Back

The ATO (Australian Taxation Office) has credited the BAS claim in two payments. However, I’m not able to match or categorise the two payments as a tax claim in the BAS return. How can I match the two payments to the BAS return?

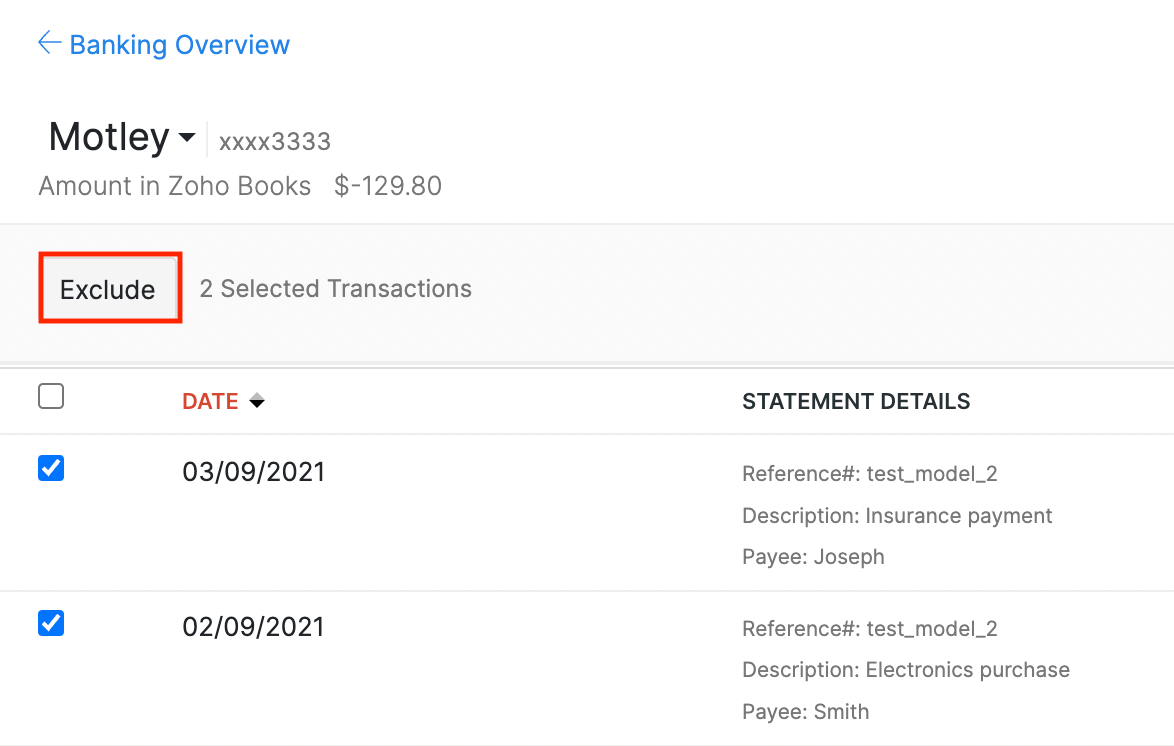

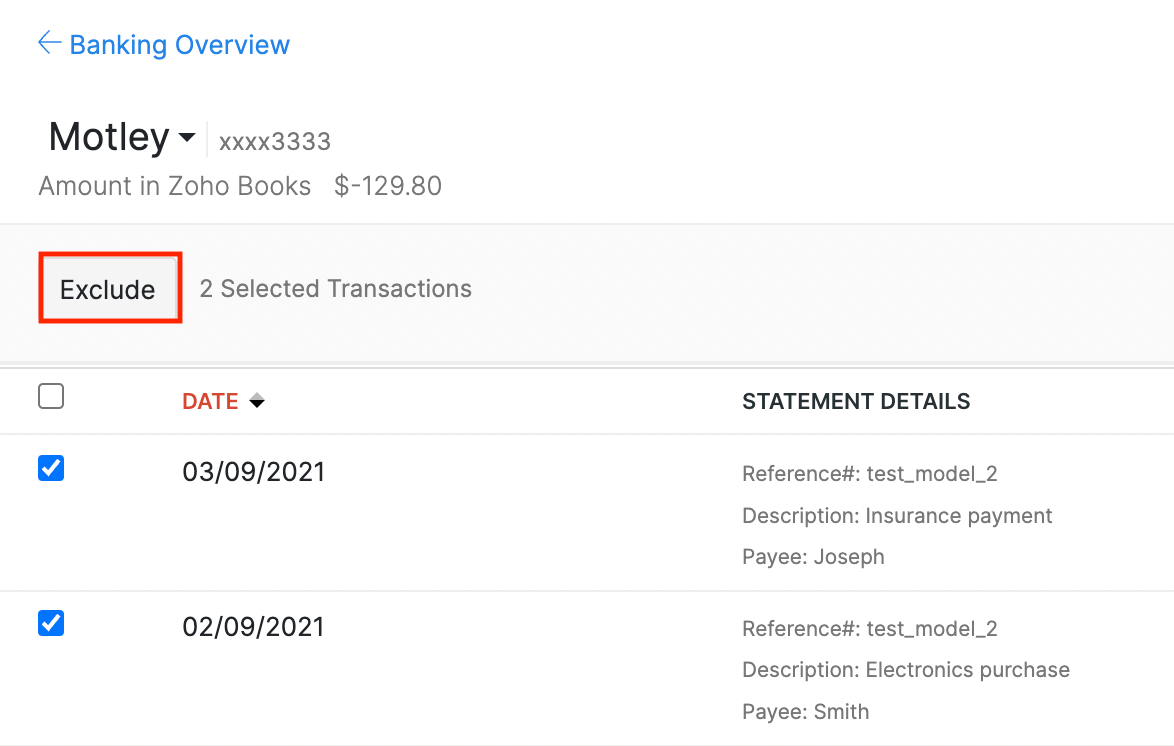

Currently, it is not possible to apply two partial claims to a BAS return in Zoho Books. However, as a workaround, you can exclude the deposit feeds in the bank account (for the payment from ATO). Here’s how you can exclude the deposit feeds:

- Go to the Banking module on the left sidebar.

- Select the account in which you wish to exclude uncategorised transactions.

- Select the Uncategorised Transactions tab.

- Select the deposit feeds and click Exclude.

- Click Exclude All to confirm your action.

Once you exclude the deposit feeds, you can manually import the deposit feed along with the entire BAS amount. You can then proceed to match or categorise the manually imported feed to the BAS return as a tax claim.

Yes

Yes