E-Invoicing in Belgium

Belgium is introducing mandatory electronic invoicing (e-invoicing) for B2B transactions. Starting 1 January 2026, all VAT-registered businesses in Belgium will be required to issue, receive, and process structured electronic invoices for domestic B2B transactions. Invoices sent via email in PDF format will no longer be considered valid for VAT purposes. The invoices must comply with the European e-invoicing standard and be transmitted through the Peppol network.

What is an e-invoice?

An e-invoice is a machine-readable invoice that is issued by a supplier in a structured data format that allows for its automatic processing. The buyer can then import it directly to their system instead of entering the details manually.

How E-Invoicing Works in Zoho Billing

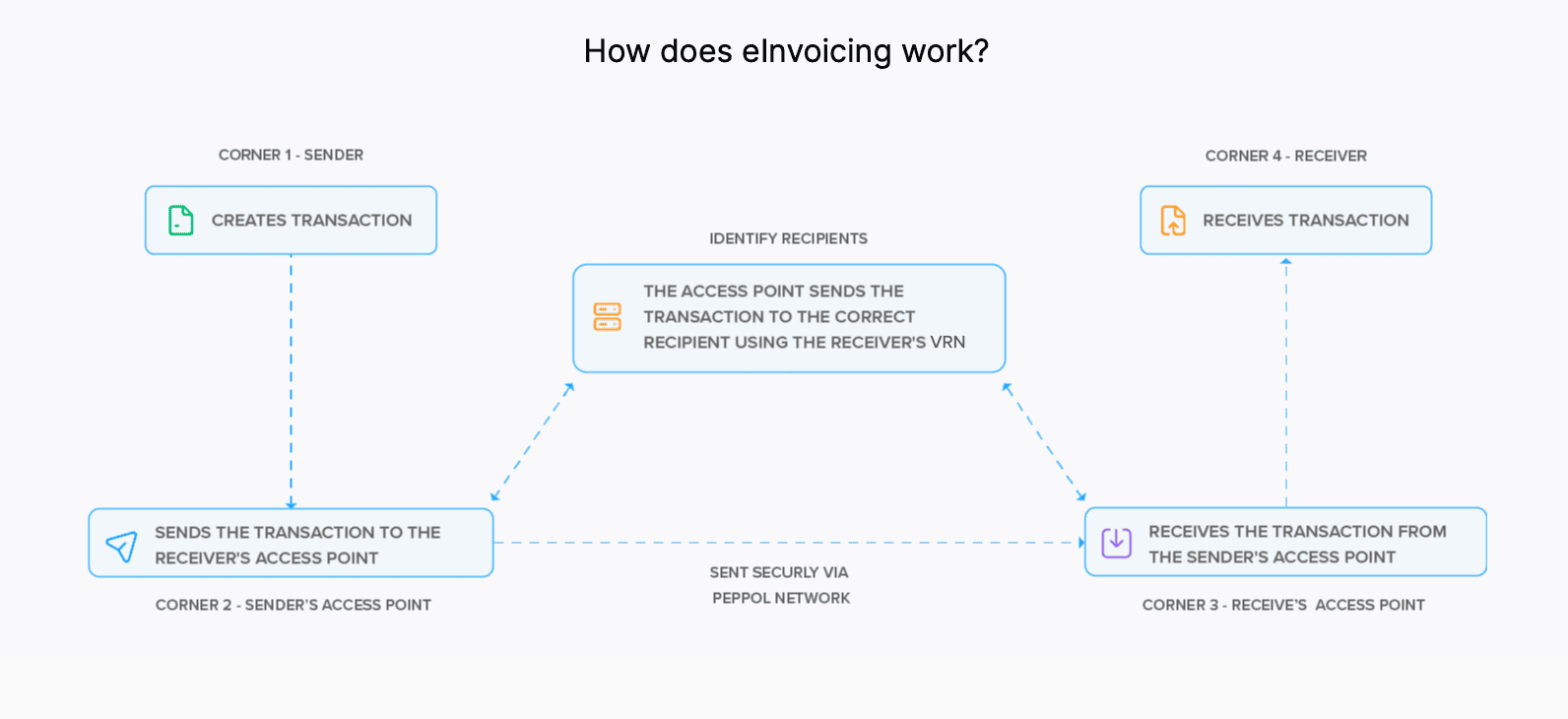

PEPPOL (Pan-European Public Procurement Online) is an EU standard that facilitates the exchange of electronic documents like invoices, credit notes and so on.

Here’s how E-Invoicing works in Zoho Billing:

Converting to Peppol Format

- The transactions you create in Zoho Billing are automatically converted into the Peppol format, which is the standard electronic format used for e-invoicing in Belgium.

- The system then checks whether all required fields are included, such as your VAT ID, your customer’s VAT ID, and other transaction details.

Sending Transactions

- If your customer is registered on the PEPPOL network:

- The invoice is sent through your Peppol Access Point to the customer’s Access Point.

- The transaction is validated and delivered directly to the customer’s accounting or ERP system.

- Your customers will receive the invoices you send as bills and credit notes as debit notes in their systems.

- If your customer is not registered on the Peppol network:

- You can send the invoice in PDF format via email.

- Once the customer becomes PEPPOL-registered, future invoices can be sent electronically through the network.

- For transactions sent to government agencies (B2G), Zoho Billing delivers them through PEPPOL to Mercurius, Belgium’s government e-invoicing platform.

- For B2C transactions, businesses are not legally required to send their transactions through Peppol.

- For cross-border transactions, you can send them through Peppol as you do for domestic transactions.

Tracking and Handling Rejected Transactions

- After a transaction is sent, Zoho Billing tracks and updates its status.

- You can view whether an invoice has been sent, accepted, or rejected.

- If a transaction is rejected, you will receive a notification that includes the reason specified by your customer.

- Since you cannot edit or delete an invoice once it is sent through PEPPOL, Zoho Billing allows you to create a credit note for the invoice to nullify it. Then you can create a new invoice which can be sent through PEPPOL.

Set Up E-Invoicing in Zoho Billing

Setting up e-invoicing in Zoho Billing is a one-time process. Let’s see how you can set up e-invoicing in Zoho Billing.

Prerequisite: You can set up e-invoicing only if you’ve enabled taxes in your Zoho Billing organisation. Make sure to enter your tax registration number with “BE” as the label.

- Go to Settings.

- Select E-Invoicing under Taxes & Compliance in the Organization Settings pane.

- Click Configure E-Invoicing.

- Enter all the required details under Organization Details and Tax Settings.

- Read and accept the terms and conditions.

- Click Finish.

Push Transactions via PEPPOL

Note: You can send e-Invoices only to customers whose VAT Registration Number (VRN) is registered in PEPPOL.

To send e-Invoices to a customer through PEPPOL:

- Go to Sales and select Invoices or Credit Notes, based on your preference.

- Enter the required details.

- Click Save as Draft.

- Click Send Invoice at the top of the invoice’s Details page.

Once the invoice is sent to your customer through Peppol, a unique UUID will be generated for the invoice. You can copy it by clicking Copy UUID next to the e-invoice status. A bill or vendor credit will be created in your customer’s system, and a copy of the invoice will also be sent as an attachment.

- Once an invoice is sent through PEPPOL, it cannot be edited or deleted. To cancel the invoice, you should create a credit note and send it through PEPPOL.

- Invoices generated from subscriptions will be sent automatically through Peppol. If there are any errors while sending an invoice, you will be notified both in the app and by email.

Statuses of Transactions in E-Invoicing

The status of each transaction will be displayed in the transaction’s overview page. The statuses of the transactions in e-invoicing are:

| Status | Description |

|---|---|

| Yet To Be Pushed | When you create a transaction and save it as draft, the status of the transaction will be Yet To Be Pushed. |

| Pushed | When you send the transaction to your customer and there are no errors, then the status of the transaction will be changed to Pushed. |

| Failed | If there are any errors, such as missing fields in the transaction, then the e-invoice will not be sent and the status will be changed to Failed. You can rectify the errors and try again. |

| Accepted | If your customer accepts the transaction, the status of the transaction will be changed to Accepted. |

| Rejected | If your customer rejects your transaction, then the status of your transaction will be changed to Rejected. |

You can filter invoices based on these statuses by clicking the All Invoices dropdown at the top and then selecting the desired e-invoice status. If you want to filter invoices using your own criteria, you can create a custom view with these statuses.

Allow Users To Push and Cancel Invoices

You can allow users in your organization to send transactions through Peppol. Here’s how:

- Go to Settings.

- Select Roles under Users & Roles in the Organization Settings pane.

- Create a new role or edit an existing one.

- Mark Push and Cancel Transactions under e-Invoicing to allow users with this role to send transactions.

You can unmark the option to restrict users to perform these actions.

Disable E-Invoicing

If you don’t want to send transactions to your customer through Peppol, you can disable it. Here’s how:

- Go to Settings.

- Select E-Invoicing under Taxes & Compliance in the Organization Settings pane.

- Slide the toggle near Push Transactions to Disabled.

You can enable them anytime by sliding the toggle to Enabled.

You can also delete the E-Invoicing configuration if you want. Here’s how:

- Go to Settings.

- Select E-Invoicing under Taxes & Compliance in the Organization Settings pane.

- Click Disable at the top.

- In the popup, click Disable to confirm the action.

The configuration will be deleted. To send transactions again through Peppol, you should configure E-Invoicing in Settings.

Yes

Yes