Depreciation Calculation

This document helps you understand the depreciation calculation in detail with suitable examples. Before that, here are a few terms that you should be aware of:

| Terms | Description |

|---|---|

| Purchase Value | The cost at which the asset was purchased. |

| Current Value | The asset’s value at the start of the depreciation period. |

| Salvage Value | The estimated value of the asset at the end of its useful life. |

| Depreciated Value | The value that is depreciated from the asset in every frequency (monthly or yearly). |

Now, let us have a look at how depreciation is calculated for a fixed asset you record in Zoho Books. There are two types of depreciation methods:

Straight Line Depreciation

In this depreciation method, the asset will be depreciated in two ways:

Pro Rata

Depreciated Value = (Depreciable Value / Remaining No. of Depreciation days) * No. of Days in Current Depreciation

where,

Depreciable Value: The value that can be depreciated from the asset’s current value, and is calculated as:

Depreciable Value = Current Value - Salvage Value

Remaining No. of Depreciation Days: The total number of days remaining for the asset to get fully depreciated.

No. of Days in Current Depreciation: The total number of days in the selected frequency (monthly/yearly) for depreciation.

Non-Pro Rata

Depreciated Value = Depreciable Value / Remaining Life Period

where,

Remaining Life Period: The total number of years or months between current depreciation’s start date and asset’s depreciation end date.

Declining Balance Method

In this depreciation method, the asset will be depreciated in two ways:

Pro Rata

Depreciated Value = ((Current Value * Percentage/100) / No. of Days in the Given Year) * No. of Days

where,

Percentage: The percentage provided for the declining balance method, calculated annually.

No. of Days in the Given Year: The total number of days in that particular year.

No. of Days: The total number of days in that particular depreciation period.

Non-Pro Rata

Annual Depreciation = Current Value * Percentage/100

where,

Percentage: The percentage provided for the declining balance method.

This is used to calculate the annual depreciation of a fixed asset. To calculate the asset’s monthly depreciation:

Monthly Depreciation = Annual Depreciation / 12

Examples

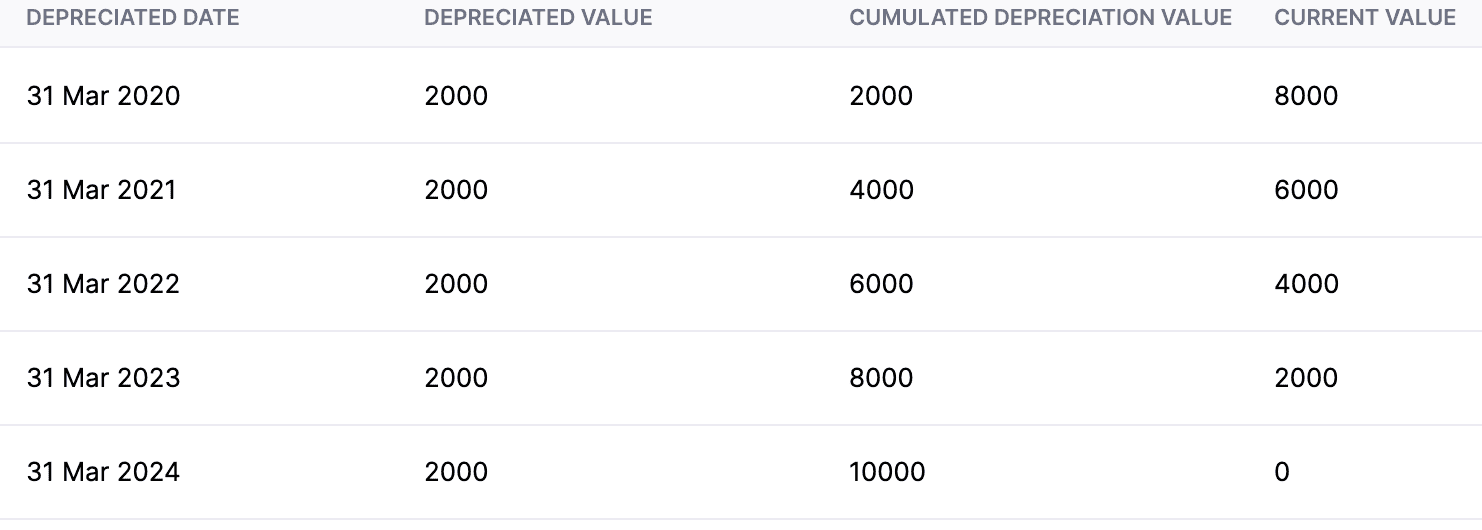

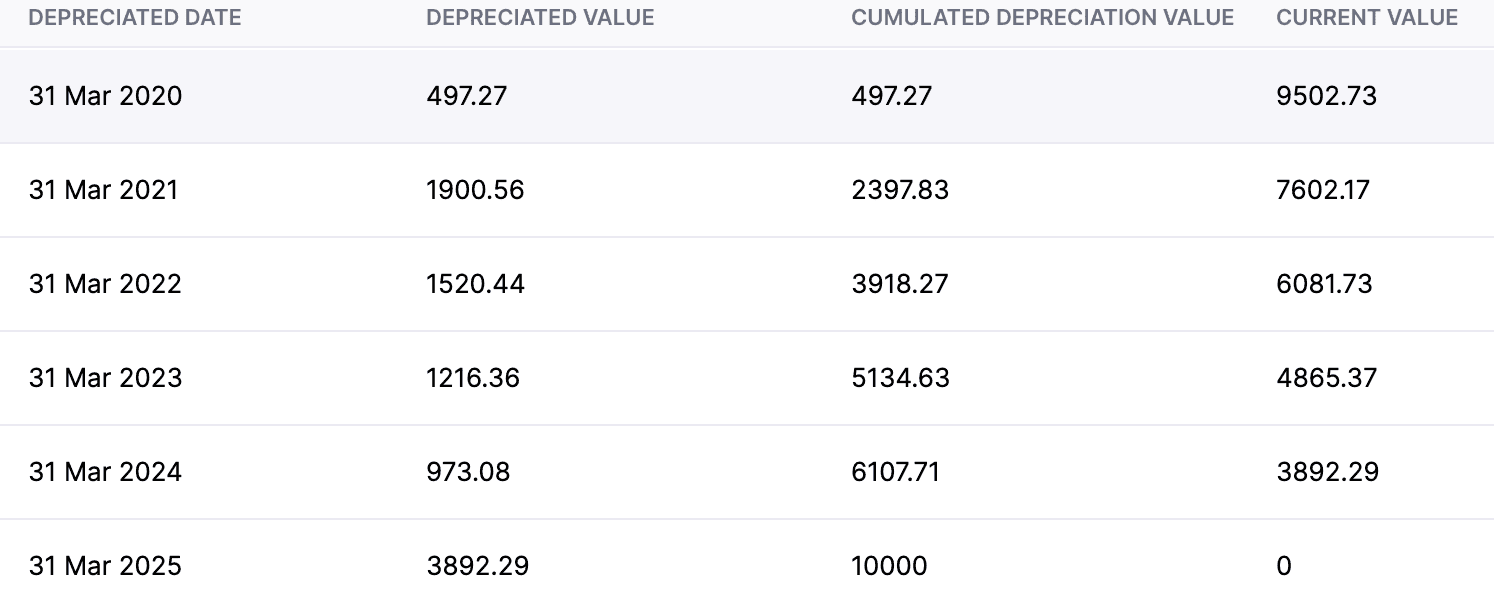

Straight Line Method for Yearly Asset Depreciation on a Non-Pro Rata Basis

| Frequency | Computation Type | Start Date | Total Life Period | End Date |

|---|---|---|---|---|

| Yearly | Non-Pro Rata | 01/01/2020 | 60 | 31/03/2024 |

If the current value of the asset is $10,000, and the fiscal year you follow in your organization is April to March.

With respect to the current value of the asset, let us start depreciating the asset using the Straight Line Method.

As the frequency of depreciation is given as Yearly, convert the total life period to years.

Total Life Period = 60/12 = 5

Therefore, total life period is 5 years.

In March 2020, the value of the asset will be:

Depreciated Value = Depreciable Value / Remaining Life Period

Depreciated Value = 10,000 / 5

Depreciated Value = 2,000

Current Asset Value = 10,000 - 2,000 = 8,000

Therefore, by the end of March 2020, the current value of the asset will be $8,000.

In March 2021, the value of the asset will be:

Depreciated Value = Depreciable Value / Remaining Life Period

Depreciated Value = 8,000 / 4

Depreciated Value = 2,000

Current Asset Value = 8,000 - 2,000 = 6,000

Therefore, by March 2021, the current value of the asset will be $6,000.

In March 2022, the value of the asset will be:

Depreciated Value = Depreciable Value / Remaining Life Period

Depreciated Value = 6,000 / 3

Depreciated Value = 2,000

Current Asset Value = 6,000 - 2,000 = 4,000

Therefore, by March 2022, the current value of the asset will be $4,000.

In March 2023, the value of the asset will be:

Depreciated Value = Depreciable Value / Remaining Life Period

Depreciated Value = 4,000 / 2

Depreciated Value = 2,000

Current Asset Value = 4,000 - 2,000 = 2,000

Therefore, by March 2023, the current value of the asset will be $2,000.

In March 2024, the value of the asset will be:

Depreciated Value = Depreciable Value / Remaining Life Period

Depreciated Value = 2,000 / 1

Depreciated Value = 2,000

Current Asset Value = 2,000 - 2,000 = $0

Therefore, by the end of March 2024, the current value of the asset becomes 0 or reaches its salvage value, which means that the asset’s useful life is complete or the asset is completely depreciated.

Straight Line Method for Monthly Asset Depreciation on a Non-Pro Rata Basis

| Frequency | Computation Type | Start Date | Total Life Period | End Date |

|---|---|---|---|---|

| Monthly | Non-Pro Rata | 01/04/2020 | 30 | 30/09/2022 |

For the above case, the depreciation is calculated on a Monthly basis using the Straight Line Method.

In April 2020, the value of the asset will be:

Depreciated Value = 10,000 / 30 = 333.33

Current Asset Value = 10,000 - 333.33 = 9666.67

Therefore, by the end of April 2020, the current value of the asset will be $9666.67

In May 2020, the value of the asset will be:

Depreciated Value = 9666.67 / 29 = 333.33

Current Asset Value = 9666.67 - 333.33 = 9333.34

Therefore, by the end of May 2020, the current value of the asset will be $9333.34

In June 2020, the value of the asset will be:

Depreciated Value = 9333.34 / 28 = 333.33

Current Asset Value = 9333.34 - 333.33 = 9000.01

Therefore, by the end of June 2020, the current value of the asset will be $9000.01

When you keep depreciating the asset in this way, the current value of the asset at the end of September 2022 will become 0 or reaches its salvage value, which means that the asset’s useful life is complete or the asset is completely depreciated.

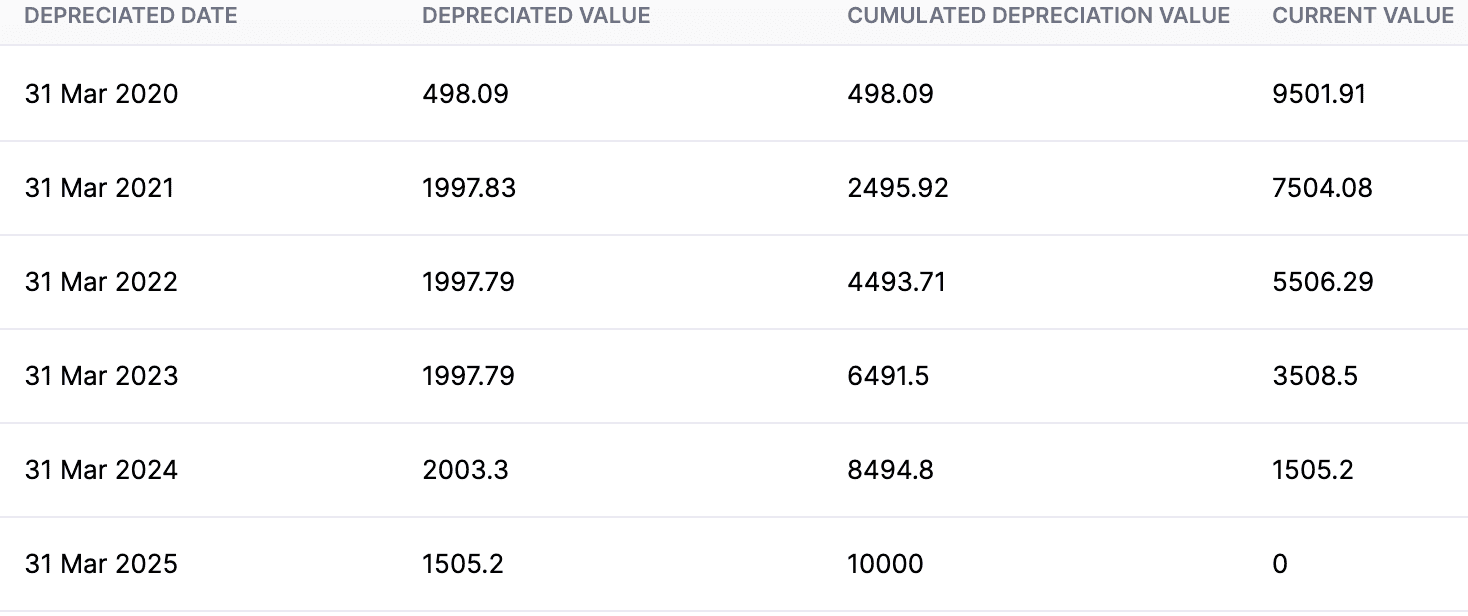

Straight Line Method for Yearly Asset Depreciation on a Pro Rata Basis

| Frequency | Computation Type | Start Date | Total Life Period | End Date |

|---|---|---|---|---|

| Yearly | Pro Rata | 01/01/2020 | 60 | 31/12/2024 |

For the above case, the depreciation is calculated on a Yearly basis using the Straight Line Method.

The remaining number of depreciation days (until 31/12/2024) = 1827.

As the financial year ends by March 2020, the depreciation is calculated for the first three months (01/01/2020 to 31/03/2020) separately.

So, the number of days in the current depreciation = 91.

In March 2020, the value of the asset will be:

Depreciated Value = (Depreciable Value / Remaining No. of Depreciation Days) * The No. of Days in the Current Depreciation

Depreciated Value = (10000 / 1827) * 91

Depreciated Value = 5.4375 * 91

Depreciated Value = 498.09

Therefore, the current value of the asset at the end of 2020 = 10000 - 498.09 = $9501.91

In March 2021, the value of the asset will be:

Depreciated Value = (Depreciable Value / Remaining No. of Depreciation Days) * The No. of Days in the Current Depreciation

Depreciated Value = (9501.91 / 1736) * 365

Depreciated Value = 5.4735 * 365

Depreciated Value = 1997.83

Therefore, the current value of the asset at the end of 2021 = 9501.91 - 1997.83 = $7504.08

In March 2022, the value of the asset will be:

Depreciated Value = (Depreciable Value / Remaining No. of Depreciation Days) * The No. of Days in the Current Depreciation

Depreciated Value = (7504.08 / 1371) * 365

Depreciated Value = 5.4735 * 365

Depreciated Value = 1997.91

Therefore, the current value of the asset at the end of 2022 = 7504.08 - 1997.91 = $5506.17

When you keep depreciating the asset this way, the current value of the asset at the end of December 2025 will become 0 or reaches its salvage value, which means that the asset’s useful life is complete or the asset is completely depreciated.

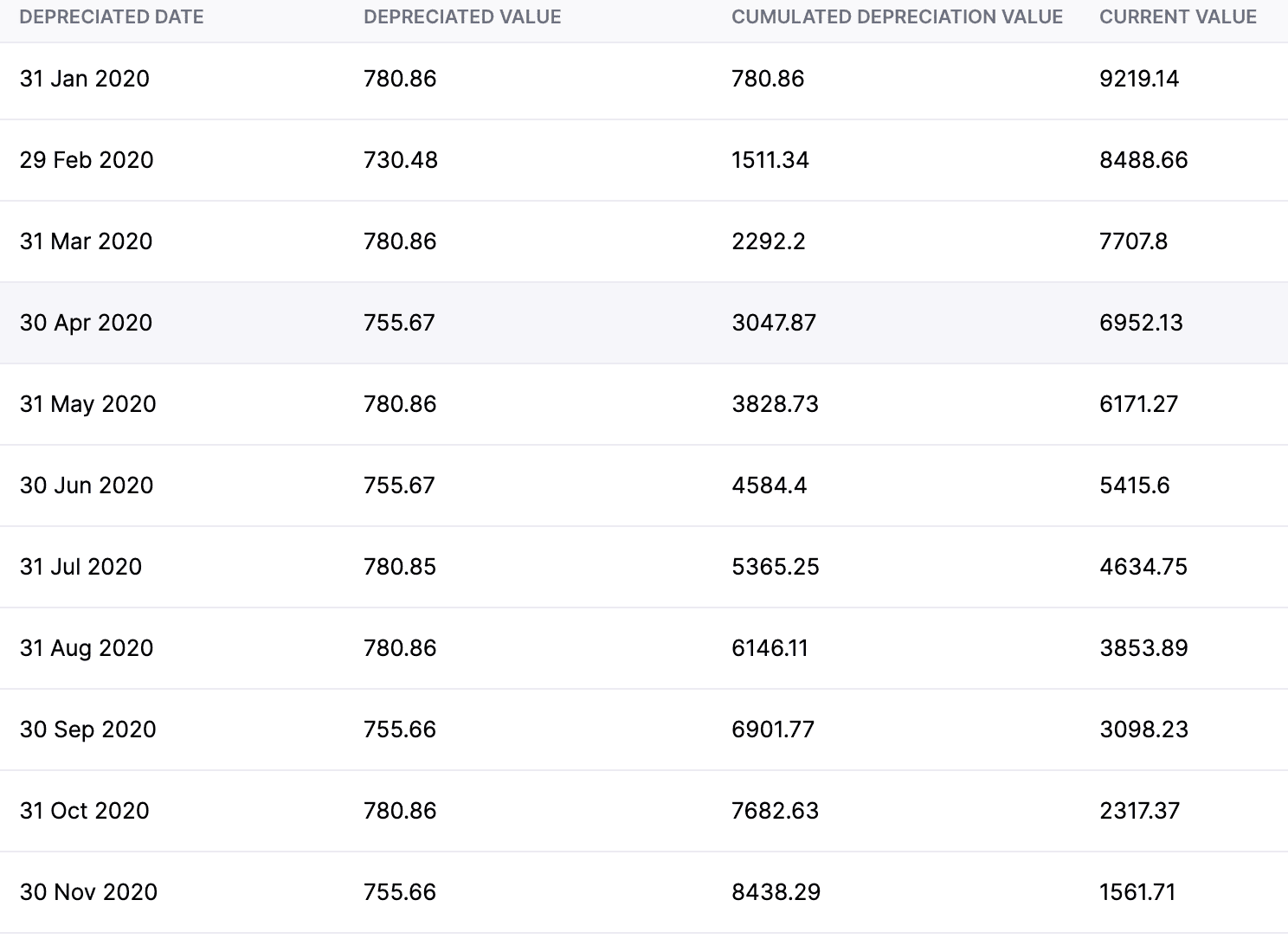

Straight Line Method for Monthly Asset Depreciation on a Pro Rata Basis

| Frequency | Computation Type | Start Date | Total Life Period | End Date |

|---|---|---|---|---|

| Monthly | Pro Rata | 01/01/2020 | 13 | 01/01/2021 |

For the above case, the depreciation is calculated on a Monthly basis using the Straight Line Method.

The total number of remaining days (until the asset’s useful life) = 397 days.

By the end of January 2020, the value of the asset will be:

Depreciated Value = (Depreciable Value / Remaining No. of Depreciation Days) * The No. of Days in the Current Depreciation

Depreciated Value = (10000 / 397) * 31

Depreciated Value = 25.1889 * 31

Depreciated Value = 780.8559

Therefore, the current value of the asset (until January 2020) = 10000 - 780.8559 = $9219.1441

By the end of February 2020, the value of the asset will be:

Depreciated Value = (Depreciable Value / Remaining No. of Depreciation Days) * The No. of Days in the Current Depreciation

Depreciated Value = (9219.1441 / 366) * 29

Depreciated Value = 25.1889 * 29

Depreciated Value = 730.4781

Therefore, the current value of the asset (until February 2020) = 9219.1441 - 730.4781 = $8488.666

When you keep depreciating the asset this way, the current value of the asset at the end of January 2021 will become 0 or reaches its salvage value, which means that the asset’s useful life is complete or the asset is completely depreciated.

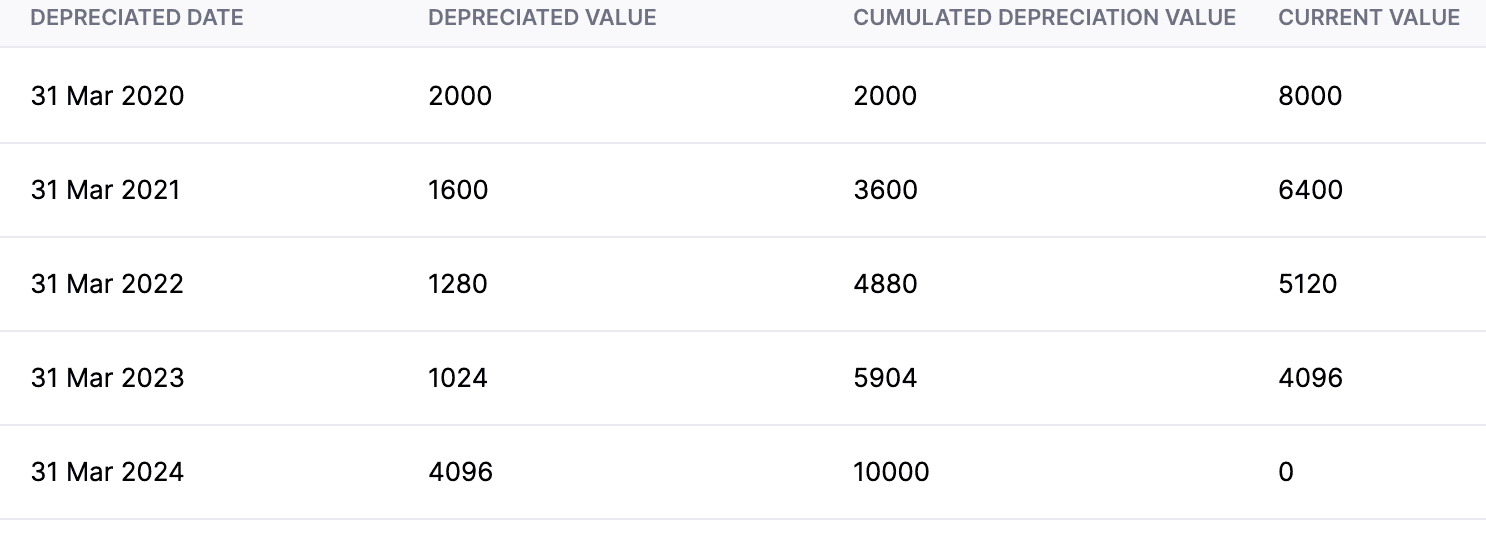

Declining Balance Method for Yearly Asset Depreciation on a Non-Pro Rata Basis

| Frequency | Computation Type | Start Date | Total Life Period | End Date |

|---|---|---|---|---|

| Yearly | Non-Pro Rata | 01/01/2020 | 60 | 31/03/2024 |

The current value of the asset is $10,000, and the fiscal year you follow in your organization is April to March.

With respect to the current value of the asset, let us start depreciating the asset using the Declining Balance Method.

The Depreciation Percentage = 20% = 20 / 100 = 0.20

By the end of March 2020, the value of the asset will be:

Depreciated Value = Current Value * Percentage/100

Depreciated Value = 10000 * 0.20

Depreciated Value = 2000

Therefore, the current value of the asset is 10000 - 2000 = $8000.

By the end of March 2021, the value of the asset will be:

Depreciated Value = Current Value * Percentage/100

Depreciated Value = 8000 * 0.20

Depreciated Value = 1600

Therefore, the current value of the asset is 8000 - 1600 = $6400.

When you keep depreciating the asset this way, the current value of the asset at the end of March 2024 will become 0 or reaches its salvage value, which means that the asset’s useful life is complete or the asset is completely depreciated.

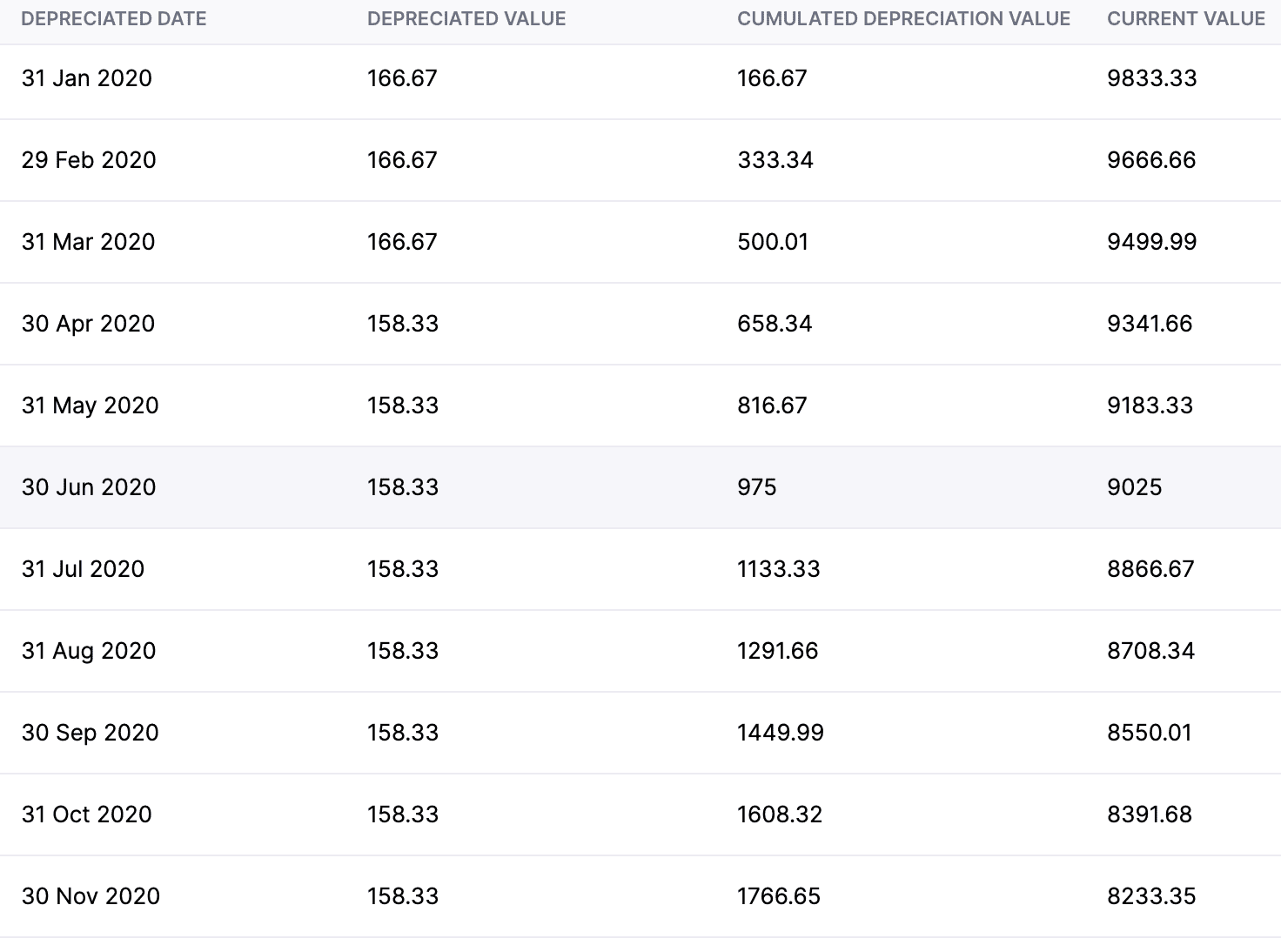

Declining Balance Method for Monthly Asset Depreciation on a Non-Pro Rata Basis

| Frequency | Computation Type | Start Date | Total Life Period | End Date |

|---|---|---|---|---|

| Monthly | Non-Pro Rata | 01/01/2020 | 13 | 31/01/2021 |

With respect to the current value of the asset, let us start depreciating the asset using the Declining Balance Method.

To calculate the asset’s monthly depreciation using the declining balance method, find the annual depreciation value and divide it by 12.

The depreciated value at the end of January 2020 will be:

Depreciated Value (annual) = 10000 * 0.20 = 2000

Now, Depreciated Value (monthly) = 2000 / 12 = 166.67

The current value of the asset = 10000 - 166.67 = $9833.33

The asset’s value at the end of February 2020 will be:

Depreciated Value (monthly) = 2000 / 12 = 166.67

The current value of the asset = 9833.33 - 166.67 = $9666.66

The asset’s value at the end of March 2020 will be:

Depreciated Value (monthly) = 2000 / 12 = 166.67

The current value of the asset = 9666.66 - 166.67 = $9499.99

The asset’s value at the end of April 2020 will be:

Depreciated Value (annual) = 9499.99 * 0.20 = 1899.99

Depreciated Value (monthly) = 1899.99 / 12 = 158.33

The current value of the asset = 9499.99 - 158.33 = $9341.66

When you keep depreciating the asset this way, the current value of the asset at the end of January 2021 will become 0 or reaches its salvage value, which means that the asset’s useful life is complete or the asset is completely depreciated.

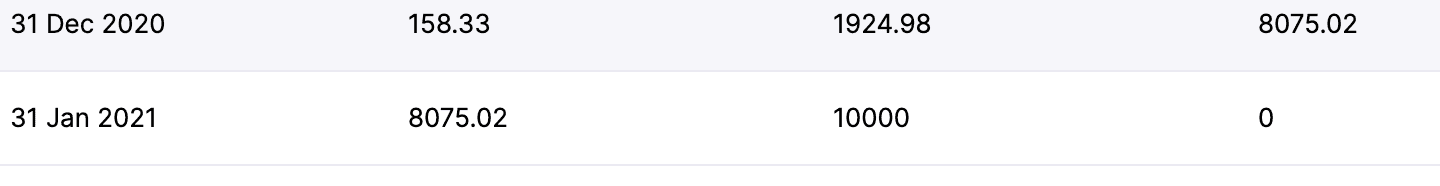

Declining Balance Method for Yearly Asset Depreciation on a Pro Rata Basis

| Frequency | Computation Type | Start Date | Total Life Period | End Date |

|---|---|---|---|---|

| Yearly | Pro Rata | 01/01/2020 | 60 | 31/12/2024 |

The number of days in the current year = 366

The number of days in the current depreciation period = 91

The asset’s value at the end of March 2020 will be:

Depreciated Value = ((Current Value * Percentage/100) / No. of Days in the Given Year) * No. of Days

Depreciated Value = ((10000 * 0.20) / 366 ) * 91

Depreciated Value = (2000 / 366) * 91

Depreciated Value = 5.464 * 91

Depreciated Value = 497.224

The current value of the asset is 10000 - 497.224 = $9502.776

The asset’s value at the end of March 2021 will be:

Depreciated Value = ((Current Value * Percentage/100) / No. of Days in the Given Year) * No. of Days

Depreciated Value = ((9502.776 * 0.20) / 365) * 365

Depreciated Value = (1900.555 / 365) * 365

Depreciated Value = 5.207 * 365

Depreciated Value = 1900.555

The current value of the asset is 9502.776 - 1900.555 = $7602.17

When you keep depreciating the asset this way, the current value of the asset at the end of December 2024 will become 0 or reaches its salvage value, which means that the asset’s useful life is complete or the asset is completely depreciated.

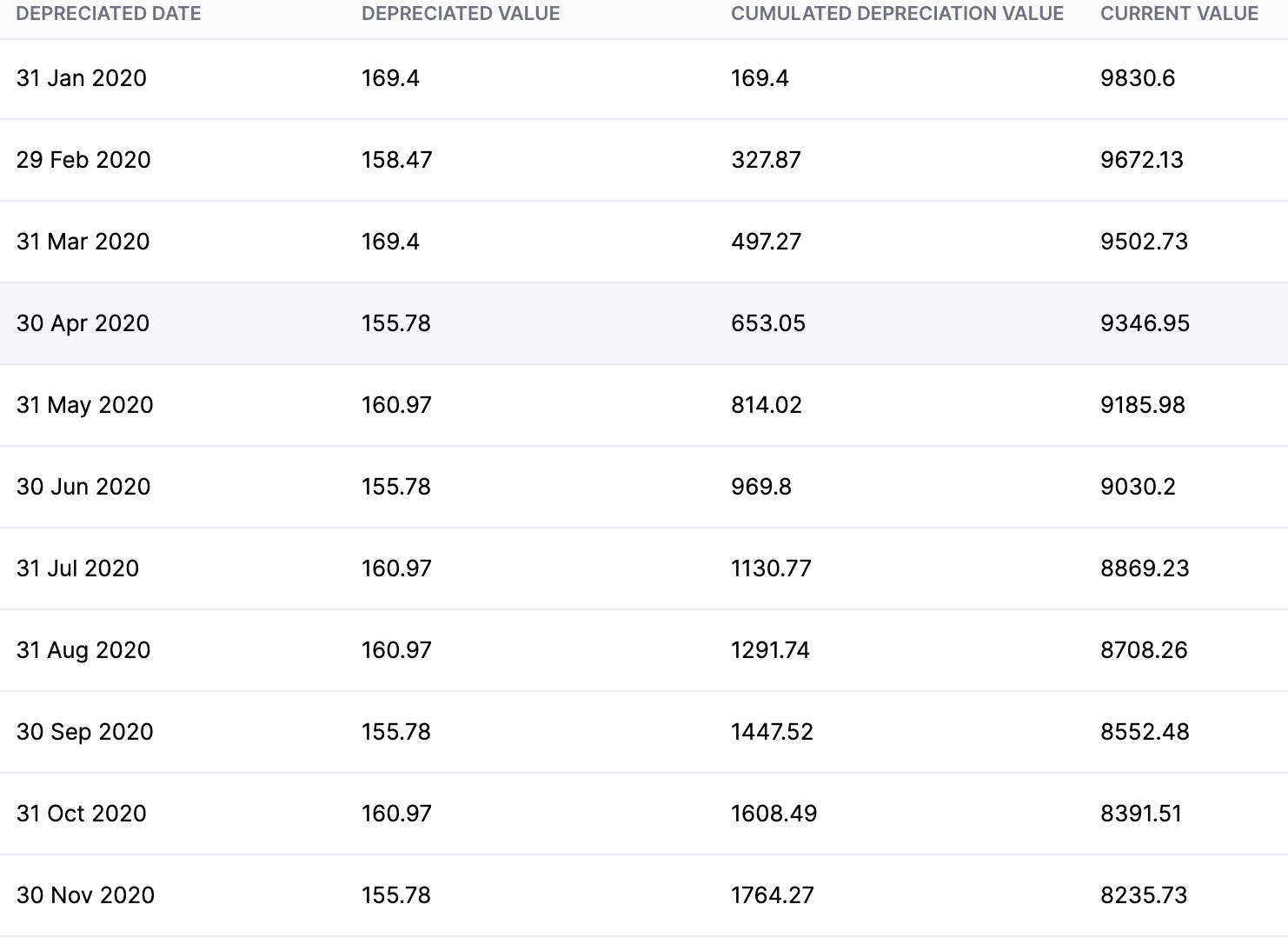

Declining Balance Method for Monthly Asset Depreciation on a Pro Rata Basis

| Frequency | Computation Type | Start Date | Total Life Period | End Date |

|---|---|---|---|---|

| Monthly | Pro Rata | 01/01/2020 | 13 | 31/01/2021 |

The number of days in the current year = 366

The number of days in the current depreciation period (January 2020) = 31

The asset’s value at the end of January 2020 will be:

Depreciated Value = ((Current Value * Percentage/100) / No. of Days in the Given Year) * No. of Days

Depreciated Value = ((10000 * 0.20) / 366) * 31

Depreciated Value = (2000 / 366) * 31

Depreciated Value = 5.464 * 31 = 169.38

The current value of the asset = 10000 - 169.38 = $9830.6

The asset’s value at the end of February 2020 will be:

Depreciated Value = ((Current Value * Percentage/100) / No. of Days in the Given Year) * No. of Days

Depreciated Value = ((10000 * 0.20) / 366) * 29

Depreciated Value = (2000 / 366) * 29

Depreciated Value = 5.464 * 29 = 158.45

The current value of the asset = 9830.6 - 158.45 = $9672.13

The asset’s value at the end of March 2020 will be:

Depreciated Value = ((Current Value * Percentage/100) / No. of Days in the Given Year) * No. of Days

Depreciated Value = ((10000 * 0.20) / 366) * 31

Depreciated Value = (2000 / 366) * 31

Depreciated Value = 5.464 * 31 = 169.38

The current value of the asset at the end of the fiscal year = $9502.73

The asset’s value at the end of April 2020 will be:

Depreciated Value = ((Current Value * Percentage/100) / No. of Days in the Given Year) * No. of Days

Depreciated Value = ((9502.73 * 0.20) / 366) * 30

Depreciated Value = (1900.55 / 366) * 30

Depreciated Value = 5.192 * 30 = 155.78

The current value of the asset = 9502.73 - 155.78 = $9346.95

When you keep depreciating the asset this way, the current value of the asset at the end of January 2021 will become 0 or reaches its salvage value, which means that the asset’s useful life is complete or the asset is completely depreciated.

Note: This section of the help document deals with the two types of declining balance methods, which is available only in the Global and US editions of Zoho Books.

150 Declining Balance Method

The 150 declining balance depreciation method calculates the depreciation of fixed assets over time using a percentage based on the asset’s service life.

When depreciation is calculated using the 150 declining balance method, it is also calculated using the straight-line method. If the asset’s value after applying the declining balance method is lower than its value after straight-line depreciation, it will be switched to the straight-line method for the remaining life of the asset.

Depreciated Value = Current Value * (150/100) / Total Life of the Asset

Depreciated Value = Current Value * (1.5 / Total Life of the Asset)

Note: When you calculate depreciation for a mid-life asset in Zoho Books (an asset that has already started depreciating), their depreciation rates may vary because the asset has already undergone depreciation, which affects its remaining useful life and calculation methods.

200 Declining Balance Method

The 200 declining balance method depreciates fixed assets by the same percentage in each depreciation period.

When depreciation is calculated using the 200 declining balance method, it is also calculated using the straight line method. If the asset’s value after applying the declining balance method is lower than its value after straight line depreciation, it will be switched to the straight line method for the remaining life of the asset.

Depreciated Value = Current Value * (200/100) / Total Life of the Asset

Depreciated Value = Current Value * (2 / Total Life of the Asset)

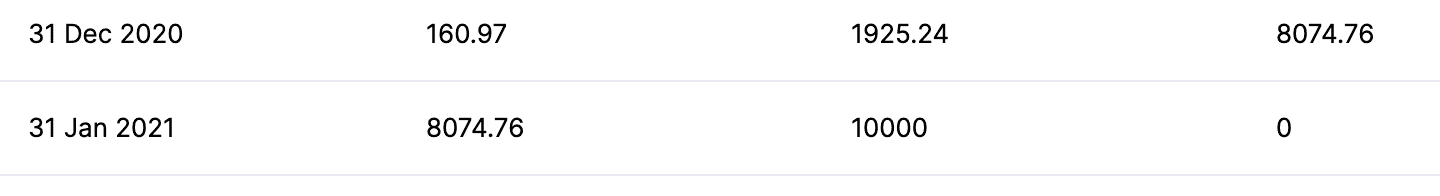

Let us consider the following example:

| Frequency | Computation Type | Start Date | Total Life Period (in months) | End Date |

|---|---|---|---|---|

| Yearly | Non-Pro Rata | 01/01/2020 | 60 | 31/03/2024 |

The Depreciation Percentage = 150% = 150 / 100 = 1.5

As the frequency of depreciation is given as Yearly, convert the total life period to years.

Total Life Period = 60/12 = 5

Therefore, total life period is 5 years.

The value of the asset at the end of March 2020 will be:

| Using the 150 Declining Balance Method | Using the Straight Line Method |

|---|---|

| Depreciated Value = Current Value * (Percentage/100) / Total Life of the Asset | Depreciated Value = Depreciable Value / Remaining Life of the Asset |

| Depreciated Value = 10000 * (1.5/5) | Depreciated Value = 10000 / 5 |

| Depreciated Value = 10000 * 0.3 | Depreciated Value = 2000 |

| Depreciated Value = 3000 |

As the depreciated value is higher when the asset is depreciated using the 150 declining balance method, the current value of the asset = 10000 - 3000 = $7000.

The value of the asset at the end of March 2021 will be:

| Using the 150 Declining Balance Method | Using the Straight Line Method |

|---|---|

| Depreciated Value = Current Value * (Percentage/100) / Total Life of the Asset | Depreciated Value = Depreciable Value / Remaining Life of the Asset |

| Depreciated Value = 7000 * 0.3 | Depreciated Value = 7000 / 4 |

| Depreciated Value = 2100 | Depreciated Value = 1750 |

As the depreciated value is higher when the asset is depreciated using the 150 declining balance method, the current value of the asset = 7000 - 2100 = $4900

The value of the asset at the end of March 2022 will be:

| Using the 150 Declining Balance Method | Using the Straight Line Method |

|---|---|

| Depreciated Value = Current Value * (Percentage/100) / Total Life of the Asset | Depreciated Value = Depreciable Value / Remaining Life of the Asset |

| Depreciated Value = 4900 * 0.3 | Depreciated Value = 4900 / 3 |

| Depreciated Value = 1470 | Depreciated Value = 1633.3 |

Here, the depreciated value is higher when the asset is depreciated using the straight line method. Therefore, the asset will be switched to the straight line depreciation method for the rest of its useful life.

Therefore, the current value of the asset = 4900 - 1633.3 = $3266.7

The value of the asset at the end of March 2023 will be:

Depreciated Value = Current Value / Remaining Life Period

Depreciated Value = 3266.7 / 2

Depreciated Value = 1633.35

Therefore, the current value of the asset = 3266.7 - 1633.35 = $1633.35

When you keep depreciating the asset this way, the current value of the asset at the end of March 2024 will become 0 or reach its salvage value, which means that the asset’s useful life is complete or the asset is completely depreciated.

Similarly, the asset’s depreciation is calculated using the 200 declining balance method.