Back

How to associate sales tax to a contact?

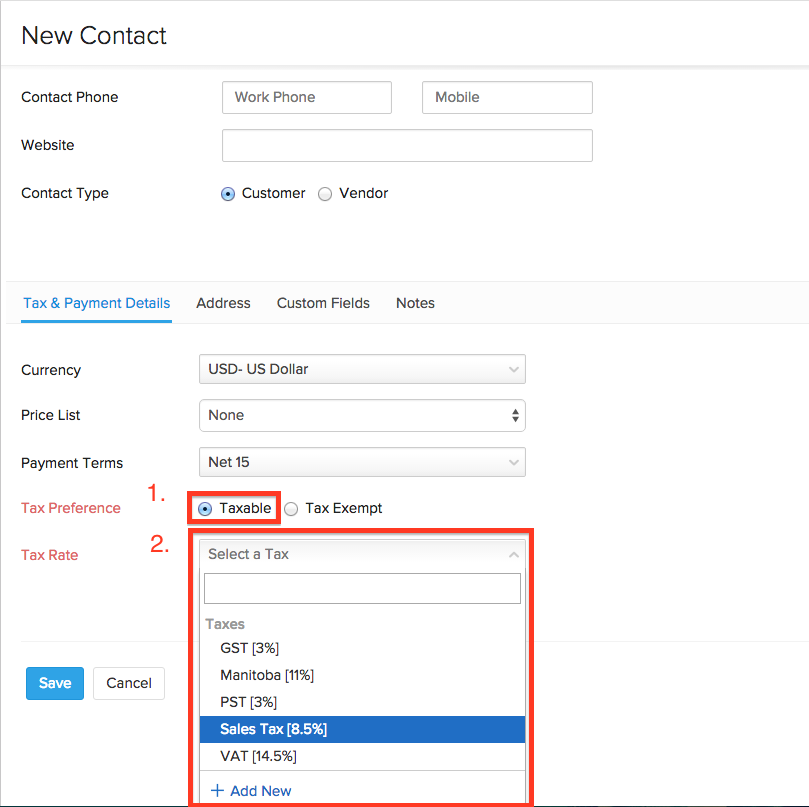

Let’s say, your customer resides in Utah where a sales tax rate of 4.7% applies. Read below to find out how you can associate this rate to the customer.

- Go to the Contacts tab.

- After filling in customer details, scroll down to the Tax Type label and ensure that Taxable is checked.

- Select the required tax rate for contact from the drop down box adjacent to the Tax Rate label.

- You can also add new taxes here.

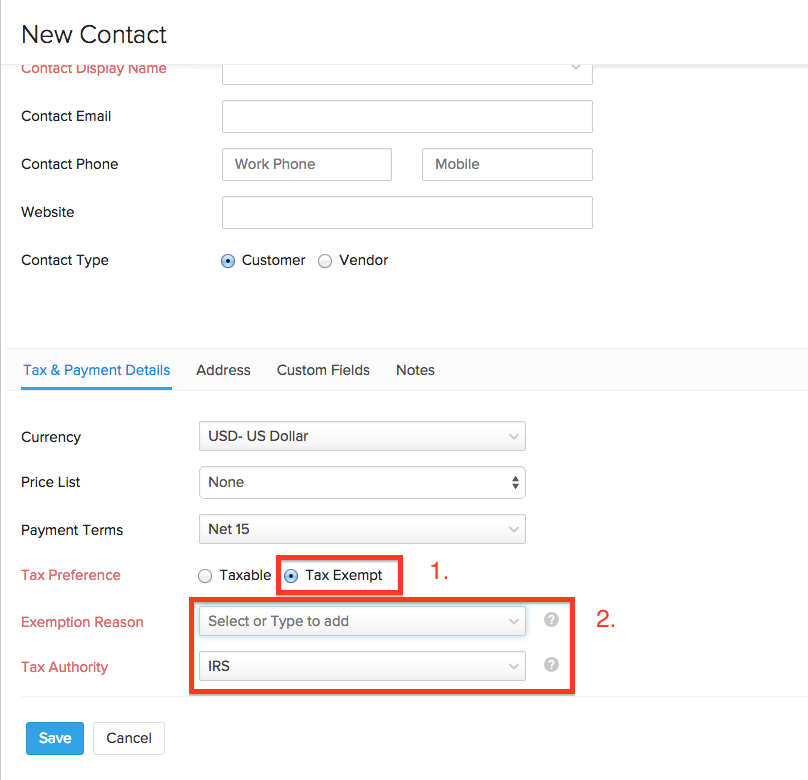

Making a contact nontaxable

There might be occasions where your customer is a non-profit organization which is exempt from tax. You can make a particular customer non-taxable by following the below steps.

- Go to the Contacts tab.

- After filling in customer details, scroll down to the Tax Type label and ensure that Non-Taxable is checked.

- Enter the Exemption Reason and Tax Authority.

- Scroll down and click the Save button.