Customer Journey at

a Car Insurance Company

Objective: A car insurance company increases customer satisfaction by connecting with customers via multiple touchpoints.

- Scenario

- Setting up

Scenario

Customers who purchase car insurance often manage their claims and repair or replacement through brokers and third-party vendors. The customers have to communicate with these vendors and get updates on the claim settlement and car status on their own. The insurance firm has very little involvement with its customers at these stages which is challenging for maintaining a long-term engagement. The lack of communication and inconsistent liaison often leads to dissatisfaction.

The insurance firm needed a solution to stay connected with the customers throughout their journey and understand their behavior by connecting at various touchpoints.

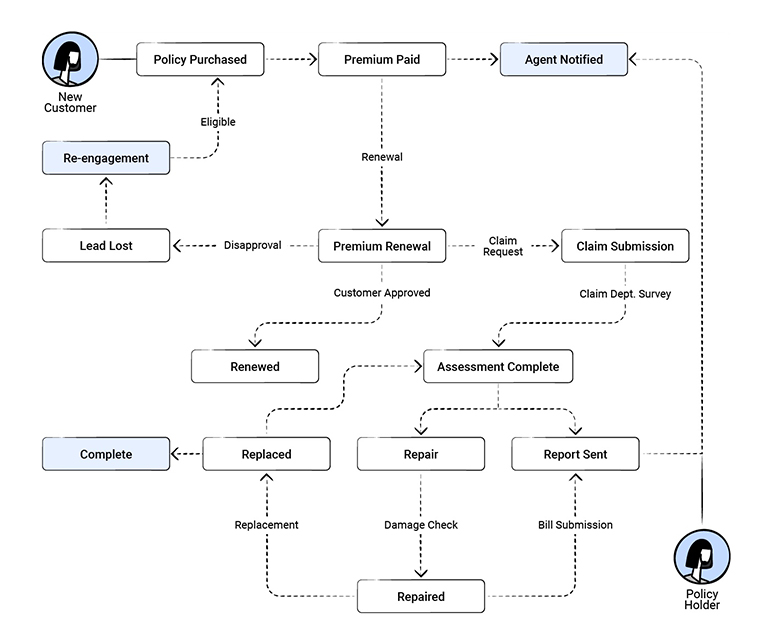

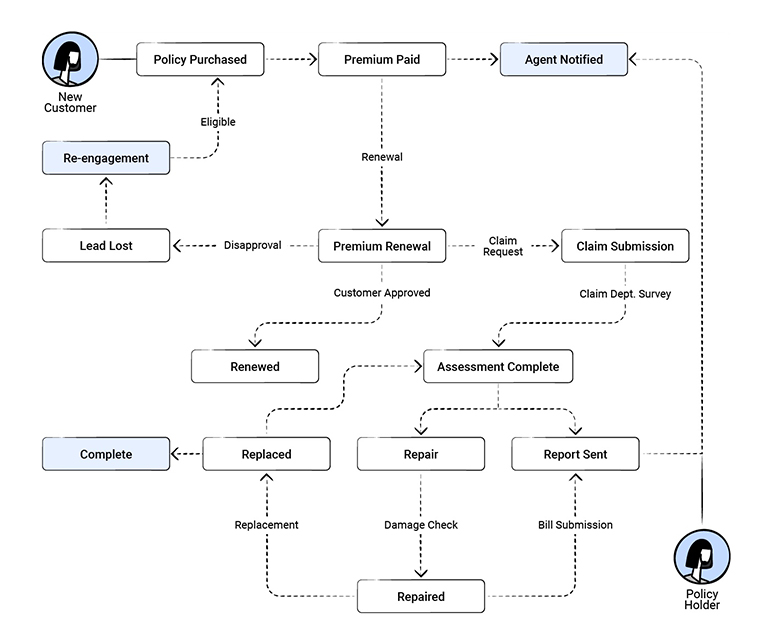

Activity Diagram:

This is the pictorial representation of the policy purchase and claim management process.

Flow of event problem setting up

Purchase and premium payment: A customer purchases one of the policies and pays the annual premium. Agents send reminder emails and phone the customers to ensure they pay the premium before the due date.

Policy renewal: A month before the policy expiration date, the customer is reminded to renew. Sometimes, customers choose not to renew and they are churned out of the sales process.

Claims: When their car is damaged, the customer makes a claim with the broker, who passes on the information to the insurance firm and manages the necessary paperwork independently. The cash settlement and required formalities are completed by the broker. The broker then communicates the transaction details to the insurance firm, who update the customer data.

Replacement and repair: Complete vehicle replacement, part replacement, and repairs are managed by a third-party vendor who provides end-to-end services. Details about the transaction are communicated to the insurance firm who they update the customer data.

Problem?

Because claims and replacement activities are managed outside the firm, the insurers struggle to keep their customers informed of the current status of their funds and vehicles. Customers are often frustrated by their inability to find out:

- When will they get their car back?

- What has been replaced?

- Did the replaced spare part come from the original parent company?

- What is the final repair charge?

Let us see how CommandCenter can help answer these questions.

Setting up CommandCenter

CommandCenter provides a unique platform to combine all the touchpoints in a customer journey under one roof. This enables the company to monitor its customers' activities from the time of purchase to the claim settlement and completion of repairs or replacement.

They can communicate the status of the vehicle at every stage to the customers, ensuring consistent communication.

The states, transitions, and actions that are configured for the process are as follows:

State

The states that we will configure for customers who make a claim are: Policy Purchase > Claim Submission > Survey Assessment > Claim Approved > Fund Release > Repair/Replacement > Car Status > Complete.

Transition

A customer can only move to the Claim Submission state if they make a claim request. This is a mandatory condition that must be fulfilled in order to move to the next state.

Therefore, Claim Request will be a transition between the Policy Purchase and Claim Submission states. All transitions will be explained in the table below.

Actions in states and transitions

When a claim request is received, a claim request form is sent to the customer via email. This must occur automatically when the customer is in the Claim Submission state. Other automated actions could be sending an email or SMS or notifying vendors. All these actions will be explained in the table below.

Here is how the CommandCenter model of the process will look like.

**The numbers represent the states and the yellow colored boxes are the transitions.

Let us move on to the next section where we will discuss more on designing and implementing journeys.

- 1. Go to the CRM Setup > Process Management > CommandCenter.

- 2. Click Create Journey and enter the following information:

- Journey name: Claim management.

- Description: Journey of the customer from policy purchase to claim settlement.

- 3. Click Proceed.

- 4. In the Journey Builder page, click Click to add State.

- 5. Create State: In Create State, enter the State Name, Description, and choose the module under Type.

- 6. Click Save.

You will be redirected to the journey builder page. You can either add an Action for the created state or click + Add State, to include the next state. - 7. Action for State: Click Actions tab for the state and select from of the following action types:

- Instant

- Scheduled

- Recurring

- 8. Click Save, to save the action.

- 9. Click + Add StateRepeat steps 5 to 8.

- 10. Create Transition: Click the + icon displayed between the two states, to add a Transition.

- 11.In the Transition info tab, enter the Transition name, Description, and Trigger on.

- 12. Click save.

- 13. Action for Transition: Click Actions tab, to add an action to the transition.

- 14. Click Conditions tab, to set the transition for selected records only.

The table below shows the states, transitions, and actions configured to build the Claim management journey.

| Default State | Transition | State 1 |

|---|---|---|

Name: Start Automatic action: N/A | Name: Policy Chosen When it will be triggered: When a lead is converted to a contact. | Name: Policy Purchased |

You have successfully configured customer journey for car insurance.