- HOME

- Taxes & compliance

- How to Register for VAT in Bahrain: Step-by-Step Guide

How to Register for VAT in Bahrain: Step-by-Step Guide

Some business owners are required to register under VAT, some can choose to register voluntarily, and others are not eligible to register at all. Regardless of whether their registration is mandatory or voluntary, those who register under VAT are called taxable persons and those who do not are called non-taxable persons. In this guide, you will be learning more about the VAT registration process in Bahrain, so that you will know what to do when it’s time for you to register your business. The topics that we will be covering are:

- Eligibility for registration

- How to register for VAT

- Exemption from registration

- Tax group registration

- De-registration

Eligibility for registration

Businesses are required to register under VAT if the value of their taxable supplies crosses a certain threshold. The value of their taxable supplies includes standard-rated supplies, zero-rated supplies, reverse charges received, and imported goods.

Mandatory registration

There are different deadlines for mandatory registration depending on the value of the business’ annual supplies.

| Annual Turnover in Sales (in BHD) | Registration Deadline | VAT Effective From |

|---|---|---|

| Greater than BHD 5,000,000 | 20th December, 2018 | 1st January, 2019 |

| From BHD 500,000 to BHD 5,000,000 | 20th June, 2019 | 1st July, 2019 |

| From BHD 37,500 to BHD 500,000 | 20th December, 2019 | 1st January, 2020 |

Taxable persons who have annual supplies that are worth more than, or expected to be more than, BHD 5,000,000 must register for VAT by the 20th of December, 2018. These taxpayers must be VAT compliant starting on the 1st of January, 2019.

Taxable persons who have annual supplies that are worth more than, or expected to be more than, BHD 500,000 but less than or equal to BHD 5,000,000 must register for VAT by the 20th of June, 2019. These taxpayers must be VAT compliant starting on the 1st of July, 2019.

Taxable persons who have annual supplies that are worth more than, or expected to be more than, BHD 37,500 must register for VAT by the 20th of December, 2019. These taxpayers will be VAT compliant starting on the 1st of January, 2020.

Taxpayers who at first did not expect to have supplies worth more than BHD 5,000,000 but have exceeded this limit, must register for VAT within:

30 days after the last day of the month in which they exceeded the limit, or

If they have not yet exceeded the limit but expect to, then within 30 days before the first day of the month in which they expect to exceed the limit.

Taxpayers who at first did not expect to have supplies worth more than BHD 500,000, but have exceeded this limit after the 1st of July, 2019 must register for VAT within:

30 days after the last day of the month in which they exceeded the limit, or

If they have not yet exceeded the limit but expect to, then within 30 days before the first day of the month in which they expect to exceed the limit.

Registration for non-residents of Bahrain

There are no exceptions for non-residents of Bahrain; all non-residents must register for VAT as soon as they start making taxable supplies in Bahrain, regardless of the value of their supplies. However, non-residents are given the option to register under VAT using a tax representative. A tax representative is a resident of Bahrain who has been approved by the NBR through an official power of attorney. A tax representative will also be held accountable for any tax liabilities that the non-resident taxable person incurs.

Voluntary registration

If a person falls under one of the following categories, they can choose to voluntarily register under VAT even if they are not required to do so.

The total worth of their annual supplies or expenses in Bahrain has exceeded BHD 18,750 in the past year.

The total worth of their annual supplies or expenses in Bahrain is expected to exceed BHD 18,750 in the coming year.

Note that the effective date of registration for volunteers is the day the NBR approves the voluntary registration request. This is different from the effective date of registration for mandatory registrants.

How to register for VAT

To register under VAT:

Step 1:

Visit the official website of the National Revenue Agency, and click Create NBR Profile.

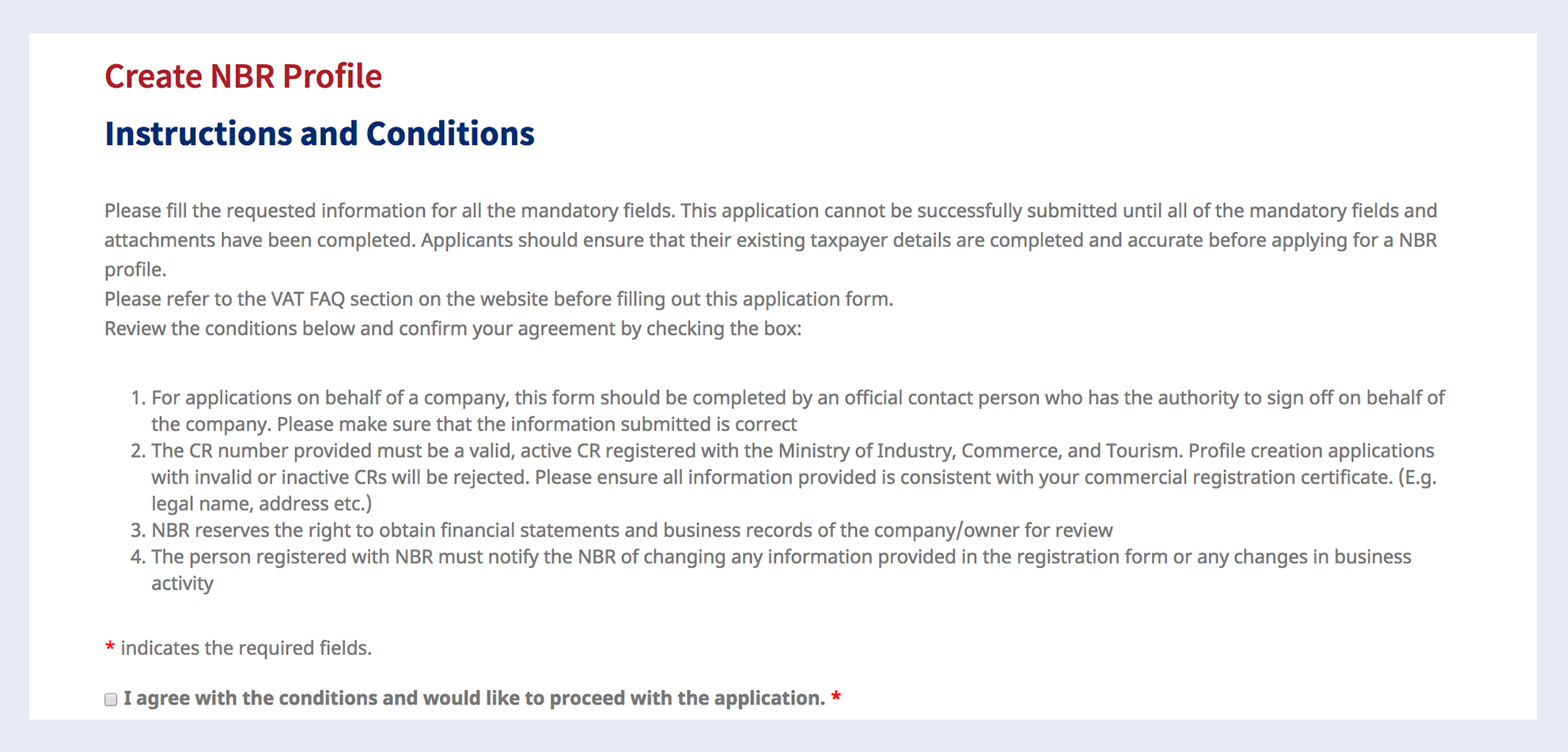

Step 2: You will be redirected to a page of instructions on how to create your NBR profile. Click on the agreement box before resuming the registration process.

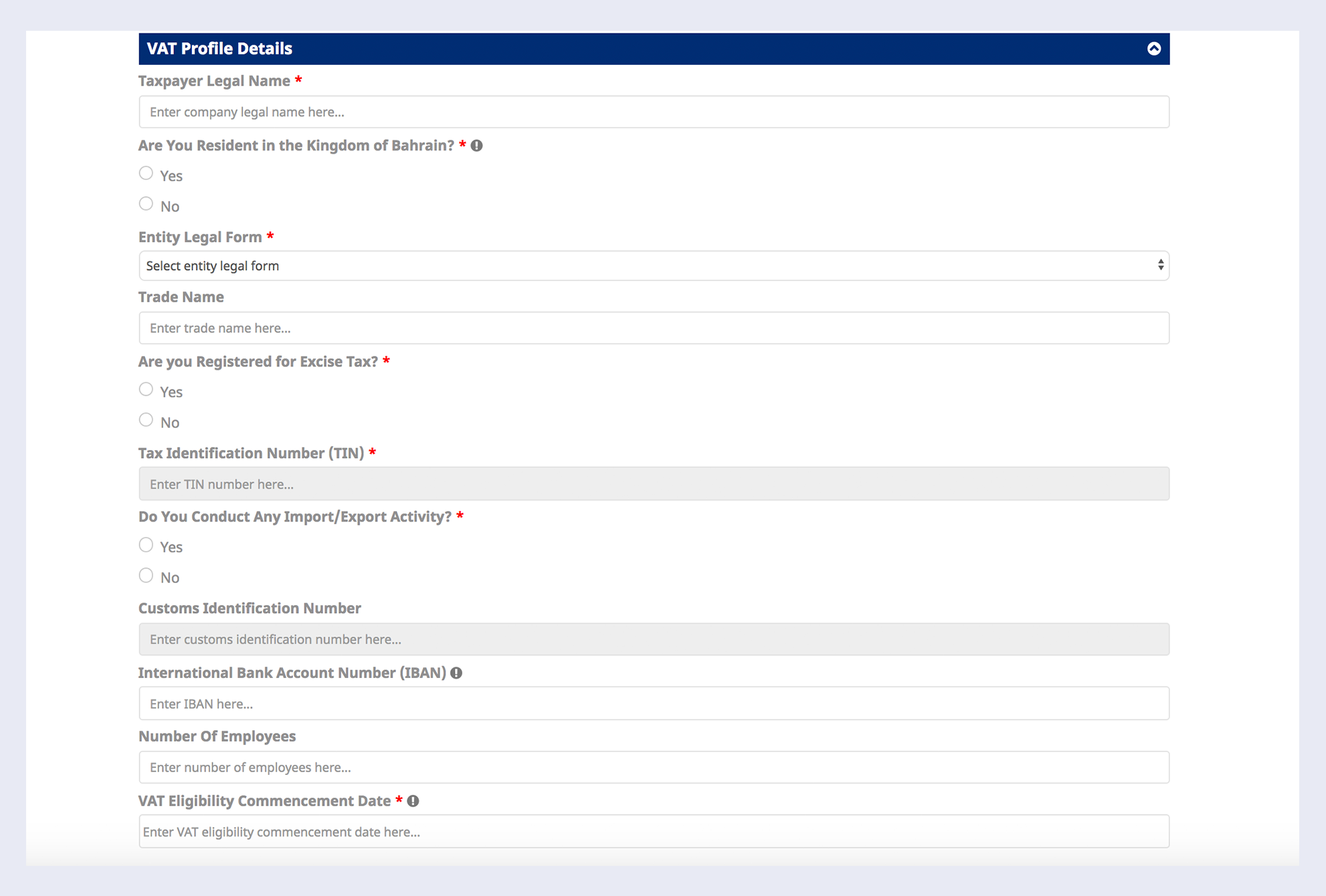

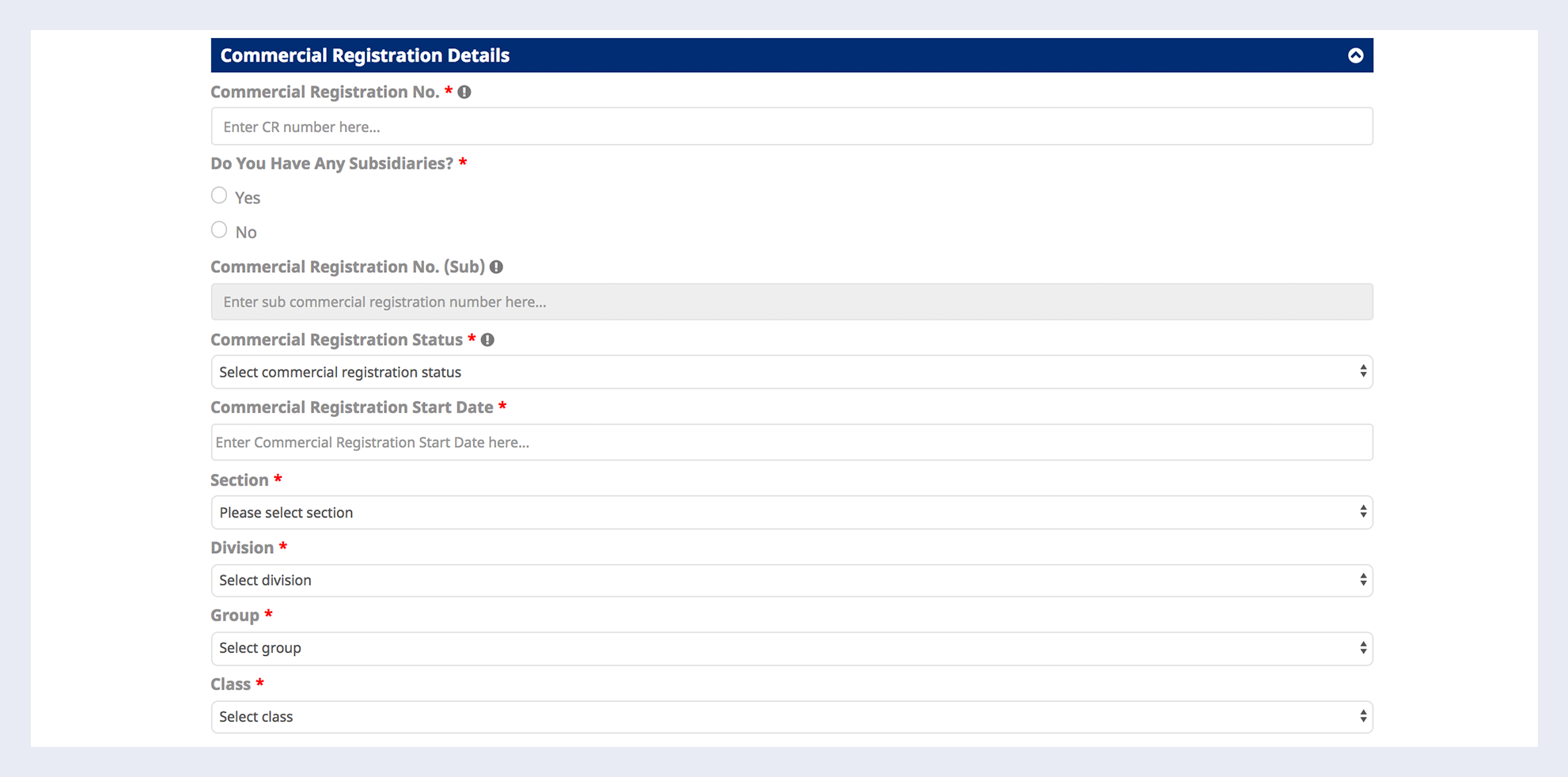

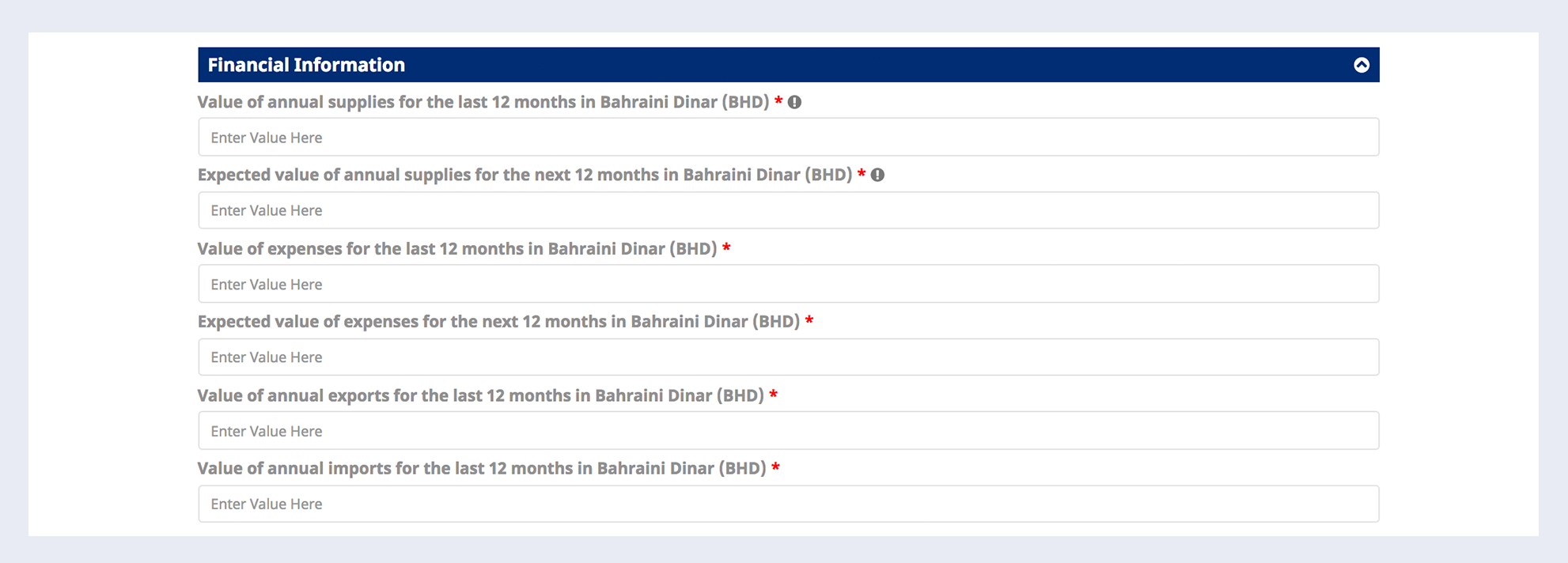

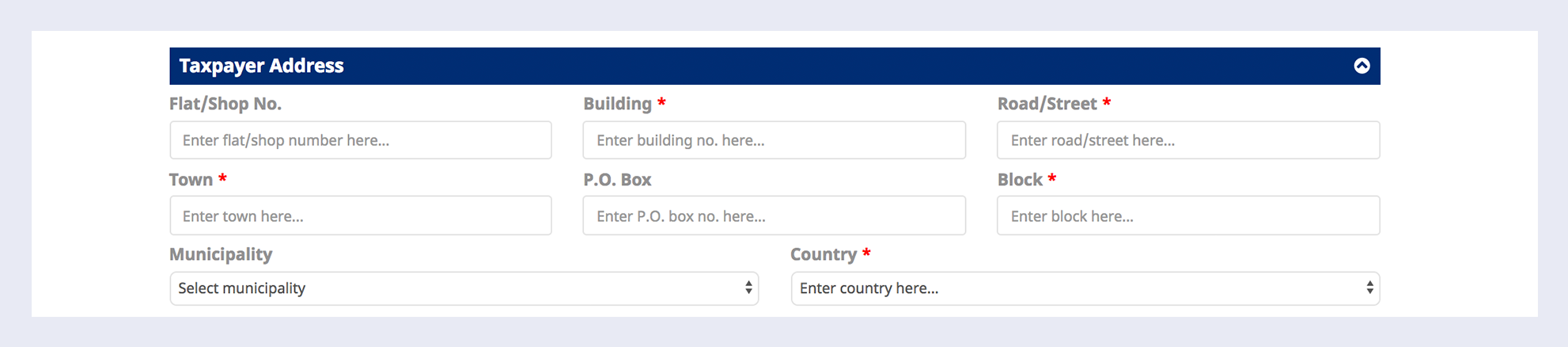

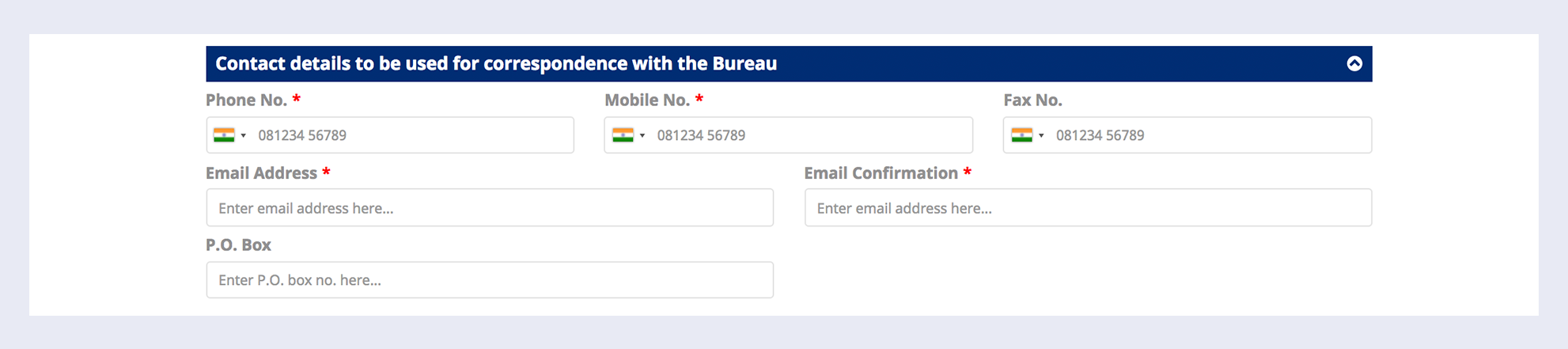

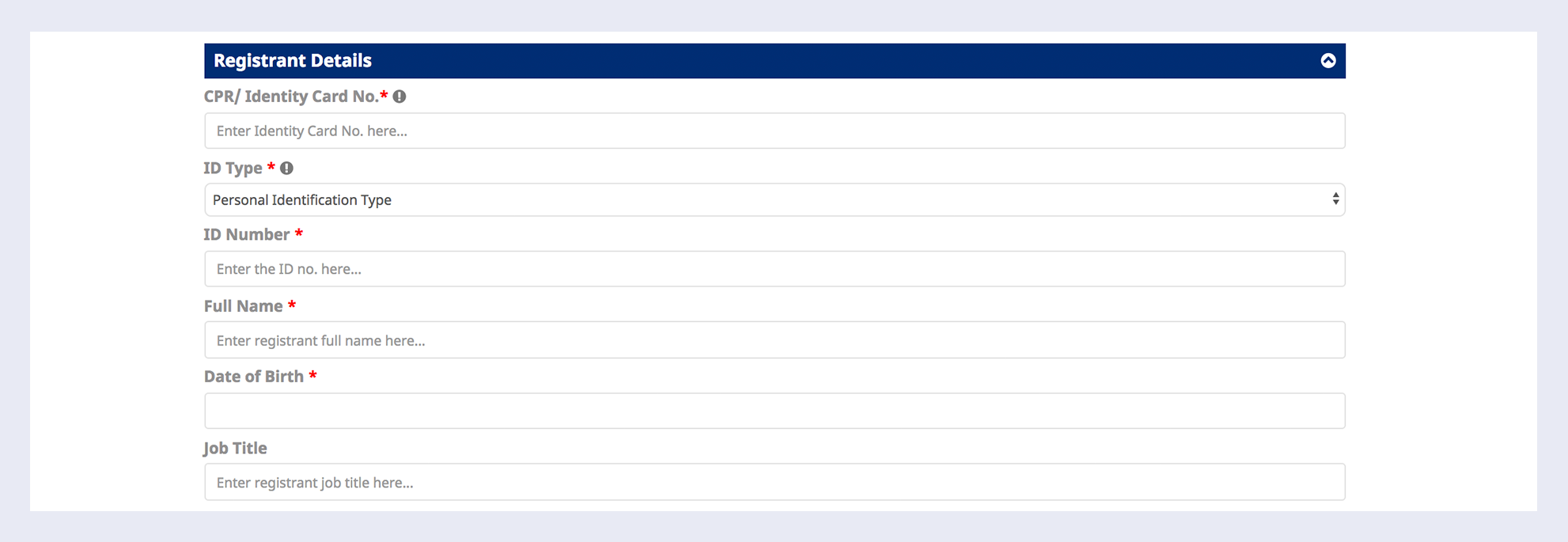

Complete the form below the instructions with identifying information like your business details, commercial registration details, financial information, and personal details.

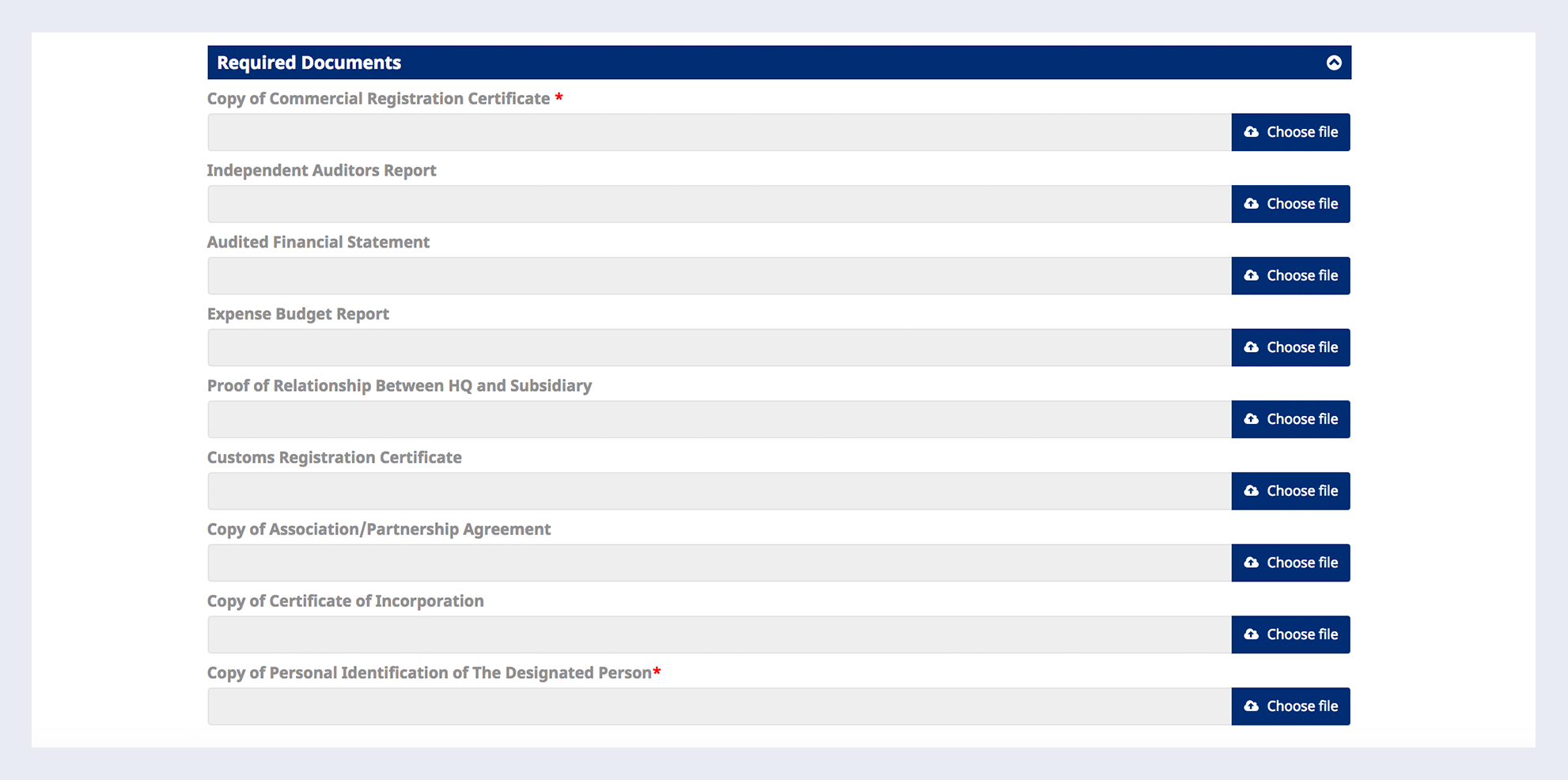

You will also be asked to upload a few documents as proof.

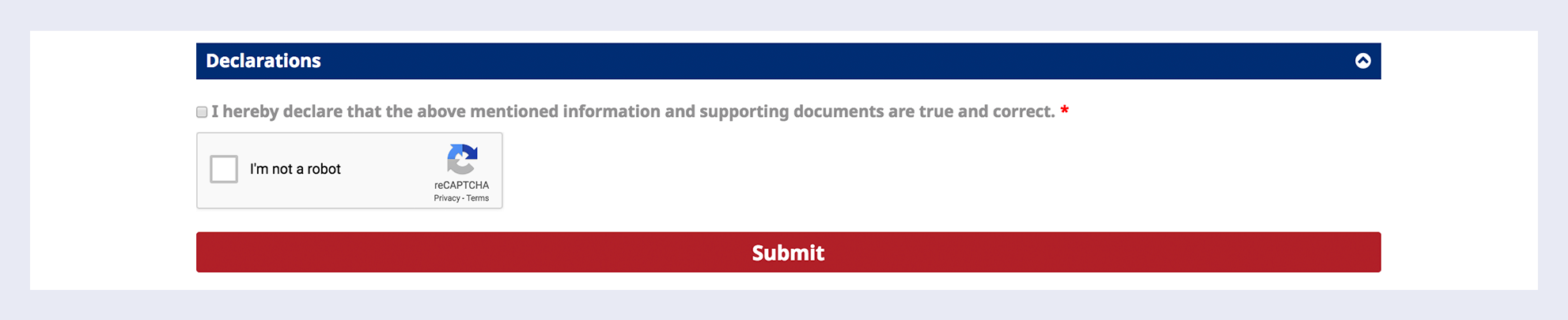

Step 3: Check the declaration box and submit your request to create an account with the National Revenue Agency of the Gulf. You should receive an email from the NBR saying that your request was received and is being processed.

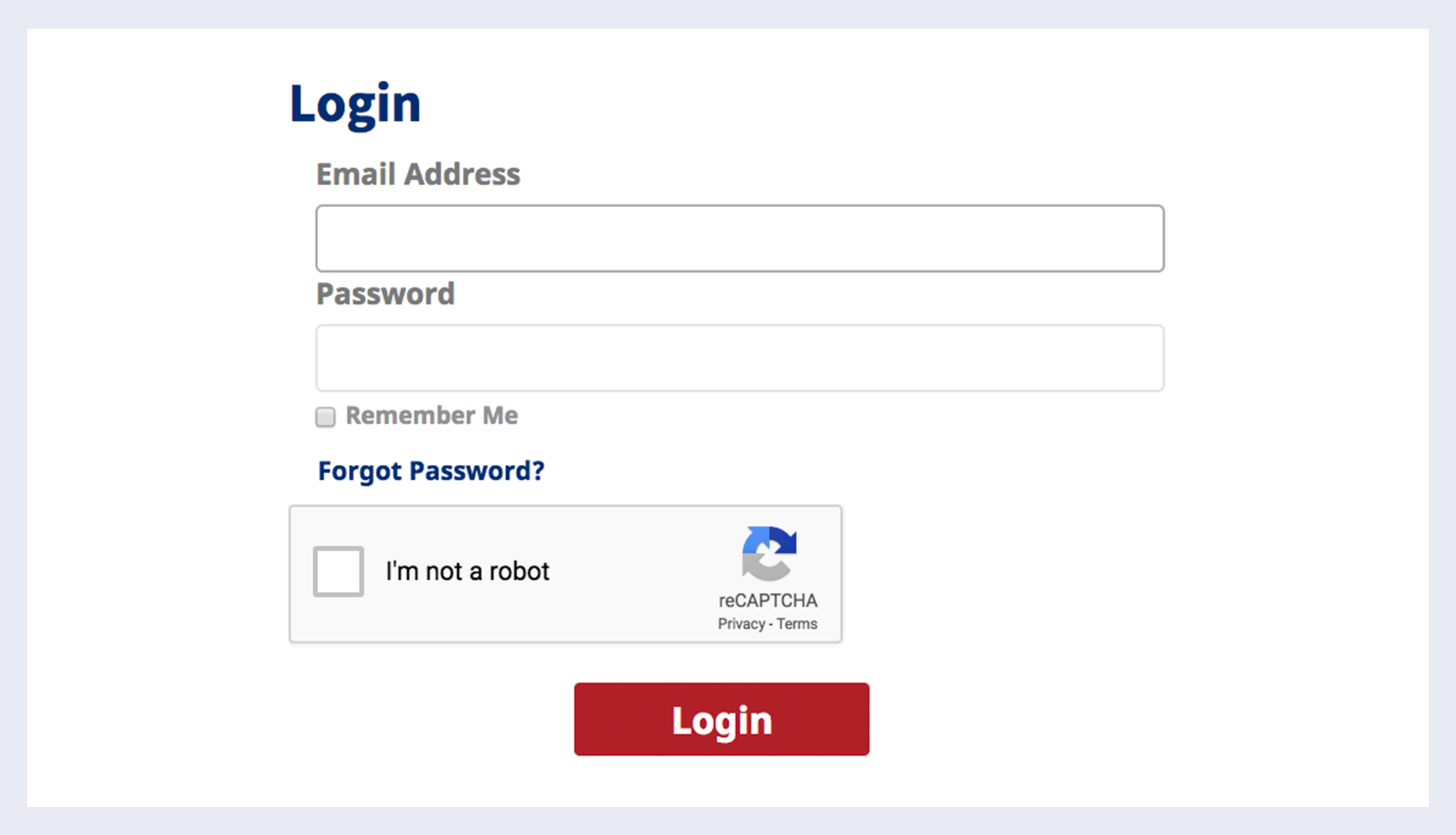

Step 4: If your account has been approved, then you will be sent credentials to log in and access your registration form. Log into your account to confirm your registration.

Step 5: After your applicant’s registration is confirmed and complete, you will receive a VAT certificate in your account that includes your VAT registration number.

Exemption from registration

It is not compulsory for every person that supplies goods and services to register under VAT. Suppliers who meet all of the following conditions can request exemption from registering under VAT:

The goods or services that the person supplies are zero-rated under VAT.

The total worth of the zero-rated supply exceeds the mandatory threshold.

The person does not receive any goods or services that are subject to standard-rate VAT under the reverse-charge mechanism.

Once the person requests exemption from registering, they must wait for approval from the NBR, after which they will be considered a non-taxable person. As a non-taxable person, they will neither be allowed to collect VAT for their supplies nor recover VAT. If the person ever stops qualifying to be registered under VAT, they must apply to de-register within 30 days after the day they stopped qualifying. Note that applying later than that may incur a penalty of up to BHD 10,000.

Tax group registration

Tax groups must abide by the following criteria to be approved by the NBR:

All members of the tax group must be a part of an economic activity.

All members of the tax group must be residents of Bahrain.

All members of the tax group must be registered under VAT for tax purposes.

All members of the tax group must be related, where the term related can be defined with the following conditions:

- Two or more members of a tax group must be in a formal partnership that meets at least one of the following conditions:

- When added together, members have a voting interest of at least 50%.

- When added together, members have a market value interest of at least 50%.

- Members have control in some other form. (It should be noted that common ownership does not always mean that the owner is a member of he tax group.)

The members of the tax group must also provide evidence that they have met all the requirements mentioned above. If they are unsure about whether they have met these conditions but feel that they have something that ties them together as a group, they can still apply for tax group registration and be evaluated by the NBR.

De-registration

In the event a taxpayer is no longer eligible to be registered under VAT, they must de-register within 30 days after the day they no longer meet the requirements. There are several different cases where a taxpayer might de-register:

Case 1: Low turnover A resident of Bahrain must mandatorily de-register when: The value of their annual supplies and expenses during the last 12 months has dropped below the voluntary registration limit, and The value of their annual supplies and expenses is not expected to exceed this limit in the upcoming 12 months either.

Case 2: Inactivity A resident or non-resident of Bahrain must mandatorily de-register when: They are no longer conducting any economic activity in Bahrain, or They have not made any taxable supplies for 12 consecutive months.

Case 3: No obligation to be registered A resident may de-register on a voluntary basis when: They have been voluntarily registered under VAT for a minimum of 2 years. The value of their annual supplies in the past 12 months is lower than the mandatory registration threshold (BHD 37,500), but, including their annual expenses, exceeds the voluntary registration limit (BHD 18,750), and The value of their annual supplies in the upcoming 12 months is expected to be lower than the mandatory registration limit (BHD 37,500), but, including their annual expenses, exceeds the voluntary registration limit (BHD 18,750)

Case 4: Non-residents A non-resident cannot de-register on a voluntary basis at all.