The VAT regime has had a major impact on business owners and their accounting. This new tax system has been in the works for quite some time, and business owners have had their share of concerns about how they would be affected. Now that it’s here, we can see that it hasn’t just impacted the price of goods and services, but also changed the way that business owners record their sales and accounts. The new requirements laid down by the Federal Tax Authority (FTA) has business owners scrambling to find appropriate accounting software. For some business owners who’ve been using manual accounting up to now, the VAT regime marks the first time they’ve had to use accounting software at all.

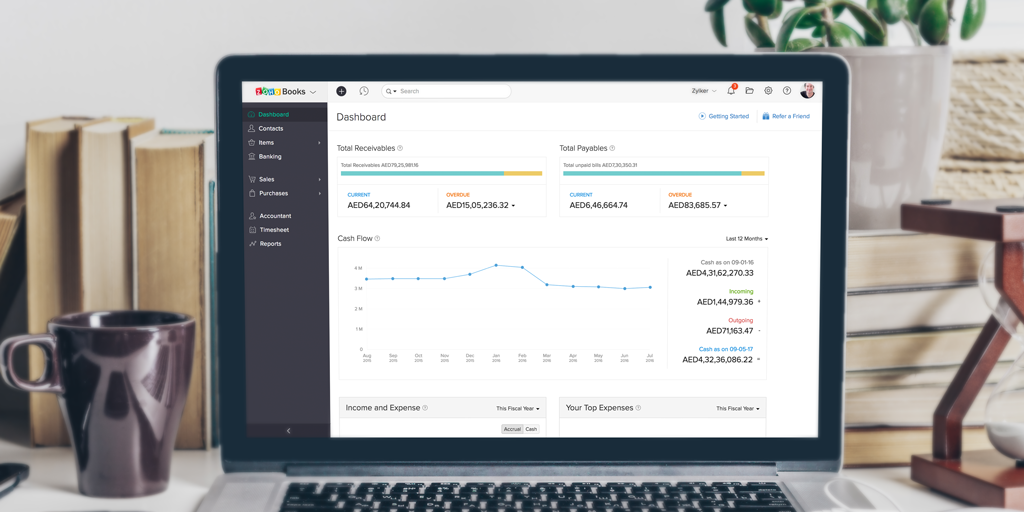

To help business owners manage their finance and stay VAT compliant, we’ve made Zoho Books VAT-ready. With Zoho Books you can complete business transactions, manage your customers and vendors, issue VAT compliant documents, generate reports, and file your tax returns in a few clicks. Now that Zoho Books has all the necessary features for a business to comply with the VAT laws, it has been recognized as FTA accredited tax accounting software.

Let’s take a look at what VAT-ready business owners need to do with their accounting software.

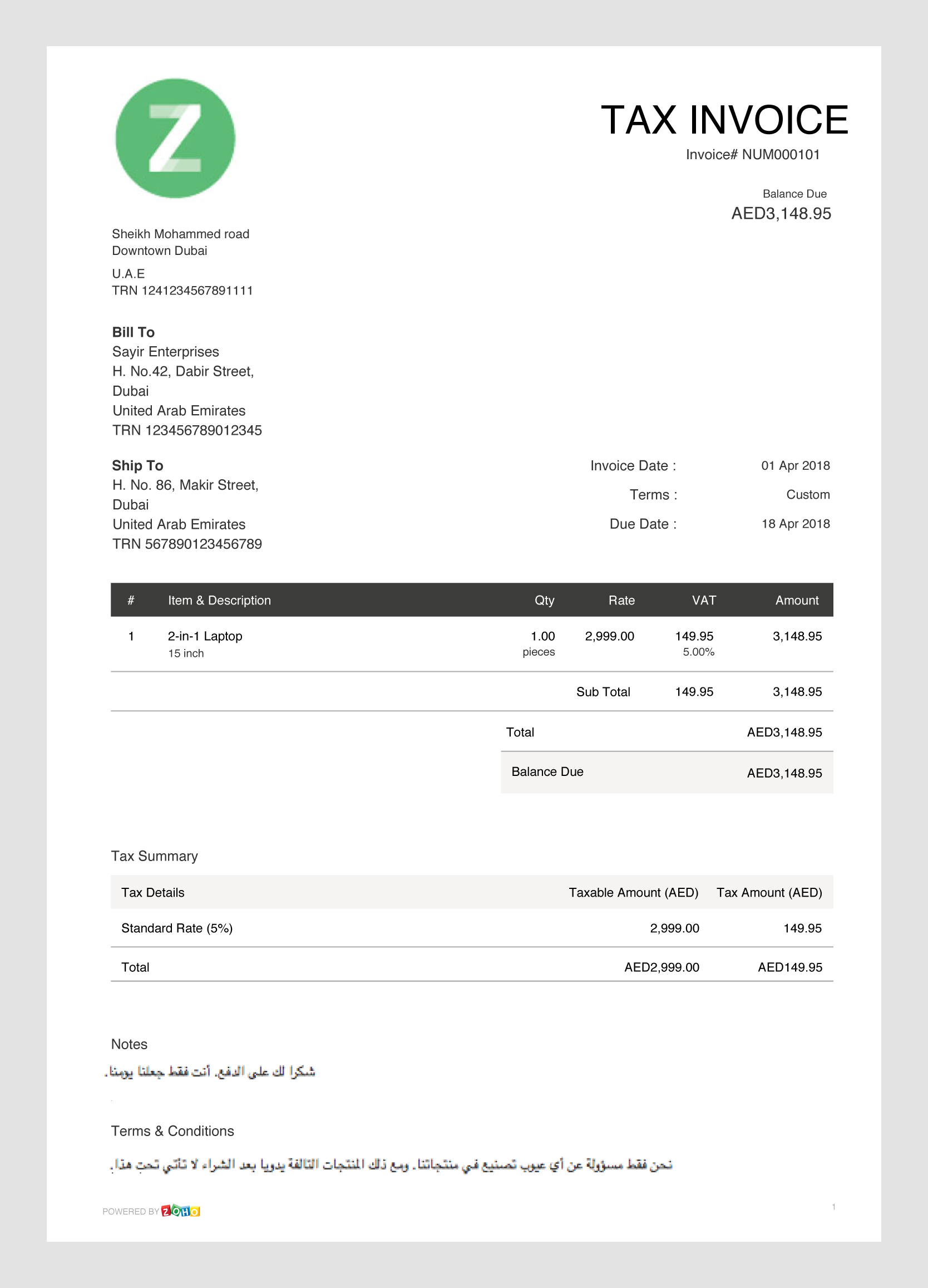

Issue VAT compliant documents

The FTA has established certain rules for transaction documents and the data fields that they should contain. Leaving out important specifications, or generating documents that do not comply with the laws, is likely to attract a heavy penalty from the FTA.

With Zoho Books, you can issue FTA-approved documents like tax invoices, self-billed invoices, bills, and credit and debit notes. Transactions that involve the reverse charge mechanism are explicitly identified on the document.

You can also customize your invoices or use templates to add a dash of your personal touch and ensure brand recognition. Starting with the included templates, you can format your invoices and rearrange data fields to suit your business.

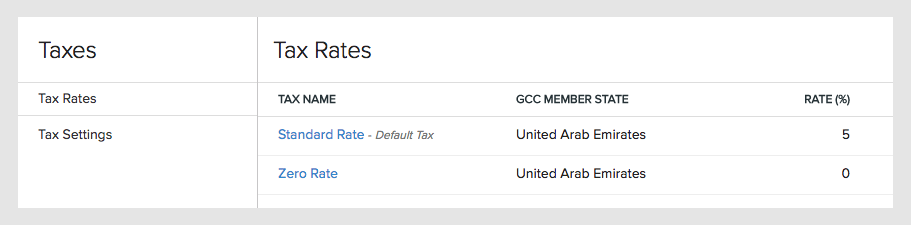

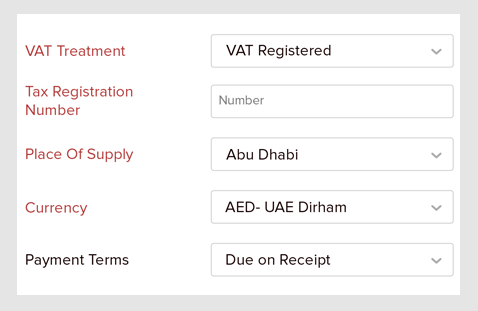

Record the right transaction details

FTA’s new regulations require business owners to record details like the VAT rate and place of supply for each transaction. Keeping the tax laws and the needs of business owners in mind, Zoho Books has been designed to ease the process of recording transactions.

Business owners who handle transactions both inside and outside the UAE can divide their customers and vendors into VAT registered, non-VAT registered and non-GCC entities.

These categories make it easy to record the Place of Supply and select the appropriate VAT rate for each transaction. Special designations for excise goods (like tobacco) and digital services (like animation) help ensure the right VAT rates for each supply.

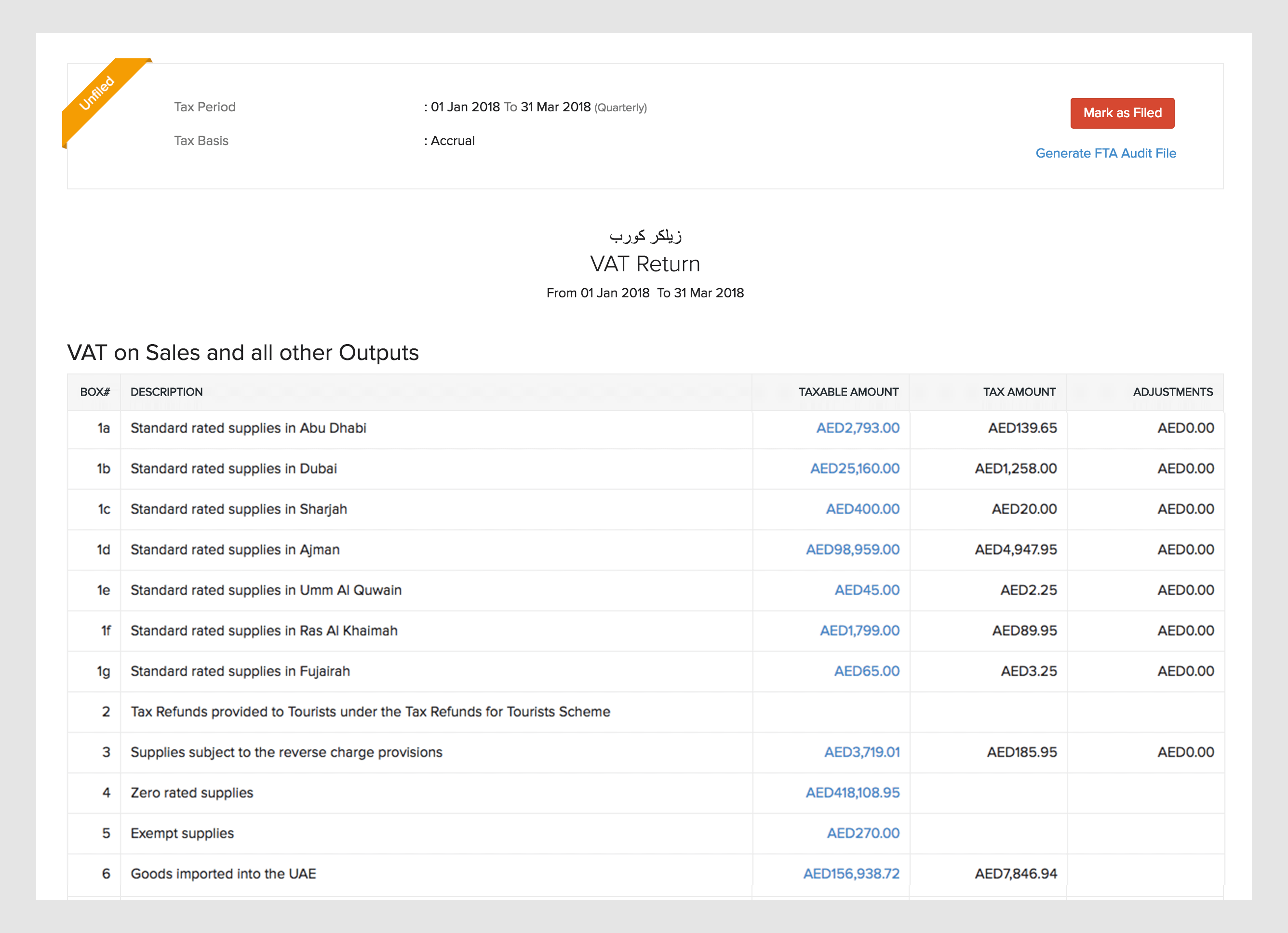

File accurate tax returns

Registered business owners in the UAE must file a VAT return each tax period. The tax period can be either monthly or quarterly, depending on the business’ annual turnover.

Filing VAT returns for the first time can be a little confusing, but Zoho Books helps reconcile your transactions and file your VAT returns. The VAT Return Summary generated in Zoho Books contains all of the necessary data about your input and output transactions as well as your claimable input credit. The data provided in the VAT Return Summary is ready to use to file returns in the FTA portal.

Check out our VAT Resources for step-by-step guidance in filing VAT returns.

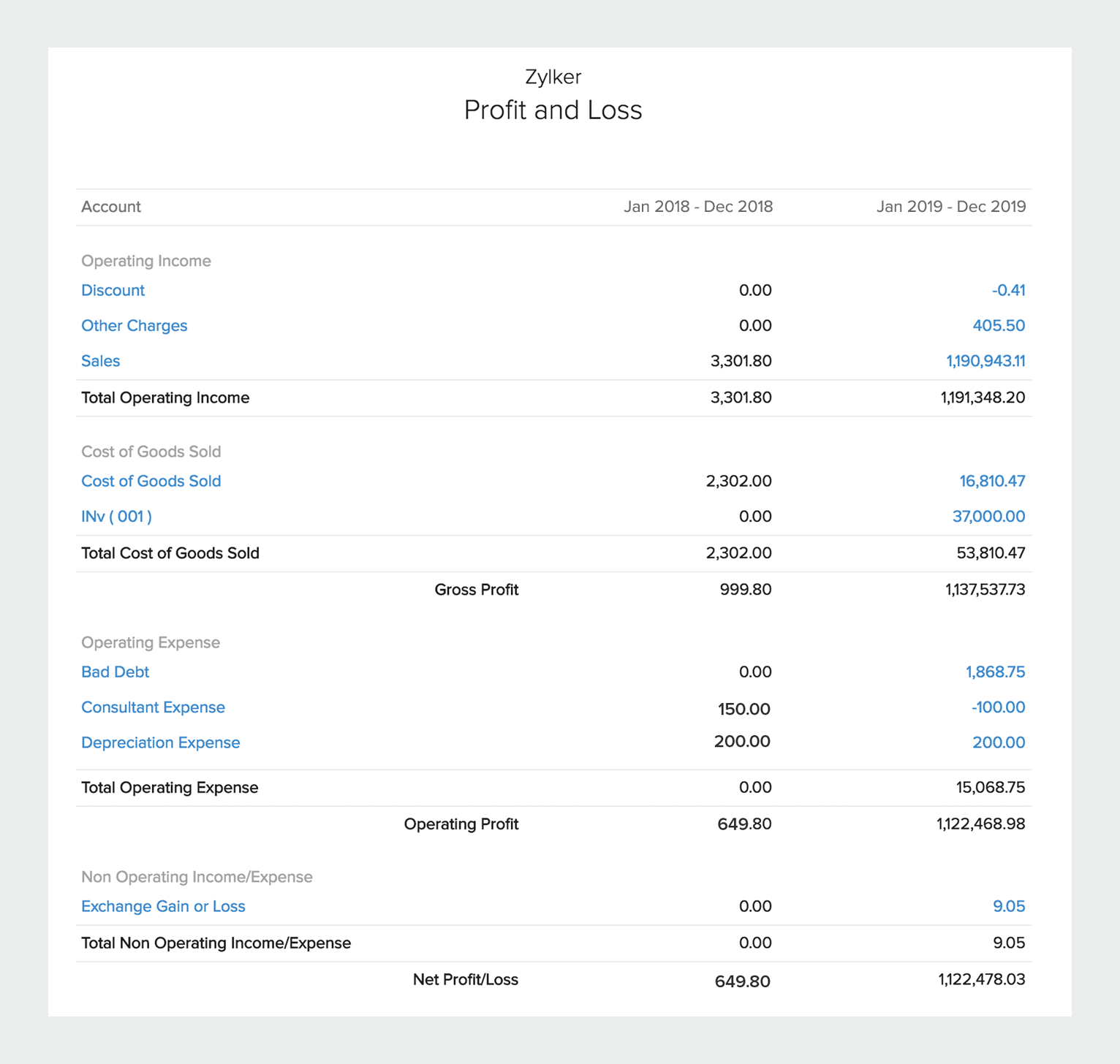

Generate insightful reports to facilitate business decisions

To make important business decisions, business owners should have a clear picture of their business finance. Financial reports provide detailed insights on the financial position of the firm and the cash flow. Right from allocating resources to analyzing the results of strategies, reports play a vital role in the financial aspect of a business. With Zoho Books, you can generate valuable business reports like Balance Sheets, Profit and Loss statements, and Cash Flow statements to stay on top of your business finance.

In case of audits, business owners should provide the FTA Audit File (FAF)- a master file that contains information on all the sales and purchase transactions, suppliers and customers, and transaction level data. Using Zoho Books, you can generate the FAF against every VAT return.

Maintain secure financial data

According to the FTA, every business in the UAE should keep a backup of their financial and accounting records for a period of at least 5 years, irrespective of their VAT registration status.

Business owners can be at ease regarding their data back-up, because at Zoho, we offer our users top-notch data security, which is better than maintaining data on their personal computers or servers. Zoho services are accessed by several million users worldwide; this includes individuals, small and medium businesses and large organizations. To ensure security and data protection, Zoho has an extensive set of rules, policies, practices and technologies. Learn more about Zoho’s Security Practices, Policies and Infrastructure.

Learn about VAT compliant accounting

Zoho Books provides a comprehensive set of VAT help guides for the benefit of taxpayers and auditors. Using these resources, users can learn how to configure their Zoho Books account for easy VAT compliance, gain in-depth understanding of the new requirements, and get ready to file accurate returns.

With Zoho Books, you can manage your business accounting, create and track business transactions, and file your VAT returns — all while staying VAT compliant.