Items

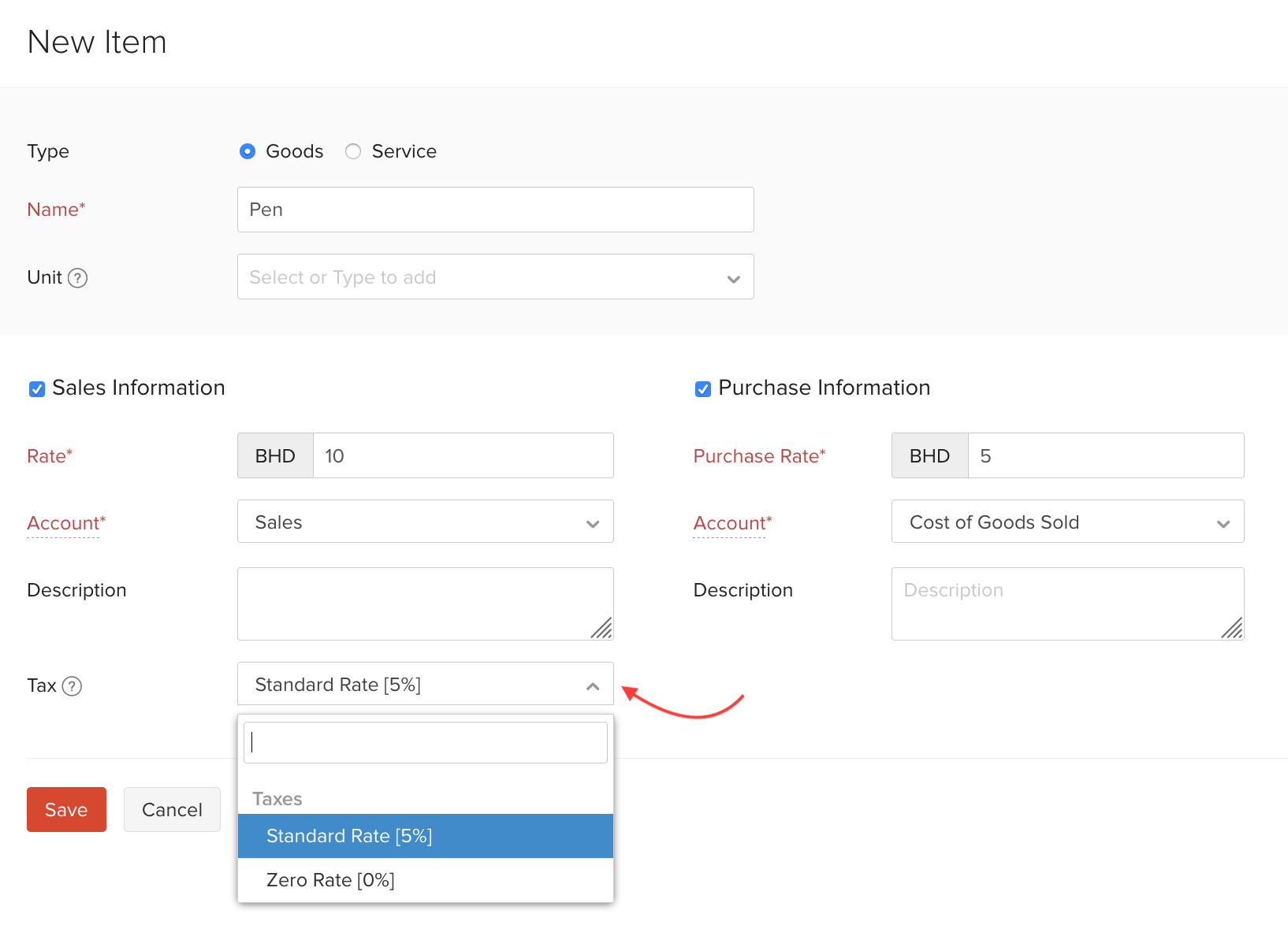

When you add an item in Zoho Books, you can configure the appropriate tax applicable on it. This tax will be auto-populated whenever you create transactions for this item. To configure the tax rate of items:

- Go to the Items module from the left sidebar and click Items.

- Click + New on the top right corner.

- Select the Tax applicable on the item.

VAT treatments such as Exempt and Out of Scope can be selected while creating transactions.

Learn more about the different VAT rates that can be applied to items.

Yes

Yes