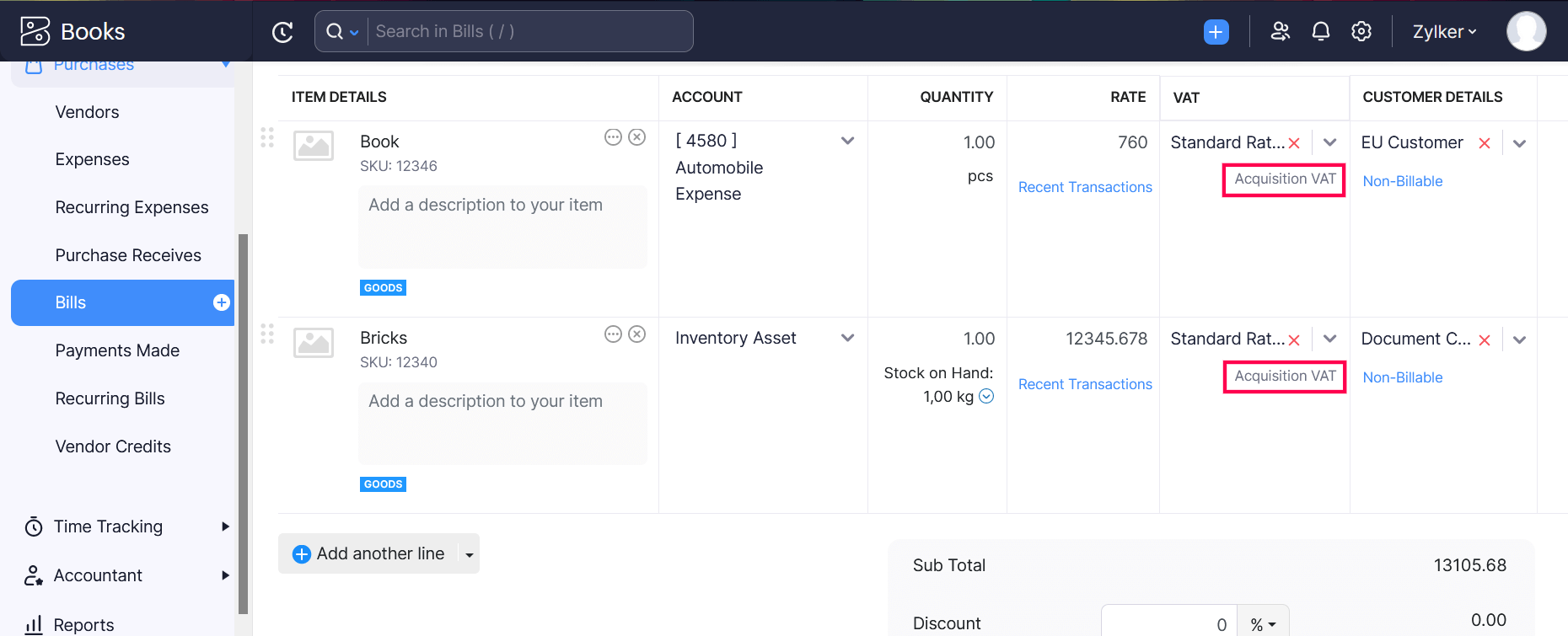

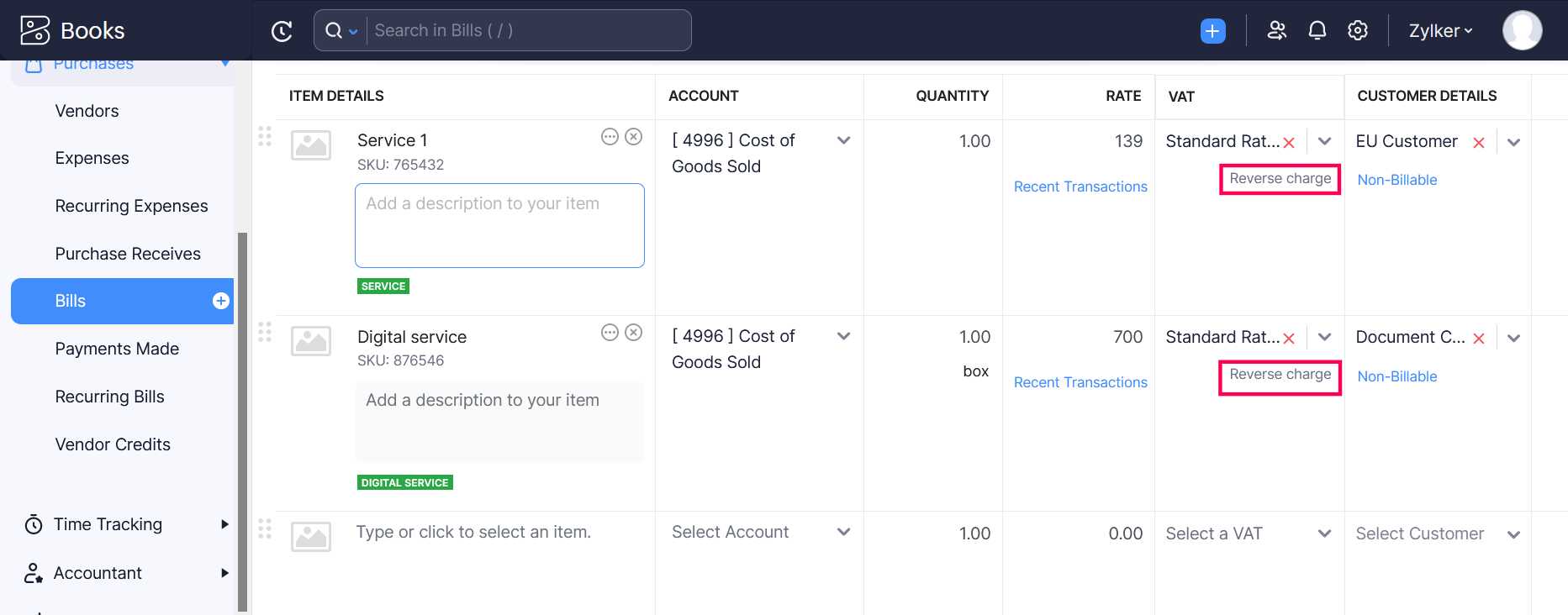

For purchases (Bills, Expenses, Purchase Orders) that are made outside Germany but with other EU countries, the VAT rates depends on the type of items you select.

Create a bill with the vendor’s VAT treatment as EU - VAT Registered or EU - Non VAT Registered.

If you select goods and services in the transaction, they will be automatically eligible for Acquisition VAT.

- If you select only services in the transaction, they will be automatically eligible for Reverse Charge.

Purchases Outside EU

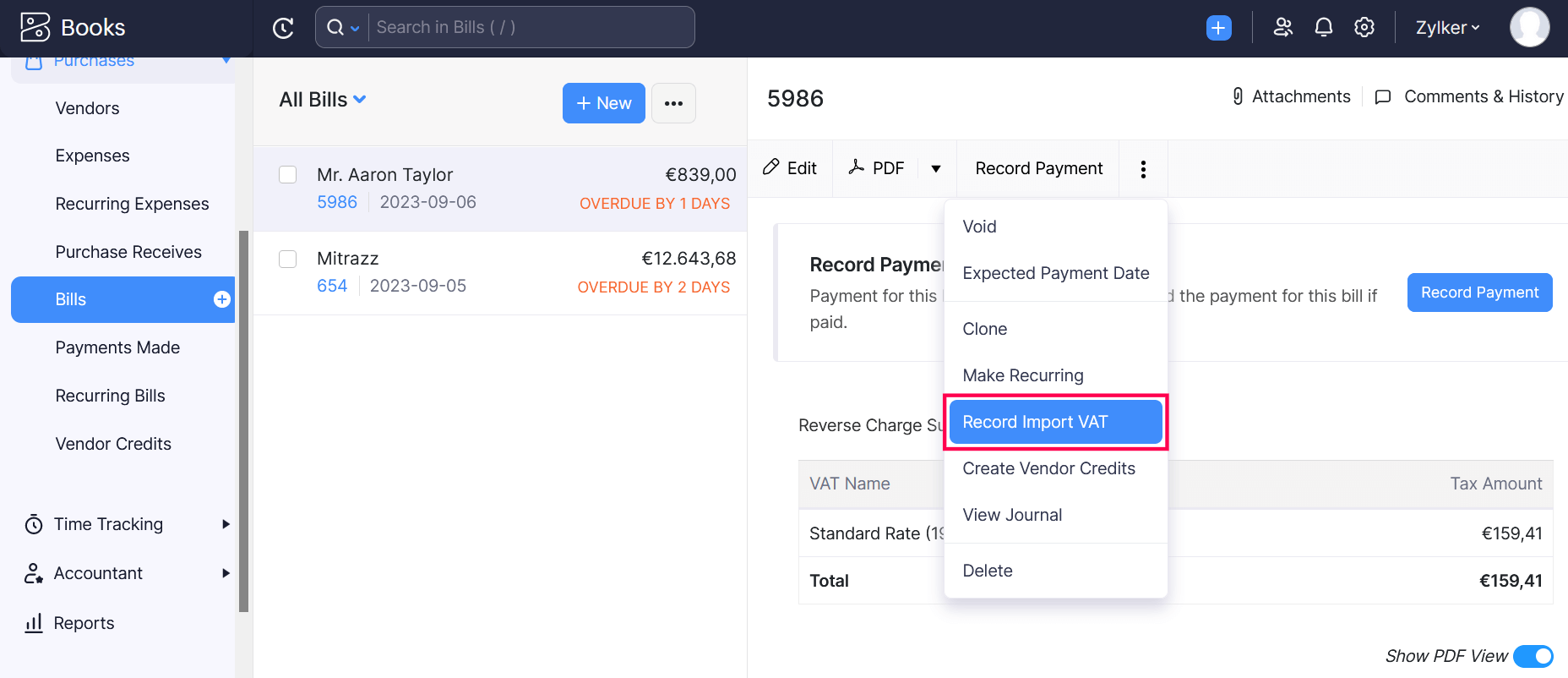

When you import goods from vendors who are outside the EU, you might have to pay additional VAT charges. These charges are mostly because of custom duties and related taxes and you cannot include these charges as VAT rates in the bill, expense, or purchase order you’re creating. Such additional charges can be recorded as Import VAT in Zoho Books.

To record the import VAT:

- Create a bill with the vendor’s VAT treatment as Overseas.

- In the bill details page, click the More dropdown in the top right corner.

- Select Record Import VAT.

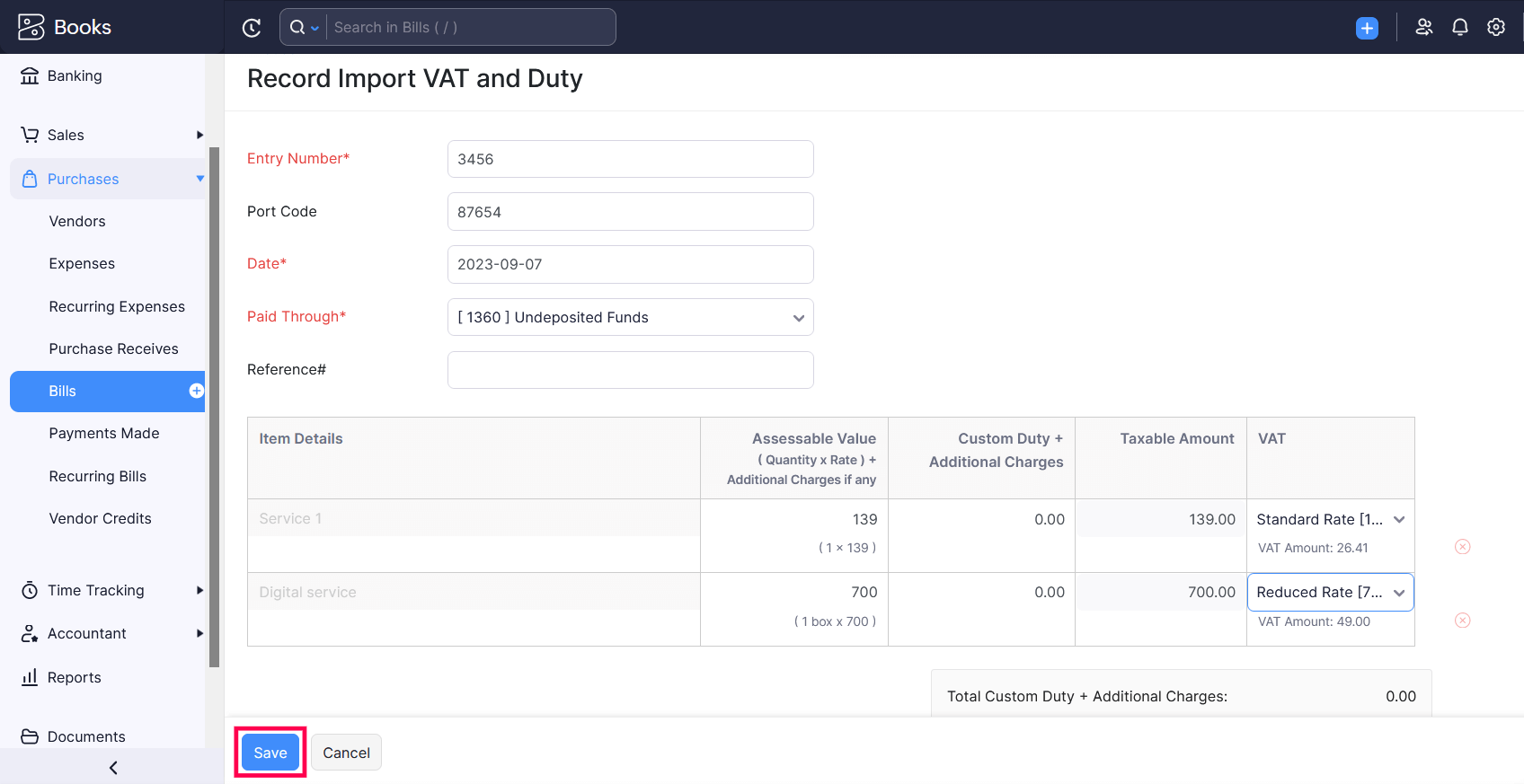

- In the next page, enter the bill Entry Number and Port Code.

Insight: A Port Code is a unique code assigned to specific locations, such as seaports, airports, and other inland destinations, used by shipping and freight companies during international transports.

- Enter the Date and the select the Paid Through account.

- Next, enter the Assessable Value (Item Quantity x Item Rate) of the goods and their Custom Duty + Additional Charges.

- Select relevant VAT rates for all the items selected in your bill.

- Click Save.

The import VAT for the bill you created will be saved.

Yes

Yes