Basic Setup

To start off, you’ll have to configure your organization for the GST settings in Zoho Books.

ON THIS PAGE

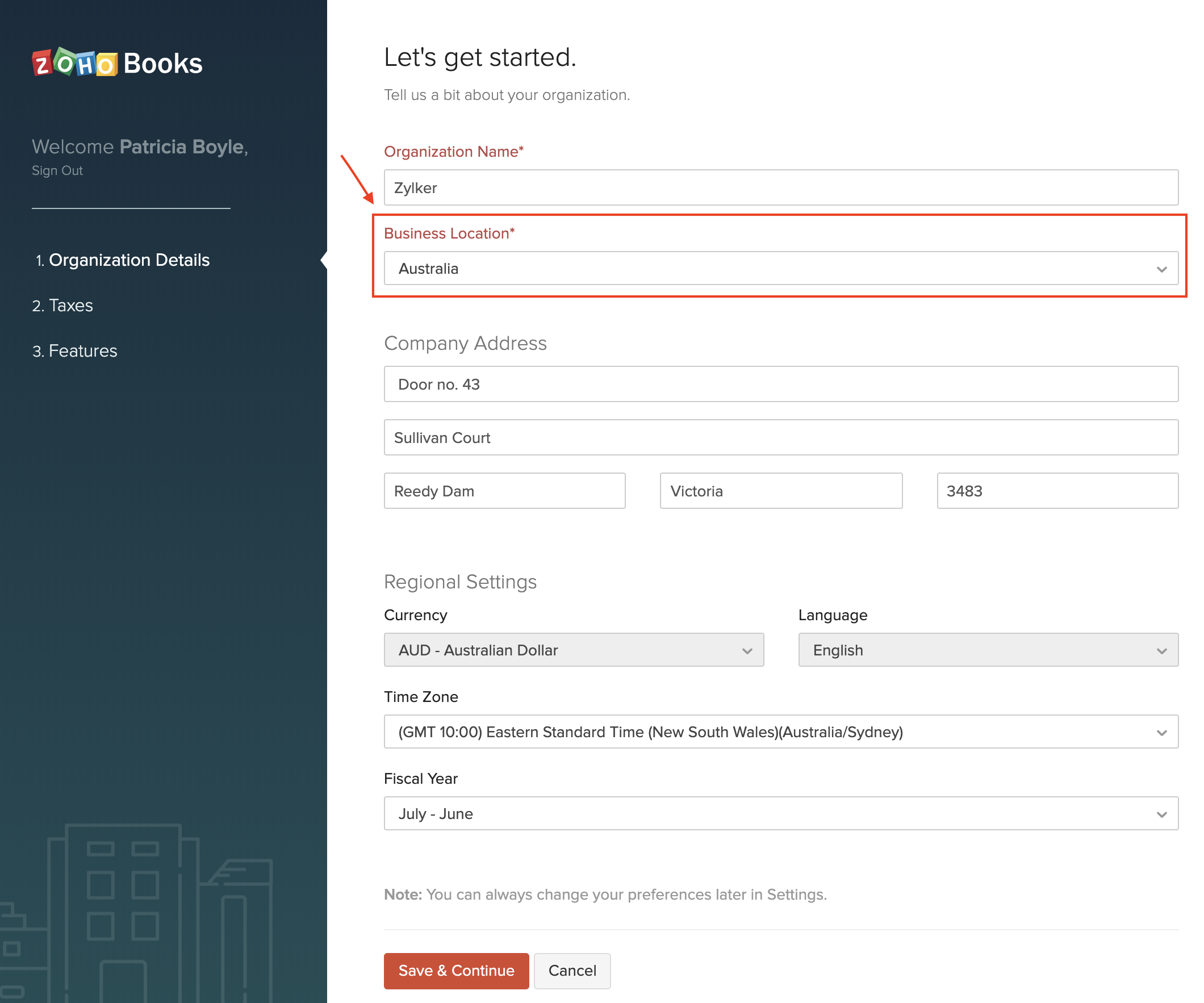

Set up Your Organization

When you are initially setting up your organization in Zoho Books, you will have to follow the steps below in order to configure Australian GST:

- In the Organization Details section, select the Business Location as Australia.

- Click Save & Continue.

Note: The Business Location cannot be changed once you have entered it while setting up your organization.

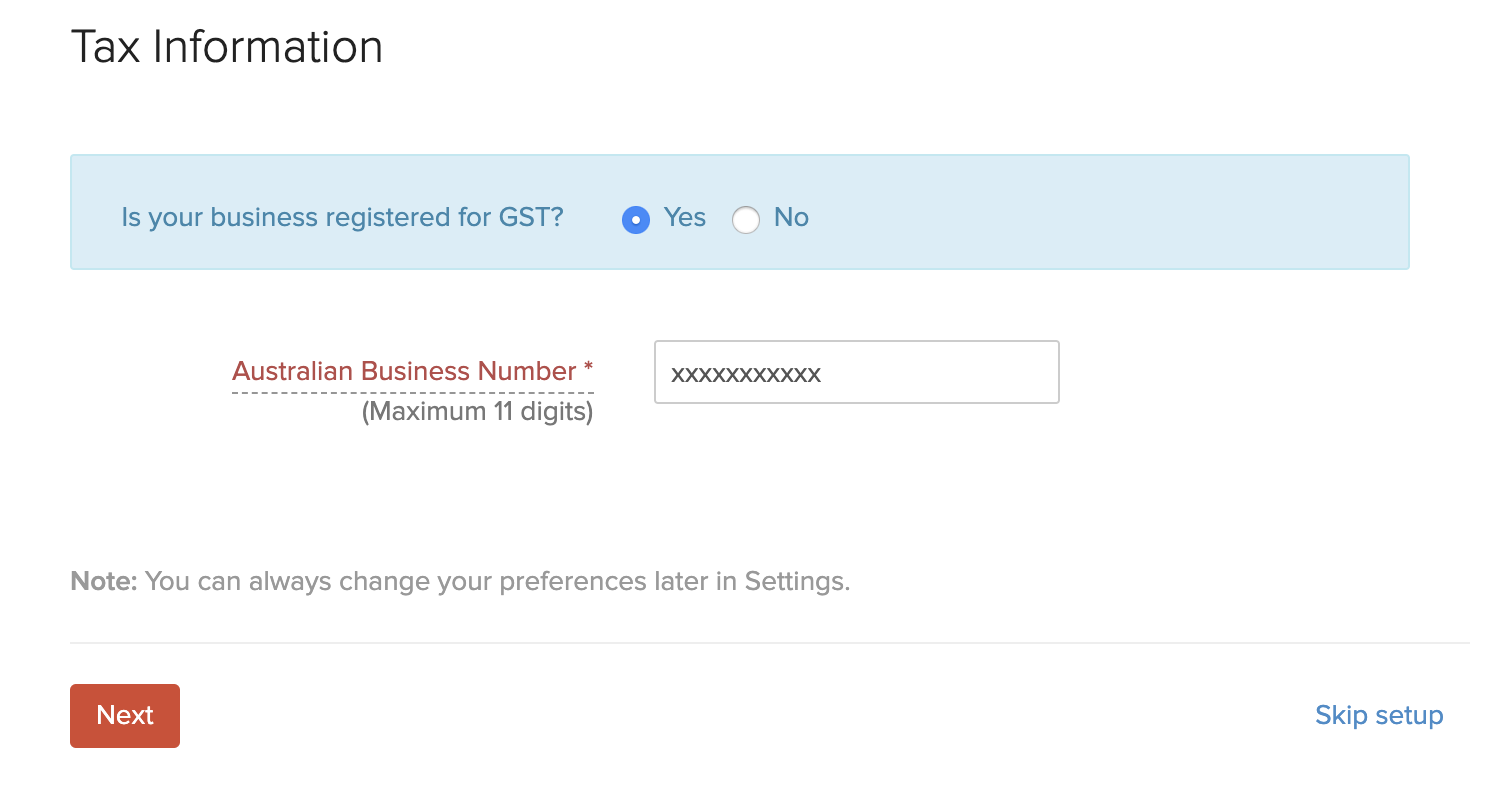

- Enter your Australian Business Number or the ABN under Tax Information.

- Click Next.

With that, you have successfully entered the Australian GST details while setting up your organization.

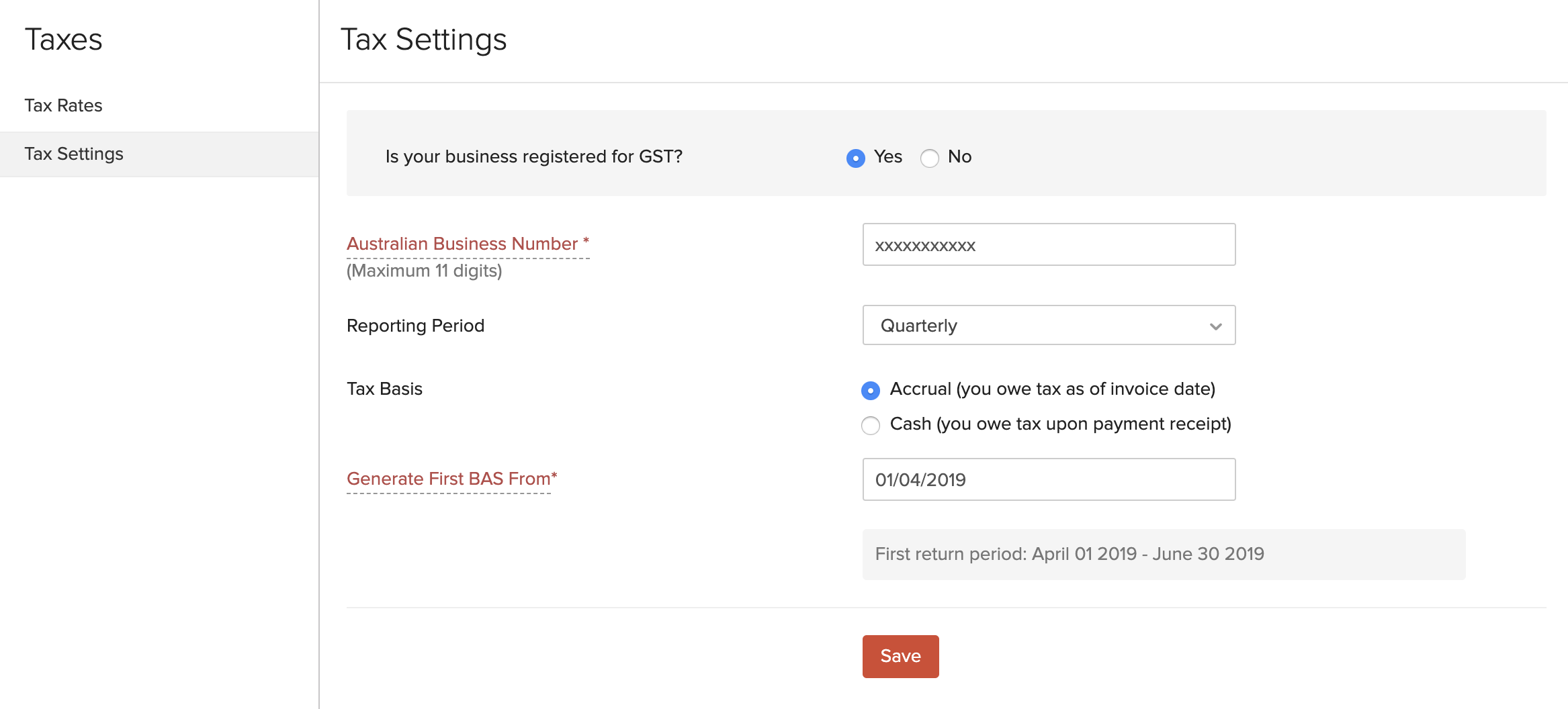

Set up Taxes

You can configure your GST Tax Settings in detail. Here’s how:

- Go to Settings on the top right corner of the page.

- Select Taxes under Taxes & Compliance.

- In the Taxes pane, select Tax Settings

Is your business registered for GST?

If your business is registered for GST, select Yes.

Australian Business Number

Enter the 11-digit ABN.

Reporting Period

Select the reporting period. It can be Monthly or Quarterly.

Tax Basis

Choose the appropriate tax basis. Your accounting can be of two types:

- Accrual: You owe tax when the invoice is created

- Cash: You owe tax upon the payment

Generate First BAS From

Choose the date from which you wish to generate your first BAS Return. The Return Period will be based on the Reporting Period that you have selected.

- After configuring your tax settings, click Save.

After this, your tax settings will be successfully configured.

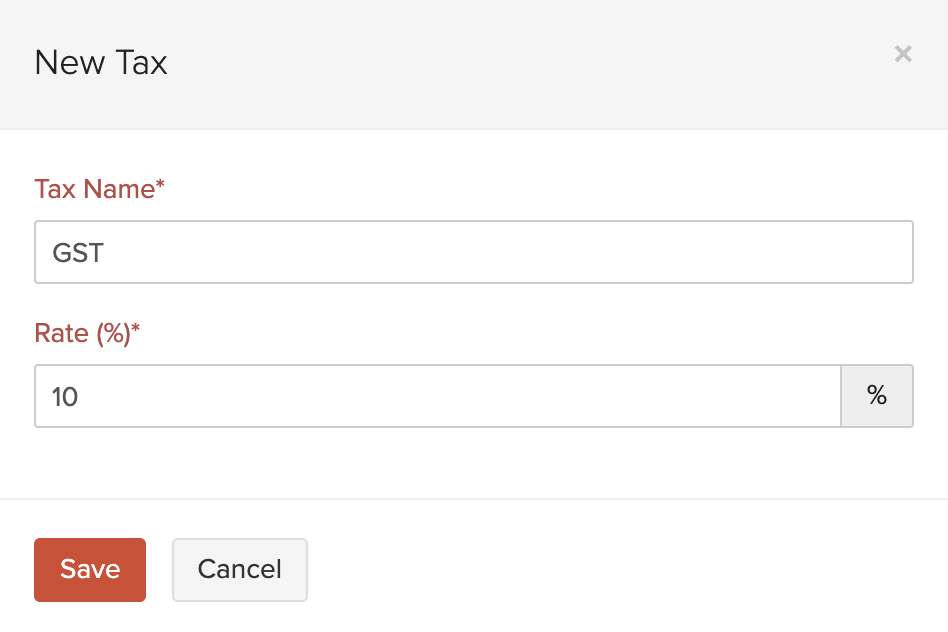

Add New Tax

You can add new tax rates for your organization. Here’s how:

- Go to Settings on the top right corner of the page.

- Select Taxes under Taxes & Compliance.

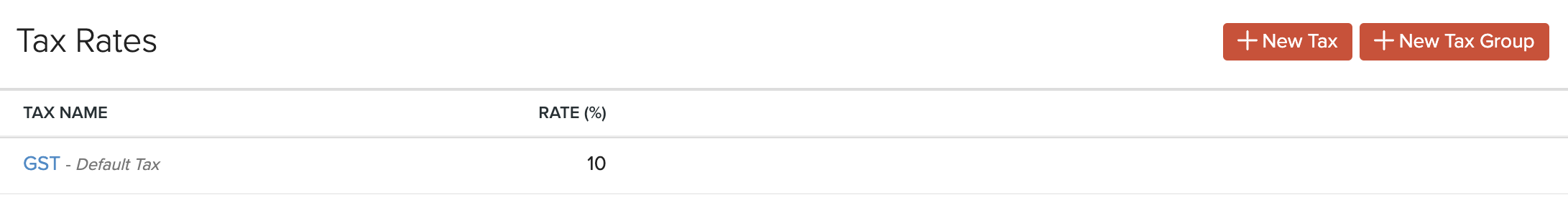

- In the Taxes pane, select Tax Rates

- Click the + New Tax button in the top right corner of the page.

- Enter a Tax Name and select the corresponding Rate for it.

- Click Save.

If this is the first tax rate that you have added, it becomes the default tax rate for your organization.

Next >

Managing Taxes

Related

Yes

Yes