Public Institution for Social Security (PIFSS)

The Public Institution for Social Security (PIFSS) holds a critical role in the State of Kuwait, overseeing the administration of social security benefits and pension schemes for employees. Employers using Zoho Payroll need to understand PIFSS to ensure compliance and provide employees in Kuwait with essential benefits.

PIFSS is committed to managing social security systems that protect employees’ financial well-being, especially during retirement and times of need. As an employer, here are key points to consider:

Mandatory Contributions

Both employers and employees are obligated to make monthly contributions to PIFSS. These contributions are calculated based on the employee’s salary through Zoho Payroll, ensuring accuracy.

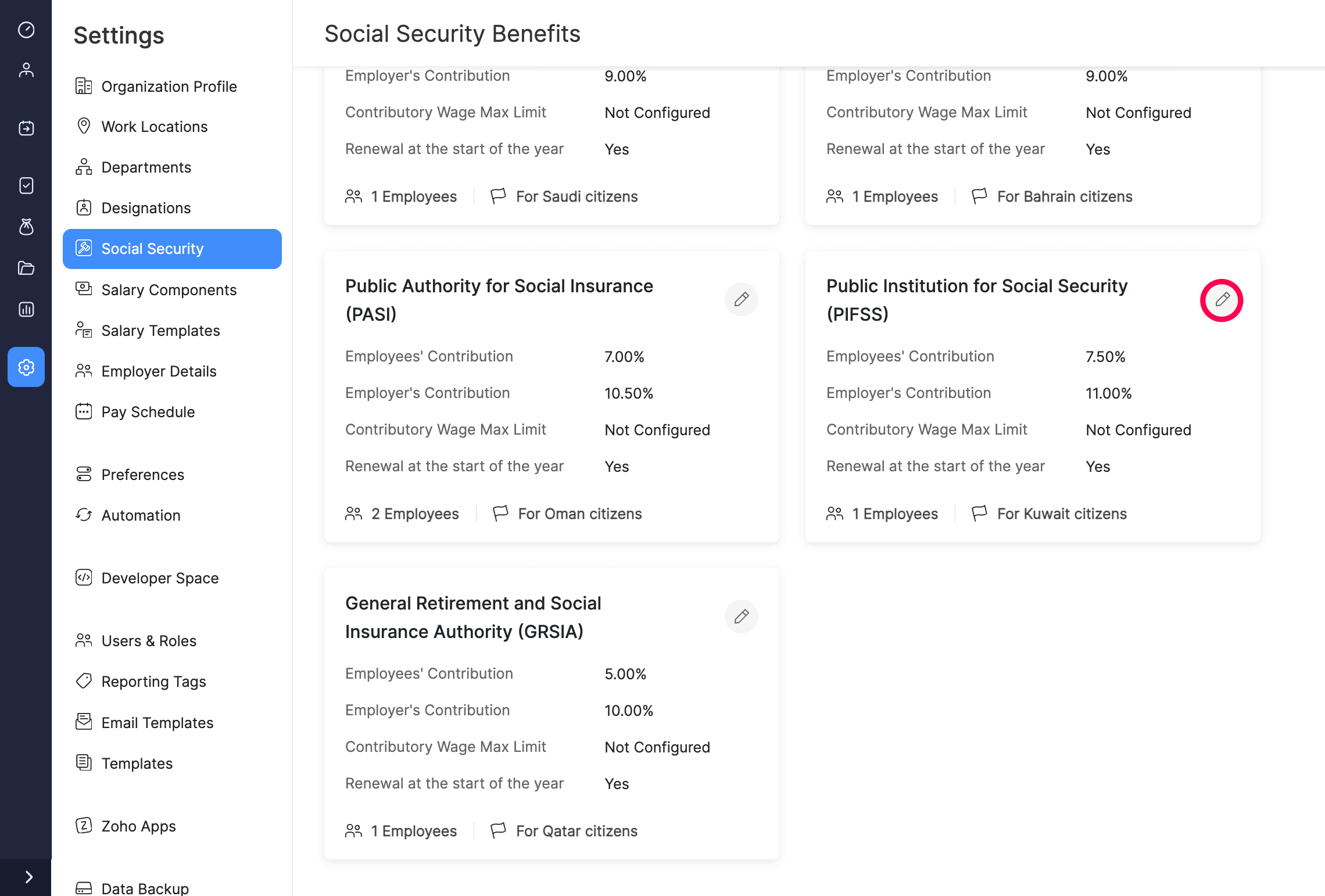

| Authority | Employees’ Contribution | Employer’s Contribution | Can be renewed at the start of the fiscal year? | Applicable for Citizens of |

|---|---|---|---|---|

| Public Institution for Social Security (PIFSS) | 7.50% | 11.00% | Yes | Kuwait |

Benefit Entitlements

PIFSS provides a range of benefits, encompassing retirement pensions, disability benefits, and social security coverage. These benefits serve as a safety net for employees, offering financial support in various life situations.

Compliance and Reporting

Employers must stay compliant with PIFSS regulations. This involves reporting the maximum contributory wage for employees and updating any changes in employment status.

Configuring PIFSS in Zoho Payroll

Pre-requisite:

Ensure that you have created or imported employees who are Kuwaiti nationals.

- Click Settings in the left sidebar of Zoho Payroll.

- Select Social Security.

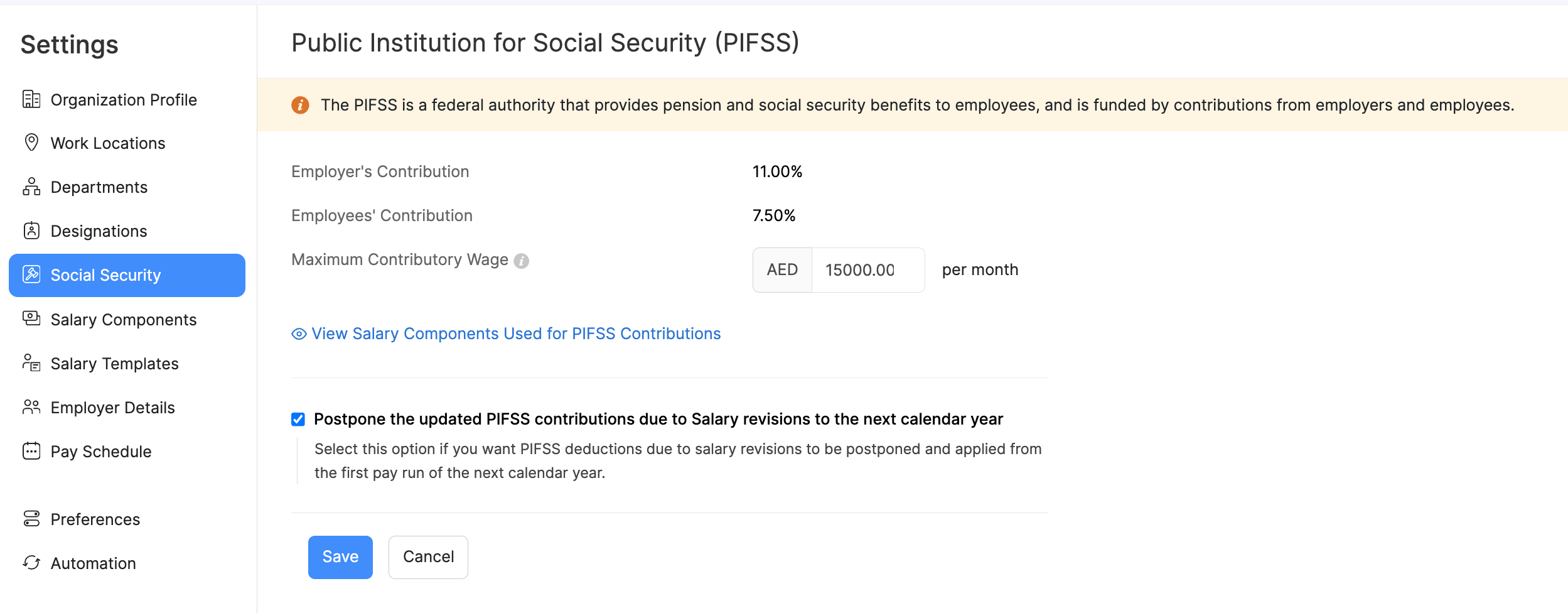

- Click Edit in the Public Institution for Social Security (PIFSS).

- Enter the Maximum Contributory Wage. This is the salary limit to which both employer and employee contribution rates apply.

- Choose the option to Postpone the updated PIFSS contributions due to Salary revisions to the next calendar year if you wish to delay deductions resulting from salary revisions until the following calendar year.

- Click Save.

Pro-tip:

View Salary Components Used for PIFSS Contributions

Understanding how the salary contributes to PIFSS is vital. Click the View Salary Components Used for PIFSS Contribution option to view the specific salary components is used to calculate the maximum contributory wage, providing transparency in the allocation of your salary towards PIFSS contributions.